AML Implications for Politically Exposed Person (PEP)

Identifying a Politically Exposed Person (PEP) can be a challenging task. The customer identification process is crucial as the exercise can help a business correctly assess the risk of creating a business relationship with PEP. If the identity and connections of the person are not known to the company and without correct risk assessment, mitigation of the risk becomes complex leading to reputational damage. In this article, we will discuss the AML implications for Politically Exposed Person (PEP).

Legal Framework concerning PEPs:

- Federal Decree-Law No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of

Terrorism and Illegal Organizations as amended by Federal Decree Law No. (26) of 2021 (“AMLCFT Law”). - Cabinet Decision No. (10) of 2019 concerning the Implementing Regulation of Federal Decree-Law

No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal

Organizations, as amended by Cabinet Decision 24 of 2022 (“AML-CFT Decision”).

Let’s discuss PEP and the implications of not correctly identifying the PEP.

What is a PEP?

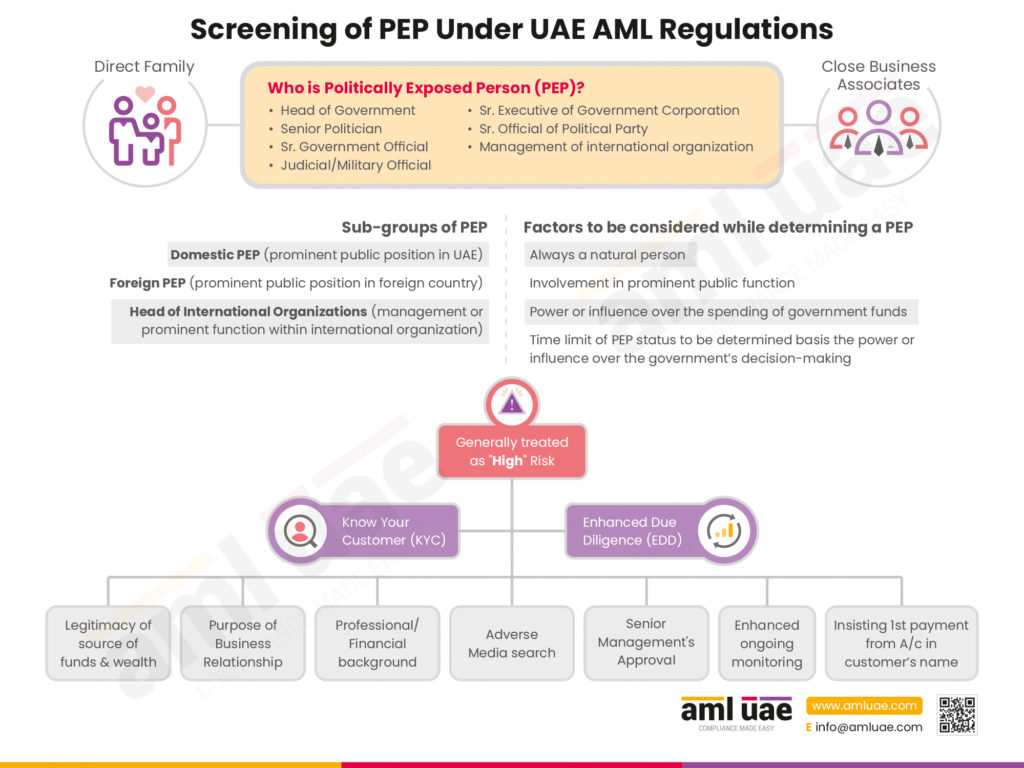

PEP is an acronym for Politically Exposed Persons. PEPs are always natural persons. The identification of PEPs in compliance is important because PEPs are persons with political power who can exercise political influence to carry out business activities and other administrative roles at their discretion. PEPs are most likely to be suspected of bribery and involved in corrupt activities, as they influence the spending of government funds. It is noteworthy that not only the person with the political power but also the family, friends, and close associates are also considered high-risk customers owing to the relationship they share with the PEP.

PEP’s definition differs from country to country, and it’s a broad term in which businesses exercise their best judgment to identify a PEP. There are several factors that businesses need to consider in the AML PEP risk assessment, such as the type of business, the country in which it operates, and the local AML regulations.

Domestic PEP:

Politically Exposed Persons who are or have been entrusted with prominent public positions in the UAE are known as domestic PEPs.

Foreign PEPs:

Politically Exposed Persons who are or have been entrusted with prominent public positions in any other foreign countries are known as foreign PEPs.

