Conducting Independent AML Audits in DNFBPs: A Comprehensive Handbook

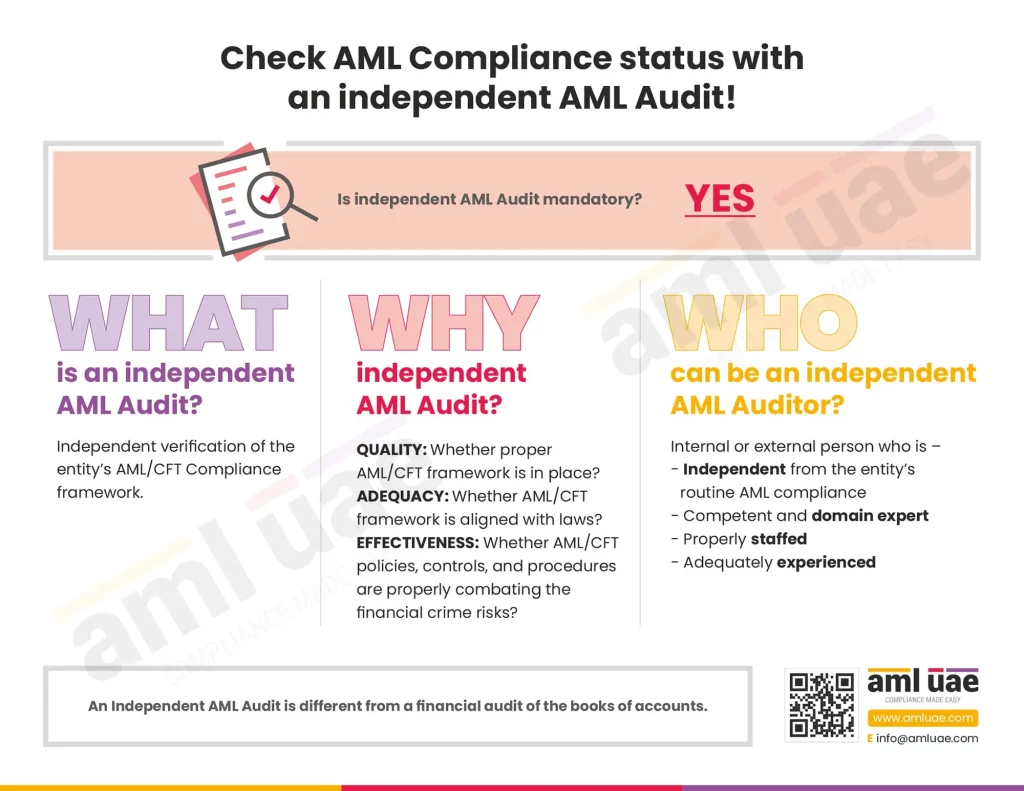

In recent years, anti-money laundering (AML) regulations have become increasingly important for the non-financial sector in the United Arab Emirates. The UAE AML regulations mandate the Designated Non-Financial Businesses and Professions (DNFBPs) to design and implement a comprehensive AML/CFT framework to detect and prevent financial crime. As part of the AML/CFT program, the UAE AML regulations provide for implementing an independent AML audit function to check the quality of the AML measures adopted by these DNFBPs.

DNFBPs (such as dealers in precious metals and stones, real estate agents, lawyers, accountants/ auditors, and company service providers) are required to undertake ML/FT Enterprise-Wide Risk Assessment and establish adequate AML/CFT policies, procedures, and controls to manage these risks. This includes conducting Customer Due Diligence, compliance with the Sanctions regime, and measures to detect and report suspicious transactions on the goAML Portal. To test the adequacy and relevance of the implemented program, the DNFBPs are required to get their AML program independently audited by competent personnel.

Independent AML Audit is very different from regular auditing of books of accounts. This focuses on the DNFBP’s AML/CFT program and the controls and systems the entity has deployed to detect the red flags and manage the risks.

In this article, we will discuss the independent AML audit in DNFBPs, and the key elements necessary for ensuring the effectiveness of the AML audit.

What is the role of an Independent AML Audit?

The independent AML audit refers to a function – whether an internal department or an external third party – that audits and evaluates the quality of the organization’s AML policies, procedures, systems, and controls. This AML audit function operates independently from the routine operations of the business, including ongoing AML activities, and provides an unbiased opinion on the DNFBP’s AML efforts.

The independent AML audit function is entrusted with the responsibility of periodically reviewing the adequacy of the AML/CFT program of the company and detecting any potential gaps or weaknesses in the DNFBP’s AML measures. AML auditors are expected to thoroughly check the DNFBP’s AML/CFT policies, procedures, and controls to ensure that such framework is in line with UAE AML regulations and the overall enterprise-wide risk assessed by the company.

The independent AML audit is not just restricted to identifying the non-compliance instances or flaws in the implemented measures but also to suggesting the remedial actions necessary for improving the AML framework. The AML auditor’s recommendations may include a requirement for the implementation of additional controls, developing or enhancing the AML training programs, and adopting new technological solutions to strengthen the DNFBP’s AML capabilities.

