The Challenges of The Sanction Screening Process

Sanction screening is an integral part of AML/CFT compliance processes. With the changing political-socio-economic scenarios worldwide, governments are emphasizing sanctions. With increased awareness and alertness about the sanctions, businesses across the globe are keen to know about the sanctions and implement the robust sanction screening process. Business organizations understand the sanctions and their implications on the company and realize the benefits of sanction screening to protect their organization from being exposed to financial crimes and safeguard its reputation from damage.

What is Sanction Screening?

A company must know who it is dealing with and whether its customers or business associates are law-abiding citizens, have a legitimate business, and carry out their business activities lawfully.

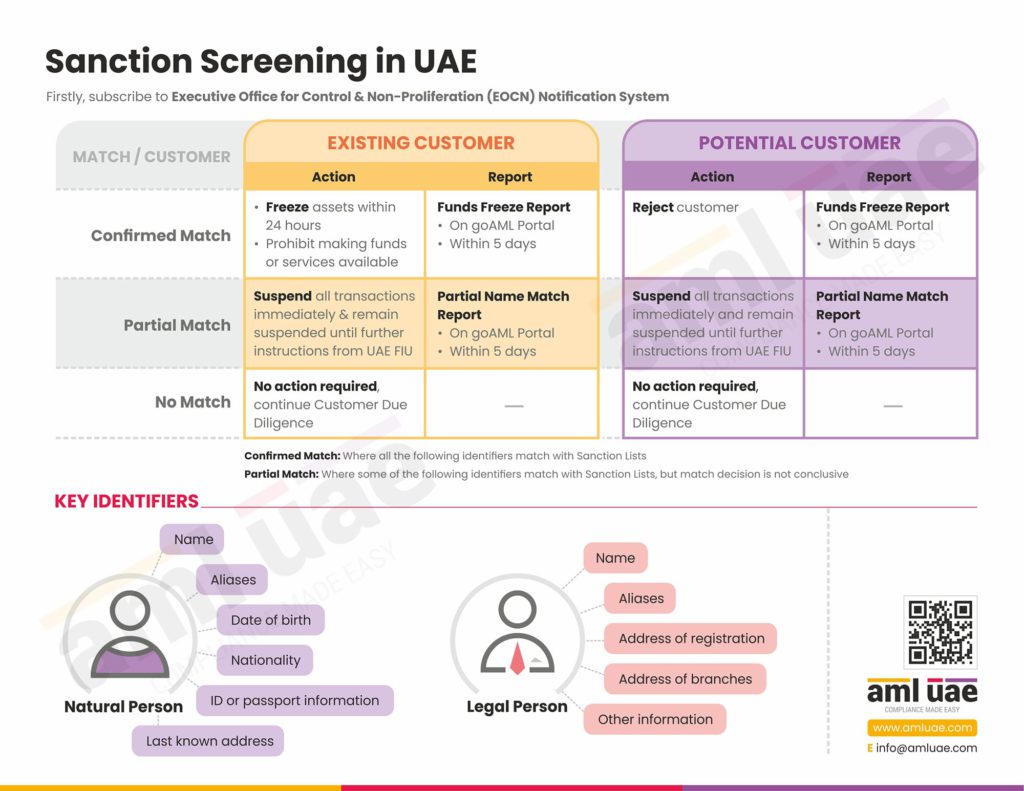

Thus, Sanction screening is a process whereby businesses screen their customers, suppliers, or any other business partner against the names of individuals/entities/organizations appearing on the sanction list. Individuals/groups who have violated the trade norms or are involved in financial crimes such as money laundering, financing of terrorism, the proliferation of financing of weapons for mass destruction, etc., are mentioned in such sanctions list. Such enlisted people are barred from trading with certain countries/groups. They are not allowed to do business because of violation of the trade agreements, and their involvement in grave offenses hampers the integrity and peace of the entire world.

