Common mistakes to avoid while submitting a Real Estate Activity Report

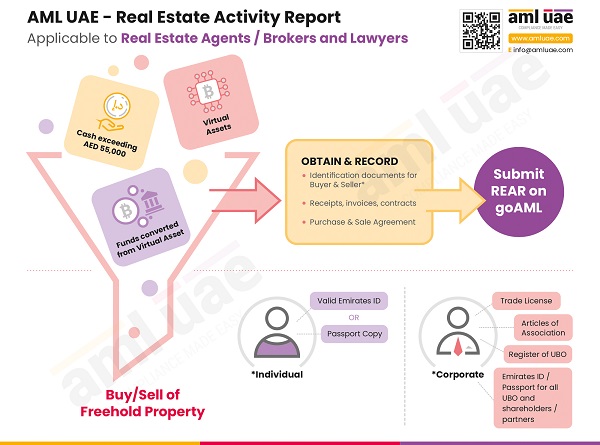

The UAE AML regulations mandate that real estate agents/brokers and lawyers/law firms furnish a Real Estate Activity Report (REAR) on the goAML Portal. REAR is to be filed for reporting the transactions involving the purchase and sale of freehold real estate, where the payment towards property is settled either in cash equal to or exceeding AED 55,000 or using virtual assets or funds converted from virtual assets.

This reporting requirement is the UAE AML authority’s step to track and prevent the exploitation of the real estate sector for money laundering activities – to route the illicit money and make it appear clean. Thus, to contribute towards these AML efforts, it is essential that the regulated entities timely and accurately furnish the required details in the Real Estate Activity Report.

The AML Compliance Officer is the person made responsible for adequate reporting of the specified transaction related to Freehold properties.

In this article, we shall discuss some of the common mistakes made by the entities while submitting REAR on the goAML Portal and best practices that may help avoid these errors, which can assist the AML Compliance Officer in discharging the REAR reporting duties satisfactorily.

What are common mistakes observed while filing a Real Estate Activity Report (REAR)?

Real Estate Activity Report assist the authorities in preventing the misuse of the real estate sector for conducting financial crimes. However, for optimal utilization of the REAR as an AML measure, it is necessary to furnish the details carefully, avoiding mistakes. Let’s understand what common mistakes are observed when submitting REAR on the goAML Portal and the best practices to address the same.

Incomplete or inaccurate details

Furnishing correct and complete details is very crucial to serve the purpose of submitting REAR. The regulated entities must include accurate details about the parties involved in the transaction, details of the transaction (date and time), the location of the property involved, transaction value (property value), mode of payment, etc. must be captured.

Capturing incomplete details and errors in the information furnished are the standard and most frequent mistakes observed in REAR.

Solution

The regulated entity may establish an internal reporting mechanism, developing the standard REAR form for internal reporting. The entity may design and implement a REAR template (as available on the goAML portal), wherein the client-serving team can create a draft REAR ready capturing the required details and submit the same to the AML Compliance Officer for review and final filing of the REAR on the goAML Portal. This will enable adequate workflow, bringing in a maker-checker role to ensure the details’ accuracy while ensuring no required details are missed.

Incorrect or insufficient documents are attached

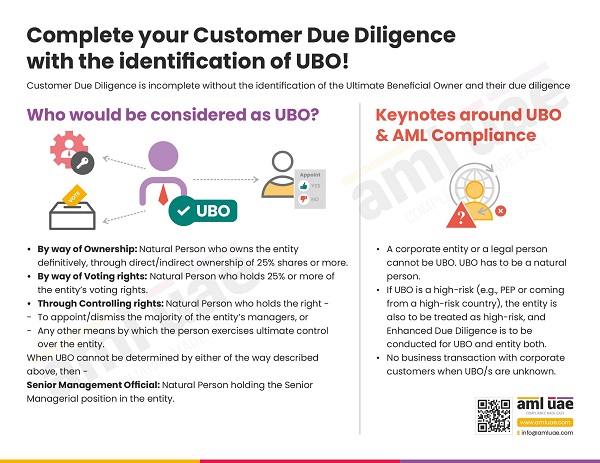

While filing REAR, the regulated entities should attach the relevant documents like the identity document of the parties, the sale/purchase agreement, UBOs’ identification documents in case of a corporate buyer/seller, etc.

These documents can be helpful to the authorities to understand the transaction better, and if required, these can be used in the course of inquiry or be presented as evidence.