Heads of International Organizations (HIOs):

Politically Exposed Persons who are or have been entrusted with the management or any prominent function within an International organisations are known as Heads of International Organizations (HIOs).

Would a person holding a political position in foreign country be also considered as “PEP” under UAE AML Regulations?

It is to be noted that that the PEP is not restricted to only domestic public functions. Rather, the person who has been entrusted with prominent public designation in any other foreign country and person entrusted with the management or any prominent function within an international organization would also be construed as PEP under the category of “foreign PEP” and “Heads of International Organizations (HIOs)” respectively.

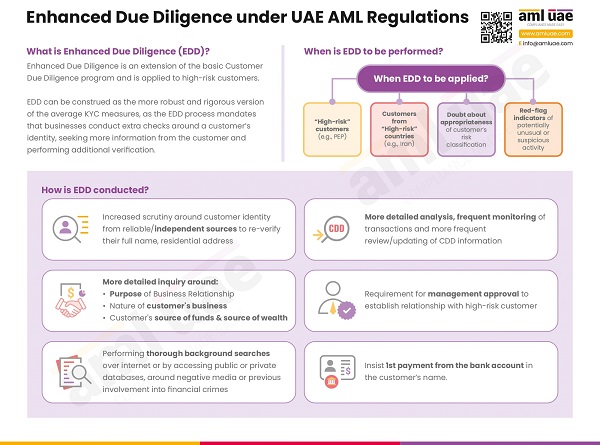

Being a PEP is not a crime, but companies must remember that a particular risk is involved in maintaining a business relationship with the PEP, that comes with their status or position in government. Companies should conduct a thorough background check and know if the persons have been involved in any money laundering cases or financial crimes. With complete knowledge of the PEP, businesses can make informed decisions regarding due diligence to be carried out and assess the risk correctly. PEPs have a higher risk because of their vulnerability to corruption and bribery cases. They can know the amount of risk involved with such entities and take appropriate measures to conduct KYC processes, apply PEP CDD measures, and perform Enhanced Due Diligence for PEPs.

Businesses must follow compliance and regulations depending on their jurisdictions and the local laws. The type of business, the sector and the company’s geographies, and the AML laws governing the country are considered while analyzing a PEP in AML. The government has imposed huge fines for not identifying the PEPs and therefore it is important to conduct Politically Exposed Person check. Also, it is essential to have an internal AML department and a robust compliance framework that will guide the business to follow the AML rules and identify PEPs by implementing an adequate due diligence process.

Why is the identification of PEP important?

PEPs are more likely to get involved in financial crimes like money laundering, corruption, and bribery. Identifying PEP is crucial because they are prone to be of high risk to businesses, as they have the power to influence decisions in government, including the spending of government funds and may try to hide the source of their wealth. Also, their relatives and associates must be scrutinized as they might be involved in money laundering activities on behalf of the PEP. They may try to run the illegal money through their names and make the illicit wealth amassed during the PEP’s political and administrative career. For regulatory reasons as well, PEP compliance is important, and Anti-Money Laundering PEP checks are a must.

Who is categorized as a PEP?

PEP is a broad term, and there is no clear answer to the above question.

Politically Exposed Person Definition:

The definition of PEP differs from one country to another. People working in the government at different levels are described as PEPs. Members of Parliament, Heads of state – presidents, ministers, heads of departments, mayors, etc. can be categorized as PEP. People at the judicial levels, such as judges, are also classified as PEP. But not all judges fall under the PEP category.

People holding diplomatic positions such as ambassadors and senior positions in the management of government-run organizations are also considered PEP. Bank officials in senior positions of national banks are regarded as PEPs. Senior officials in the sporting events responsible for organizing events and closing contracts on behalf of the government or ministry are also considered high-risk customers and fall under the PEP category.

Family & Friends:

Parents, children, spouses, partners, siblings, and close relatives can also be termed PEPs. So, they are also subject to EDD because they are associated with PEP.

Business Associates:

People with close business relationships with PEP are also considered persons associated with PEPs; people holding joint beneficial ownership or legal arrangements with the PEP are considered high-risk customers. Associates who conduct transactions on behalf of the PEP are also categorized as high-risk customers. UBOs established to provide benefits to the PEP are also considered PEPs.

Do all PEPs pose a risk?