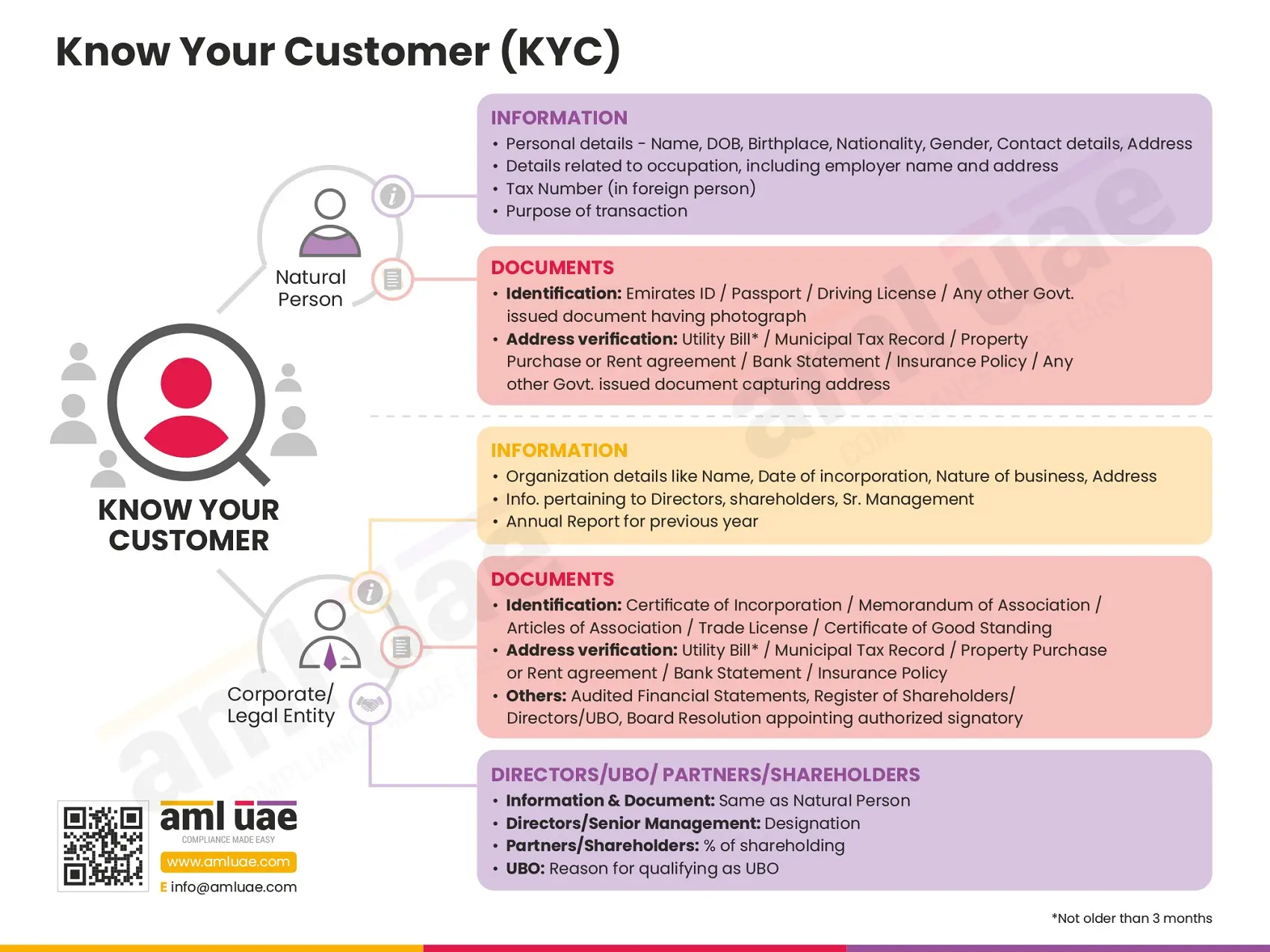

AML regulations have laid down the detailed processes to be followed to mitigate the risk of money laundering and terrorism financing. As part of the Know Your Customer or Know Your Business process, the companies must know and confirm the counterparty’s identity. Sanction screening forms part of AML/CFT compliance through the KYC process.

Under sanctions screening, the customers/suppliers’ database is screened against the loal and international sanction lists. With sanction screening exercises, businesses can know about their business partner’s records related to financial crime or illegal activities and check if any country or group has boycotted them. With screening, they can learn with whom to establish a business relationship and continue to maintain it without worrying about compliance issues. Such a regular screening process helps them protect their organization from reputational damage, penalties, financial losses, and being vulnerable to financial crimes.