However, the mistake around documentation involves –

- not uploading the necessary documents

- uploading the incorrect or expired documents

- the uploaded documents are not legible or clear

Solution

The regulated entity must have an internal checklist listing the documents to be uploaded as part of REAR filing. These documents must be obtained from the customer (buyer/seller) if the entity is not privy to the same. The checklist can be used to ensure the completeness of the information and documents to be filed with REAR.

Further, before uploading the documents, the legibility of the documents must be verified.

As required on the goAML Portal, the entity should merge the documents into a single PDF file, meeting the size criteria defined on the portal, without impacting the document’s clarity or resolution.

Delayed filing

Currently, the AML regulations in UAE do not provide any timeline within which such REAR filing is to be concluded. In the absence of any specific deadline, the regulated entities generally are seen to delay the filing beyond a reasonable period of time. This may sometimes result in absolutely missing on reporting the specific transaction in REAR.

Only when the transaction is timely intimated to the authorities will the purpose of detecting suspicious activities and preventing attempted money laundering activities be served.

Solution

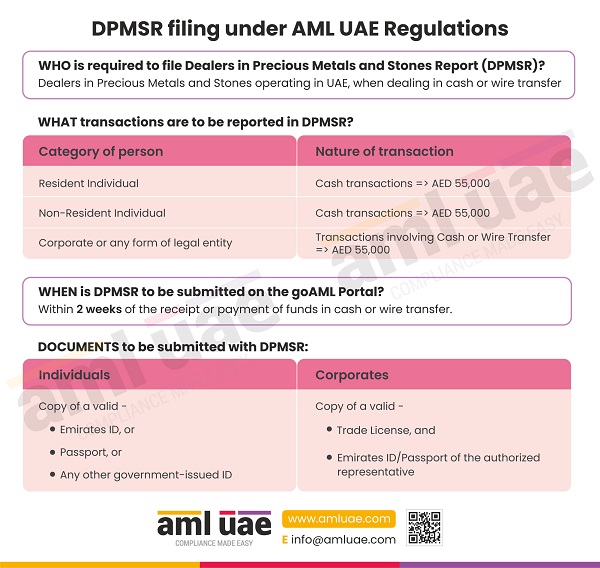

The regulated entity must understand the criticality of timely reporting of REAR and set an internal timeframe within which the reporting of the designated transactions would be completed on the goAML. For this, the entity may determine a certain reasonable timeframe – such as within two weeks from the trigger event (as prescribed for filing of Dealers in Precious Metals and Stones Report on the goAML report for submitting details of designated transactions involving precious metals and stones).

Additionally, the entity may explore the possibility of deploying necessary technology or tools to review the transactions that require REAR filing and trigger a reminder to the relevant personnel.

Other best practices for effective REAR filing

In addition to the above, the following practices may assist the regulated entity in boosting the AML compliance measures and authorities’ trust in the entity’s AML program when quality REAR are furnished:

Periodic Review of REAR-related processes

It is recommended that the regulated entity conduct a periodic review of the transactions and internal processes to determine whether all the transactions warranting REAR have been furnished. Further, a sample REAR filed during the past period must be verified independently to check the quality and adequacy of the information reported on the goAML Portal.

If any weakness or gaps have been identified in the REAR reporting process, the AML Compliance Officer must immediately address them.

Training on Real Estate Activity Report

The relevant team, engaging with a client or managing the business relationship, must be trained to REAR submission requirements and identify the activities where REAR filing is mandatory. The discussion on internal reporting mechanisms and best practices must be included in the session. The team must also be trained on the details obtained from the customer and maintain the same in an organized manner that assists the Compliance Officer in timely and accurate reporting of REAR.

REAR Documentation

The regulated entities must obtain and retain a copy of the REAR furnished on the goAML Portal and copies of the documents shared with the authorities.

How can AML UAE assist you in ensuring compliance with REAR filing?

The real estate agents and the law firms must ensure proper REAR submission, as it demonstrates the entity’s commitment towards AML compliance. Let AML UAE be your partner in REAR submission. We can assist you in developing an AML framework for the business, including the guidelines for identifying and reporting the transactions triggering REAR filing. These policies and procedures are customized to the entity’s ML/FT risk exposure and business activities, ensuring compliance with regulatory regimes and contribution to protecting the real estate sector against financial crime.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 6 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.