AML Compliance Officer: Role and Responsibilities

Money laundering and the financing of terrorism are financial crimes that pose detrimental effects on the economic system and society as a whole.

The “Cabinet Decision No. (10) of 2019 concerning the implementing regulation of Decree-Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations” was brought into force to combat the same.

These regulations are applicable to Financial Institutions (Fis), Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Asset Service Providers (VASPs) operating within the UAE.

The said legislation is formulated with the intent to aid entities with the ‘know-how’ as to how to deal with ML/FT occurrences

by having a systematic structure in place.

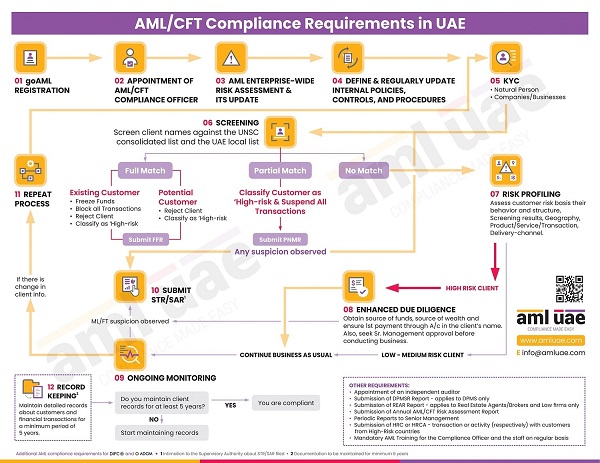

Appointment of an AML Compliance Officer is an essential requirement that fulfills the need of having an officer with a keen eye for noticing and reporting in an unbiased, fair, and transparent manner any such suspicious activity to the appropriate authority, both within and outside the entity.

As per the UAE Anti-Money Laundering (AML) Law, Financial Institutions and Designated Non-Financial Business Professionals (DNFBPs) must appoint an AML Compliance Officer. The role of such an employee is to comply with the anti-money laundering laws- Federal Decree-law No. (20) of 2018 On Anti Money Laundering and combating the financing of terrorism. Another law is Article (11) Cabinet Decision No. (58) of 2020 Regulating the Beneficiary Owner Procedure.

The legal person or entity appoints the AML compliance officer role. They are natural persons appointed and should have the requisite experience and skills to implement a robust AML compliance process. The AML compliance officer carries on the duties on behalf of the legal person or entity who provides all the required data to the legal person or entity, follows the procedures as per the AML laws, and helps prevent money laundering activities. The AML officer should carry on the duties with utmost competence to help businesses comply with the AML laws.

Who can be appointed as an AML Compliance Officer?

An independent natural person with requisite competencies and experience can be appointed as an AML Compliance Officer of the Company. Further, the Compliance Officer must be at par with the senior managerial level person who can perform his functions without undue pressure. He must be able to make independent decisions to protect the entity from ML/FT risks.

Prior approval from the Supervisory Authority

It is necessary to obtain prior approval from the relevant Supervisory Authority, and the same can be obtained by applying on the goAML portal maintained by the FIU (Financial Intelligence Unit), UAE. The reporting entities must prepare an authorization letter favoring the designated Compliance Officer and upload the same on the goAML portal along with the following:

- A copy of the passport, resident visa, and Emirates ID of the Compliance Officer

- A copy of the organization’s commercial or trade license

Additionally, certain DNFBPs, depending on the size and nature of the business, may also consider appointing a Money Laundering Reporting Officer (MLRO) to submit various reports on the goAML portal.

The reporting entities can seek guidance from the Supervisory Authority in relation to the competence and experience expected from the Compliance Officer to enforce an effective governance structure.

