Choosing an apt AML Software for DPMS

Dealers in precious metals and stones are one of the Designated Non-Financial Businesses and Professions (DNFBPs) required to comply with anti-money laundering and combating financing of terrorism (AML/CFT) regulations in the UAE. Non-compliance with AML requirements has severe consequences, including monetary fines, administrative penalties, and reputational damage. The importance of choosing an apt AML software for the DPMS sector cannot be overstated. Adopting an appropriate AML compliance software for Dealers in Precious Metals and Stones is very important to ensure compliance with the AML requirements and safeguard your precious metals and stones business against exploitation by financial criminals.

This article discusses the critical consideration for selecting the right AML software for your AML compliance needs.

Understanding the AML Compliance requirements for Dealers in Precious Metals and Stones in the UAE

Before selecting an AML screening solution, we must understand the AML compliance requirements in the UAE and why a dealer in precious metals and stones must comply with these AML requirements.

Money laundering is concealing the source of the illegally obtained funds and disguising the same as proceeds from legitimate business activities. Financial criminals often use precious metals and stones to launder their dirty and illicit money without attracting the attention of the regulatory authorities. Precious metals and stones are commonly used for laundering funds, given their inherent characteristics – high in value, compact in size and easy to transport across borders.

What are “Precious Metals and Stones” in UAE under the AML regulations?

Under UAE AML regulations, the following are considered “Precious Metals and Stones”:

– Precious Metals

- Gold (minimum purity of 500 parts per 1,000)

- Silver (minimum purity of 800 parts per 1,000)

- Platinum (minimum purity of 850 parts per 1,000)

- Palladium (minimum purity of 500 parts per 1,000)

– Precious Stones

- Rough diamonds of any weight in carats

- Polished diamonds (minimum weight of 0.3 carats per stone if loose, or a minimum weight of 0.5 carats per any single stone mounted in a setting)

- Coloured Gemstones like Emeralds, Rubies, and Sapphires (minimum weight of 1 carat per stone if loose, or a minimum weight of 2 carats per any single stone mounted in a setting)

– Pearls

- Loose (minimum diameter of 3 millimetres per bead)

- Strung or mounted in a setting (minimum diameter of 10 millimeters per any single bead)

– Other

- Any object with a minimum 50% value of the object is comprised of precious metals and stones.

Who is Dealer in Precious Metals and Stones in UAE?

A person engaged in any of the following activities related to precious metals and stones would be treated as a dealer in precious metals and stones (DPMS) in UAE:

- Extraction, refining, cutting, polishing or fabrication

- Import or export

- Purchase, sale, re-purchase or re-sale, including scrap sale of precious metals and stones

- Barter, or exchange of precious metals and stones

- Loan or lease arrangements

- Possession of precious metals and stones, e.g., as a fiduciary, warehousing, or safekeeping arrangement

- Job work arrangement, e.g., cutting, polishing, refining, casting or fabrication services related to precious metals and stones.

What is AML Compliance in UAE?

Anti-money laundering (AML) compliance is a set of regulations and governing frameworks focused on detecting and preventing the process of laundering illegal money from entering into a legitimate financial system. In UAE, the primary AML/CFT regulations are the Federal Decree-Law No. 20/2018, and its implementing guidelines in Cabinet Decision No. 10/2019.

AML compliance is essential to safeguard the business from being vulnerable in the hands of money launderers. By developing a comprehensive AML compliance framework, businesses can detect and prevent suspicious activities on time without getting their business impacted by financial criminals for money laundering activities.

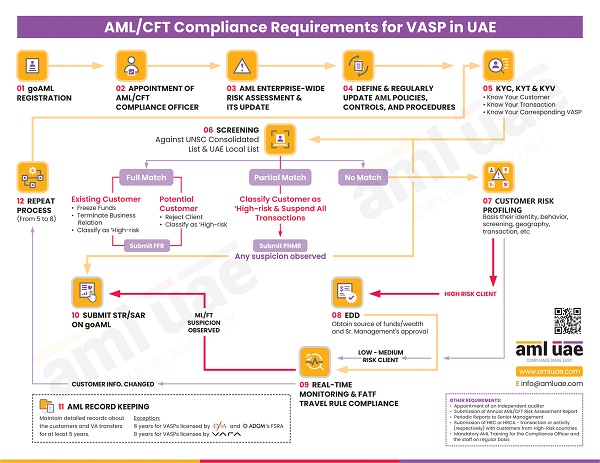

The AML regulations in the UAE mandate that Financial Institutions, Virtual Assets Service Providers (VASP) and certain Designated Non-Financial Businesses and Professions (DNFBPs) comply with these regulations. Dealers in precious metals and stones are one of the DNFBPs, required to design and implement AML/CFT policies, procedures, and controls to identify, prevent, and report suspicious transactions and activities related to money laundering and terrorism financing.