An independent AML audit demonstrates the DNFBP’s commitment to AML compliance and safeguarding the economy from financial crimes. Periodic AML audits help the DNFBPs ensure that their AML efforts and resources are moving in the right direction. They are focused on effectively managing financial crime risks and staying AML compliant.

The independent AML audit is essential to the overall AML compliance framework for DNFBPs operating in the UAE. With an independent AML audit, the DNFBPs can enhance the business reputation, attracting customer loyalty with their efforts to prioritize AML regulatory compliance and combat financial crime. Further, the supervisory authorities also develop trust in the DNFBP’s AML/CFT measures and controls when an independent AML audit forms part of the overall AML framework.

How to implement an Independent AML Audit in DNFBPs?

AML Audit Plan

An independent AML audit starts with AML Audit Plan. This involves defining the following:

- scope of the audit (what all AML aspects and records must be reviewed and the review period)

- audit objectives (why is the AML audit conducted, i.e., to check the quality of the AML/CFT framework, etc.)

- audit procedures (what auditing methods would be used – like records verification, on-site visit, positive confirmation, interviews, etc.)

- audit resources (what resources would be deployed for conducting the AML audit, including the audit team)

The AML audit team must be adequately qualified and have appropriate skills to conduct the review and form an opinion on the status of the DNFBP’s AML compliance and the quality of the AML/CFT measures implemented. Further, the AML auditor must be aware of the latest regulatory amendments and understand the AML obligations of the particular DNFBP.

The AML audit plan must be designed considering the overall ML/FT risk exposure, size, and nature of the business. The audit plan and preparation must be aligned with the UAE AML regulations and the feedback from the supervisory authorities of the DNFBP.

Conducting Independent AML Audit

The designed AML audit plan must be diligently adopted for the effective execution of the independent AML audit.

The auditor must review the DNFBP’s documented AML/CFT policies, procedures, and controls to assess their completeness and relevance in the context of the relevant AML regulatory framework and the DNFBP’s ML/FT risk exposure. Any gaps or missing compliance aspects must be highlighted in the report.

Along with a review of the high-level AML/CFT program, the AML auditor must also verify the customer onboarding records to determine the accuracy of the Customer Due Diligence process. The transaction monitoring systems must also be examined to test the reasonableness and adequacy of the monitoring rules defined and their effectiveness in detecting unusual activities or suspicious transactions.

If the DNFBP has implemented any systems or tools for AML compliance, then the integrity and effectiveness of such systems and data security must be verified.

Wherever required, the AML audit team must interview the AML Compliance Officer and the compliance team members to understand their awareness of the internal AML/CFT program and their roles and responsibilities towards AML regulatory obligations. This shall also help the AML auditor determine the level of the entity’s AML training and whether any enhancements are required in the training program.

The team must maintain independence and be able to review and provide unbiased opinions on the company’s AML/CFT program.

Once the necessary audit procedures have been applied and the AML review is complete, the independent auditor must document its observations (identified gaps and non-compliance instances), and the corresponding recommendations in an audit report addressed to the senior management of the DNFBP.

These AML audit findings shall serve as one of the critical AML compliance measures, directing the DNFBPs to improve their AML compliance measures and effectively manage the financial crime risks

Managing the AML Audit findings (Post-Audit Activities)

Once the management receives the independent AML Auditor’s report, the senior management must immediately take necessary actions to address the AML/CFT deficiencies. The necessary team must be involved, including the AML Compliance Officer, to implement the AML auditors’ recommendations to enhance the quality and effectiveness of the DNFBP’s AML program.

In simple terms, an independent AML audit is a giant umbrella to check and test the DNFBP’s implemented AML/CFT measures, thriving to ensure its adequacy, quality, completeness, and relevance with appropriate AML audit planning and program, effectively executing the AML audit procedures and ensuring the redressal of the AML gaps as post AML audit.

How can AML UAE assist in ensuring the quality of your AML framework with an independent AML audit?

Documenting the AML/CFT policies and procedures differs significantly from ensuring effective implementation. It is where the independent AML audit comes into the picture.

At all times, the implemented AML/CFT measures and controls must effectively identify and mitigate the money laundering and terrorism financing risks. The AML program must be aligned with relevant AML regulations and complete in all aspects, ensuring total coverage for fighting financial crimes and staying 100% compliant. Here is the role of the independent AML auditor to examine the existing measures, detect any loopholes and recommend the best practices to bridge the AML gaps.

AML UAE is a leading AML consultancy firm assisting the regulated entities in UAE, including DNFBPs, to design and implement customized AML policies and procedures to manage the ML/FT risks. With our domain experts and diverse experience, we can assist DNFBPs in auditing the AML framework and identify necessary improvement areas and regulatory violations that need immediate attention to strengthen the AML measures.

Implement robust independent AML audit to stay AML compliant and channel your AML efforts in the right direction!

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.