Are sanctions screening mandatory?

Yes, sanction screening is a mandatory process required by the governments as their effort toward curbing the evil of financial crimes and maintaining the economy’s stability. Different sanction lists are available in other countries. The HM sanction Treasury lists is a UK consolidated list of economic sanctions that pertains to individuals and legal entities operating within the UK’s territory.

Similarly, the OFAC sanction list applies to all nationals and entities that trade in the US and have a parent/ subsidiary or an affiliate company in the US. Any entity that uses US goods or components or works through a local agent operating in the US fall under the ambit of the OFAC sanction list. The EU Consolidated sanctions list applies to all EU citizens, irrespective of their location and entities established in the member state. Then, there is a sanction list issued by the United Nations Security Council, which is mandatorily applicable to all the UN member nations.

The Financial Actions Task Force (FATF) has also recommended the sanction screening process be implemented to adopt a risk-based approach in the AML compliance process.

Considering the sanction screening as a need of an hour, the government has imposed enormous penalties for non-compliance in implementing the financial sanctions. Sanction screening helps businesses identify customers with whom they can do business without legal repercussions. Violations of the sanction screening guidelines are a grave issue and a severe threat to the country and the world economy. Foreign relations are jeopardized, and national security is compromised if the sanction screening rules are not followed. Therefore, the government has implemented enormous fines for non-compliance with the sanction screening rules. Offenders can also face imprisonment for not complying with the sanction rules and regulations.

So, to avoid hefty fines and reputational damage, companies must comply with sanction screening and ensure adherence to the AML compliance process.

The challenges of sanction screening

The sanction screening process is full of challenges, and authorities must overcome them proactively.

1. Changing Sanction Rules

The sanction rules are ever-changing, so keeping pace with the updated guidelines is necessary. There might be additions of the sanctioned entities – individuals, particular businesses, or countries and some de-listing depending on the circumstances. Sanctions are dependent on the changing socio-economic-political events worldwide, so it’s vital to sync the sanction rules with such global updates. Further, the actions to be taken by the business entity also changes, wherein some may require freezing of fund while some call for reporting to the authorities.

A recent example is the Russia-Ukraine war which has prompted the banking sector to revise the guidelines on the sanctions. Thus, everyone has to stay updated with such amendments and updates to effectively comply with sanctions procedures.

2. Lack of Data

Sanction screening can be effectively implemented only when relevant data is available. It is essential to have quick and easy access to comprehensive information on sanction lists. Banks and financial institutions or any designated entities cannot afford to miss out on any update in the sanction lists. Therefore, they need access to real-time changes in the sanction screening guidelines.

Nowadays, various AML softwares offer real-time alerts to notify the changes in the already screened person or entities. Such screening software updates the database daily, with timely addition or deleting of the names of entities/individuals from the sanction lists. With continuous monitoring of the sanctions -local and international lists- organizations can keep their business AML compliant and free from financial crime risks.

3. Updated lists

Transactions are to be monitored regularly, whereby sanction screening is performed to check whether any person not listed on sanction continues the same status or is now sanctioned. Often organizations fail to comply with the sanction screening process due to the lack of updated lists and continue with the previous screening outcome. Thus, lack of access to the updated sanction lists often causes a delay in implementing the new changes, and business falls short of being fully compliant with the new rules. It may also end in transacting with a sanctioned person.

Rely on Experts for Sanction Screening Compliance

As sanction screening is mandatory, it is crucial to follow the proper process. More importantly, it is vital to take timely action to prevent businesses from being exposed to financial crimes. It would be best to rely on expert assistance for sanction screening compliance. AML UAE has been providing AML compliance consulting services for several years. We have served many reputed businesses in the country with their sanction screening compliance process. Our expert team comprises AML specialists and business consultants with in-depth knowledge of the sanction screening procedure. They keep themselves abreast of all the latest developments in the global sanction screening guidelines and therefore are the best choice to keep your business in sync with them.

Our Timely and Accurate AML consulting Services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.