An AML Compliance Software helps meet KYC, Screening, and Reporting requirements and saves time and costs.

Why is AML Compliance necessary for Dealers in Precious Metals and Stones in the UAE?

As precious metals and stones are considered as closely associated with money laundering typologies, the dealers in precious metals and stones are entrusted with the responsibility of iden

tifying any red flags intended towards using precious metals and stones for conducting the money laundering process.

Following are a few ML/FT red flags for dealers in precious metals and stones:

- Customer requests reshaping of gold into ordinary-looking items to hide the nature of precious metals

- Customer frequently trades diamonds and gold jewellery for cash in small incremental amounts

- Transaction involving precious metals with unusual characteristics, not matching market standards

- Charitable organization requesting to buy gold worth AED 1 million, not aligned with the customer’s activities, etc.

Complying with AML regulations helps the business from non-compliance penalties and protects the business from reputational damage. With your commitment towards complying with AML compliance requirements, you gain trust and respect from your customers, suppliers, and other stakeholders, achieving customer loyalty and long-term commercial benefits.

AML compliance is a necessary part of the routine business operations of a dealer in precious metals and stones, ensuring the business does not aid any financial criminal in laundering the illegal proceeds of crime.

An AML Screening Software will help you meet legal obligations and counter money laundering and terrorism financing.

Key Features and Functionalities of an Ideal AML Software

AML compliance is integral to any business operation to maintain integrity and avoid non-compliance penalties. With increasing importance and awareness about AML compliances, new technological solutions are designed to detect, prevent, and report money laundering activities. To ensure the completeness and accuracy of the AML compliance requirements, the selection of the right AML software is necessary. While finalizing the AML software, the following key features must be emphasized.

Customer Identification and Verification

The AML software must support the performance of customer due diligence, including Customer identification and identity verification of the customers and their beneficial owners. The customer identification process should be accurate and reliable to determine whether the customer is the one he claims to be. The software should also be able to verify the customer’s address, nationality, and date of birth.

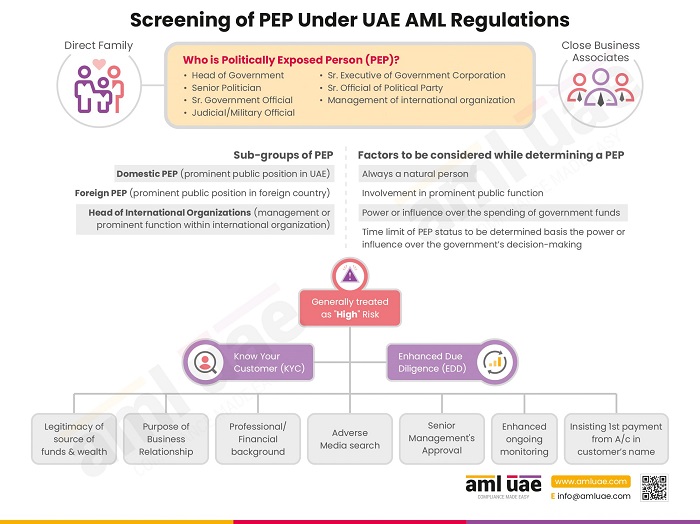

The software should support identifying the designated person or entity mentioned in the sanctions list, specifically in the UAE Local Terrorist and UNSC Consolidated lists. Further, the AML software should also allow screening of the customers and the ultimate beneficial owners against the global list of Politically Exposed Persons (PEP) and adverse media searches.

Risk Assessment and Management

The AML software should allow the Dealers in Precious Metals and Stones to assess the ML/FT risk for each of the customers and, thus, overall enterprise-wide risk assessment. The risk assessment process should be robust and accurate, considering all the relevant risk parameters such as the customer’s business activities, geographies involved, the transactional elements like mode of payment and the frequency of transactions, beneficial ownership, association with PEP, etc.

The risk scoring methodology of the AML compliance software must be simple to understand but comprehensive, assisting the AML Compliance Officer in taking necessary due diligence measures depending on the risk rating to manage the money laundering risk.

Ongoing Monitoring

The AML Compliance software should allow for maintaining and monitoring the customer’s profile and transactions executed with the customer. The transactions should be monitored against the customer’s information file to detect suspicious or unusual activity. Any unusual pattern or mismatch between the customer’s profile and the activities must be highlighted for further investigation by generating an alert. The flagging of the ML/FT red flags would ensure timely actions to prevent or mitigate the impact of the risks.