Not all PEPs pose a risk to a business. A customized approach is needed to identify a PEP and perform a PEP risk assessment, as not all PEPs are high-risk. It depends on the company policies and its risk-based approach. Some may not consider people with a political position in the lower hierarchy in the government as a risk. On the contrary, some institutions consider anyone with political and administrative powers a PEP. PEPs signify the probability of being corrupt due to the intense political connections and their influence on political, administrative, or legislative powers. Businesses cannot employ a blanket approach as not all PEPs are corrupt, and cannot make them suffer because they are connected or related to a PEP.

The factors affecting PEP Risk Assessment

1. The PEP’s controlling power to influence highly consequential outcomes.

2. The PEP’s authority and independence in their role or function.

3. The PEP’s authority to control the disbursement of funds.

4. The governance structure (Anti-corruption laws and their level of enforcement, authority of independent public auditors, etc.) in a state or organisation where the PEP is functioning.

5. The corruption level in the state or organisation where the PEP is functioning.

What are examples of Politically Exposed Persons?

Here are the examples of persons considered as PEPs:

- Heads of States or Governments

- Senior politicians

- Senior government officials

- Judicial officials

- Military officials

- Senior executive managers of state-owned corporations

- Senior officials of political parties

- Persons who are, or have previously been, entrusted with the management of an international

organisation or any prominent function within such an organisation.

What is the time limit for considering the PEP status?

Once a PEP may not necessarily remain a PEP for the lifetime. It may be irrational to consider a person as PEP years after the person has lost the power to influence government’s decision-making.

Regarding past PEP where time has elapsed since the person ceased to hold a prominent public position, it is critical to evaluate whether that person still influences government even after his official duties as PEP has been discontinued. To determine the current status of PEP’s influential power, DNFBPs should consider factors like power and seniority derived by the person from its previous role, corruption history and potential, person’s association with other PEPs, the connection between previous role and the present work profile, etc.

How do businesses identify the PEPs?

Identifying the PEPs is an integral part of the AML compliance process. The compliance team conducts manual searches and background checks on online and offline material. Nowadays, screening software solutions are available that help in AML compliance and identify the risks associated with that particular individual. Having a clear strategy is essential to making decisions regarding PEPs. It would be advisable to set up an in-house AML department that will provide an insight into the approach to be followed for identifying the PEP and the risk assessment of such a person marked as PEP.

Steps to Identify a PEP

1. Create a PEP policy

A robust PEP policy is recommended to identify the PEPs. With a robust AML compliance framework, businesses can accurately assess the risk of different customers. It helps to correctly identify and verify the customer’s identity and flag the potential PEP – whether domestic PEPs, foreign PEP or HIOs. It is advisable to get an annual health check of your compliance framework and get expert assistance from AML compliance specialists. Relying on AML software would be best to identify and verify customers and their status as PEP or associated with PEP. With CDD and EDD processes and continuous monitoring, businesses can accurately identify PEPs, monitor their status, and transaction with them.

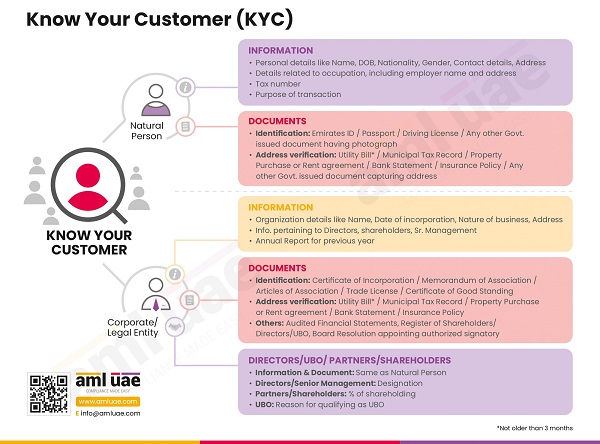

2. Onboarding Assessment

Verifying the person’s identity during onboarding is crucial. Identify the PEP at the first step of initiating the customer relationship. Also, continuous monitoring is required, as the PEP status may change over a while. So, it’s vital to keep a tab on the PEP status. It helps to assess the risk involved during the customer journey correctly. To assess the PEP status accurately, it is essential to get accurate information in real-time. Technology can immediately help you with information about the PEPs while tracking their political journey.

