AML Business Risk Assessment

AML Business Risk Assessment

Designated Non-Financial Businesses and Professions (DNFBPS) and Financial Institutions (FIs) in UAE are required to carry out Anti-Money Laundering (AML) Business Risk Assessment (BRA). Business Risk Assessment also known as Enterprise Wide Risk Assessment (EWRA)/Entity Wide Risk Assessment/ Firm Wide Risk Assessment (FWRA)/ ML/TF Risk Assessment / Business Wide Risk Assessment / Enterprise Wide ML/TF Risk Assessment. EWRA is the pillar of the risk-based approach (RBA). The AML Policy, procedures, and controls have to be in line with the business risk assessment. Higher the risk, higher the controls is the primary requirement of a risk-based approach.

AML Business Risk Assessment Methodology

We take into consideration the UAE National Risk Assessment (NRA) issued by the National Anti-Money Laundering and Combating Financing of Terrorism and Financing of Illegal Organizations Committee (NAMLCFTC), findings of FATF, MENAFAFTF, other FSRBs, the input of the AML Compliance Officer, and the nature and size of business to carry out the Business Risk Assessment.

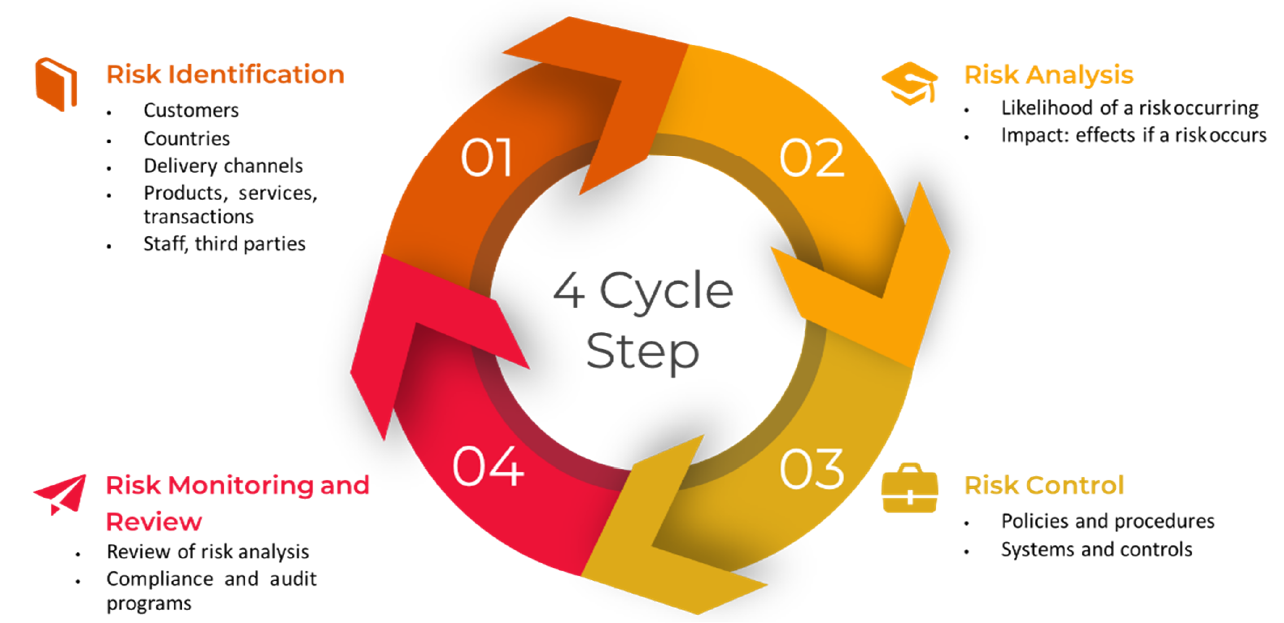

We then go on to identify the risk factors and their likelihood and impact to choose areas to prioritize in terms of AML/CFT and the policies, controls, and procedures to apply to keep those risks in check.

AML Business Risk Assessment Process

Risk Assessment. Risk Management. Compliant.

Need our assistance in conducting Business Risk Assessment?

AML Risk Assessment Steps

Identify risk Scenarios

Analysis of Controls

Assess risk Appetite

Overview of the business

Analysis of scenarios

Determination Of Residual Risks

Determine Additional Measures

Why is it important to conduct Enterprise Wide Risk Assessment (EWRA)

Top 6 reasons why FIs, DNFBPs, and VASPs have to carry out Entity Wide Risk Assessment

- EWRA helps understand the inherent AML/CFT risks (Gross Risk) and identify the effectiveness of controls in place.

- EWRA helps identify Residual Risk (Net Risk), i.e. Gross Risk-Controls = Residual Risk

- EWRA helps identify additional controls to be placed to mitigate the Residual Risk

- EWRA forms the basis for reporting entity’s AML/CFT risk management framework

- EWRA helps entities apply Risk Based Approach (RBA) and allocate resources effectively and efficiently

- EWRA helps identify gaps in AML/CFT Policy, Procedures, and Controls

How can we help?

We help companies

- Design and implement compliance monitoring programs

- Draft customized AML policies, procedures, and manuals in line with legal requirements and the nature and size of the business

- Review AML policies, procedures, and manuals according to regulatory changes

- Assess AML compliance impact of regulatory changes

- Train internal staff on AML compliance requirements

- Conduct AML compliance reviews

- Select the right name screening software for AML compliance

- Carry out Business Risk Assessment

- Perform KYC and Customer Due Diligence

- Setup in-house AML compliance department

Trusted insights. Comprehensive solutions. Expeditous delivery.

Looking for AML Compliance Services? You are at the right place.