Regulatory Reporting and Record-Keeping

The AML screening software should support the generation of intelligent and analytic reports to monitor the organisation’s compliance status.

The retention of the necessary AML records and documents must be enabled in the AML software, as required under the UAE AML regulations. The software should maintain a complete audit trail and history of the compliance activities, including the customer screened, transactions monitored, alerts generated, etc. This AML recording-keeping functionality of the AML software should serve as documentary evidence to be furnished to the regulatory authorities as proof of AML compliance.

Integration with Existing Operational Systems

The AML software should integrate easily with the business’s existing systems, processes and databases to ensure efficient AML compliance management without hampering any routine business operations. The precious metals and stones dealers can easily integrate their CRM solution with the AML software and streamline the customer due diligence process.

With comprehensive data around AML compliance available in one place, the AML Compliance Officer can review the organisation’s compliance level and ensure the quality of the AML compliance framework implemented across the organization.

Selecting the right AML compliance software is of utmost importance to ensure that dealers in precious metals and stones comply with relevant AML compliance obligations and safeguard themselves from being used for money laundering activities. Right AML Software will equip you with the resources to effectively manage your 100% AML compliance requirements.

Evaluating AML Software Providers

Selection of the right AML software vendor is equally important. You may have the best of the AML software, but you may not optimally use the features if the software provider is not professional and does not provide handholding support. Partnering with the wrong AML software provider can cost you non-compliance fines and reputational damage. Here are a few key factors to consider when evaluating AML software vendors:

Reputation and Industry Experience

The AML software provider’s reputation and industry experience are among the most important factors. Look for an AML screening software provider with experience in the precious metals and stones industry. With the vendor’s understanding of the business operations and the industry, you will get customized AML software mapped with the AML compliance requirements of the dealers in the precious metals and stones sector.

You can check the Name Screening Software vendor’s reputation and experience by referring to online reviews, customer feedback and testimonials from other dealers in precious metals and stones. It helps you make decisions, providing information about the vendor’s strengths and weaknesses and their commitment to customer satisfaction.

Customer Support and Training

Another key factor to consider is the level of post-implementation customer support and training the AML compliance software vendor provides. Implementing AML software is a different task from buying one. The implementation requires support from the vendor in configuring the features as per business needs, training the employees to use the AML screening solution and extending post-implementation ongoing support to manage any issues while using the AML software, which may arise in future once the software is live.

Pricing and Contract Terms

The budget and cost of the AML software are other crucial factors while the software providers. Look out for any additional hidden charges or costs, such as implementation or annual maintenance costs. The contractual arrangement with the vendor must be clear and transparent, laying down the scope of AML software.

Scalability and Customization Options

One-size-fits-all is not a practical principle in business. The AML software must support customization, allowing the businesses to tailor-make the AML compliance software per the business needs and compliance obligations of the dealers in precious metals and stones. Further, the solution must be scalable, supporting the organisation’s growing business. The AML software, which allows scalability and customization, is always preferred over other AML software.

Selection of the right AML software, supported by the right software vendor, is necessary for the long-term success of the investment in AML technology and for ensuring 100% AML compliance in your precious metals and stones business.

Rightfully implementing the AML Software in the Jewellery Business

Managing AML compliance is necessary to keep financial criminals away from the precious metals and stones business and avoid regulatory fines for non-compliance and reputational damage. With effective implementation of the software, you can manage your AML compliance. Take care of the following aspects while going live with the AML software, and half of your AML compliance job is done:

Configuration of the AML Software

The AML software must be aligned with local and international regulatory developments and the latest data sources to ensure accurate and correct AML compliance by dealers in precious metals and stones.

Preparing the Team

The compliance team must be well-trained in the AML software’s features and functionalities to use the AML software efficiently. The training should discuss the AML compliance obligations and how the software will help achieve each AML compliance requirement.

While deciding on the AML software, AML Compliance Officer, IT professionals and senior management must be involved. This will ensure that the Compliance Officer is satisfied with the solution’s functionalities, the IT team approves the technical configuration and data security, the management signs off the investment in AML software, and shows commitment towards compliance.

How can AML UAE assist you in selecting the right AML Software for your precious metals and stones business?

The quality and effectiveness of AML compliance depend on the resources deployed, including AML Software. Appropriate AML compliance software will help your business achieve 100% compliance with AML regulations prevalent in the UAE.

AML UAE is one of the leading AML consultancy service providers in the UAE, assisting clients in setting up and implementing the AML compliance framework. Our domain experts and AML professionals understand your business requirements and help you identify the most appropriate AML solution, including discussing the solution’s functionalities and negotiating prices with vendors.

Stay Safe, Stay AML-Compliant!

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.