3. Enhanced Due Diligence

PEPs are entrusted with administration responsibilities and wield power to get things done at their discretion. Companies can use EDD as a powerful method to identify the source of PEP’s funds and verify their financial and professional background before becoming a PEP. EDD will help make an informed decision regarding establishing a business relationship with people identified as PEPs – they may be close associates, family, or friends of the PEP. Continuous monitoring of the customer profile is also required to detect any changes from the original verification conducted at the time of onboarding. Often non-profit organizations, charities, etc., are misused to launder money by the PEPs, so businesses must also verify the PEPs’ connection with such charitable organizations.

PEPs and Risk Mitigation

How to check if someone is a Politically Exposed Person (PEP)?

In order to check if a person is a Politically Exposed Person (PEP), reporting entities can resort to AML screening software. The name-screening software would screen the customer against the sanctions list and the list of PEPs. It is difficult to check for PEPs manually as no such global database is publicly available. One can perform Google searches, but that involves a lot of filtering, and the result may not be reliable. Apart from the above, the KYC form can have the question, “Are you a Politically Exposed person?” and a PEP declaration form can be obtained from the customer.

What is PEP in insurance?

Banks must conduct Politically Exposed Persons (PEP) screening while onboarding a new customer or entering into a fresh transaction with an existing customer. If the name screening software shows a positive match, then the customer is treated as a PEP in Banking and EDD is performed.

PEP Risk Rating Criteria

1. The nature of PEP’s position to influence or control government decisions.

a. The nature of PEP’s control over issues or decisions.

b.The extent of PEP’s control over disbursement of funds

c. The extent of PEP’s autonomy or independence in decision-making

d. The PEP’s rank or status within the government or international organisation.

2. The anti-corruption controls in place in PEP’s own country

a. The country’s rating on transparency and corruption aspects

b. The level of investigations and prosecutions on the charges of high-level corruption in a country

c. The internal audit function within the PEP’s entity

d. The asset disclosure requirements on the part of PEPs in the country or jurisdiction

3. Other risk factors related to products, services, customers, geographies, delivery channels, and technology should be given due consideration

4. If there are more than two PEPs involved in an entity where one of the PEPs carries high risk, then the entity should be treated as high-risk

5. If a PEP is a domestic PEP and also happens to be a foreign PEP carrying high risk, then he should be treated as high-risk.

What is PEP in AML KYC?

UAE AML Regulations require reporting entities to carry out AML KYC checks while onboarding a new customer. The reporting entities also perform PEP screening to identify if the customer is politically exposed. If the AML screening software shows a positive result for PEP screening, such customers are treated as PEPs and considered high-risk.

What does PEP mean in banking?

UAE AML Regulations require reporting entities to carry out AML KYC checks while onboarding a new customer. The reporting entities also perform PEP screening to identify if the customer is politically exposed. If the AML screening software shows a positive result for PEP screening, such customers are treated as PEPs and considered high-risk.

Are all politically exposed persons high risk?

Politically Exposed Persons are classified as high-risk customers. However, not all PEPs are high-risk. The risks associated with PEPs should be determined considering their power to influence the government’s decision-making and spending. As a best practice, all foreign PEPs are considered high-risk. Some domestic PEPs and those holding prominent positions in international organisations are considered high-risk, but other PEPs are considered low to medium-risk customers depending on the risk-based approach taken by the entity.

What are the risk factors of politically exposed persons?

PEPs are susceptible to corruption due to their power to influence government spending. This gives rise to money laundering as they would then want to convert illicit money into legitimate money.

What is a PEP declaration form?

A PEP declaration form is nothing but an AML KYC check performed on a customer where the potential customer is asked to indicate if he is a Politically Exposed Person.

What is FATF guidance on politically exposed persons?

FATF Recommendations 12 and 22 deal with PEPs. As per the FATF Guidance, a politically exposed person (PEP) is an individual who is or has been entrusted with a prominent function. Many PEPs hold positions that can be abused to launder illicit funds or commit other predicate offences, such as corruption or bribery. The PEP assessment is necessary and the Politically Exposed Persons (Recommendations 12 and 22) require the application of additional AML/CFT measures to business relationships with PEPs.

What is a PEP close associate?

A close associate of a PEP is an individual who has close social or professional relations with a PEP.

Conclusion

AML UAE is one of the leading AML compliance advisory services providers in the UAE. We have served many businesses with AML compliance activities, including the risk assessment of PEPs. If you need help with the AML framework concerning PEPs, then you can rely on our AML compliance specialists. We offer a full range of AML compliance services, such as Annual AML Health Checks, assistance in AML software selection, AML policy, and procedures documentation. Contact us for a full range of AML compliance services.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.