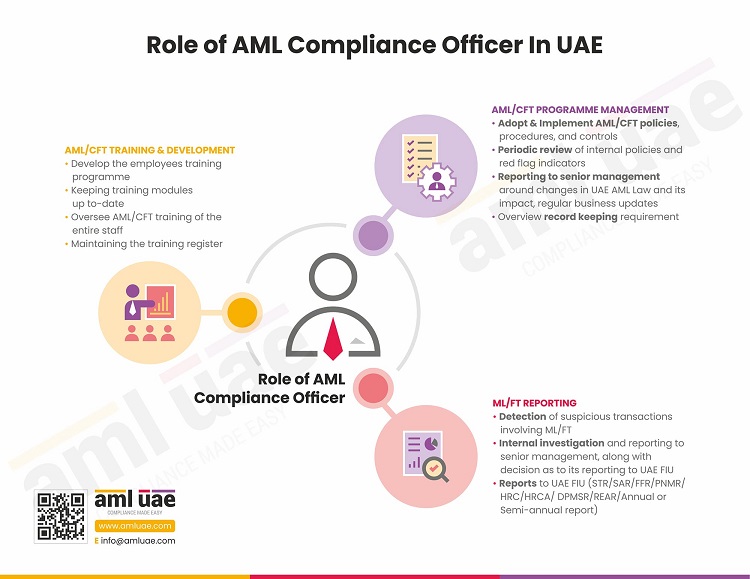

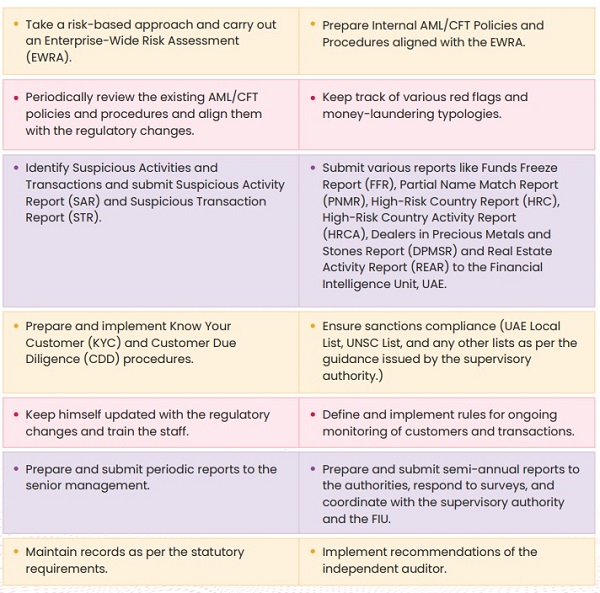

Responsibilities of an AML Compliance Officer under the UAE AML Laws

Section 8, Article 21, states the responsibilities of a Compliance Officer.

- The AML compliance officer has to detect transactions relating to any crime.

- The AML compliance officer needs to review the AML/CFT compliance program and processes to prevent financial crimes. He needs to align the AML/CFT framework in line with the regulatory requirements and the ML/TF risks faced by the entity.

- The Compliance officer must review and evaluate suspicious transactions and activities. The Compliance Officer needs to report such transactions and activities in the form of a Suspicious Transaction Report (STR) and Suspicious Activity Report (SAR) to the FIU, UAE.

- The AML compliance officer has to submit various reports like Funds Freeze Report (FFR), Partial Name Match Report (PNMR), High-Risk Country Report (HRC), High-Risk Country Activity Report (HRCA), Dealers in Precious Metals and Stones Report (DPMSR) and Real Estate Activity Report (REAR) to the Financial Intelligence Unit, UAE.

- The AML compliance officer needs to conduct training for the employees, make them aware of the AML rules and regulations, and train them in the best global practices to counter the risks of financial crimes.

- The AML compliance officer needs to submit periodic reports on AML compliance with the senior management and file semi-annual reports with the Supervisory Authority.

- Detect transactions in Financial Crimes

- The Compliance officer needs to review and evaluate data of suspicious accounts that might be concealing money laundering. The Officers can report the data to the Financial Intelligence Unit depending on the case. The transaction might be continued, and they need to state the reasons for their research. They need to collaborate with the supervisory authority and FIU to provide all the relevant data.

- The AML compliance officer reviews the internal rules and processes to prevent financial crimes. He also needs to update the relevant authorities and comply with the latest rules and regulations.

- The AML compliance officer has to submit the reports on the rules to the concerned authority.

- To conduct AML training for the employees and make them aware of the AML rules and regulations and train them on the best industry practices. Training is imparted to employees to understand money laundering methods and implement the right processes to prevent money laundering and financial terrorism.

- The AML compliance officer needs to coordinate with the Supervisory Authority and FIU, providing them with all the necessary data to help fight ML/TF risks.

The compliance officer’s duties can be categorized into two parts- Duties to the employer and responsibilities to the Government.

Ensuring independence of the compliance function in small and medium-sized entities

Small and Medium-sized entities, when they do not have enough human and IT resources and have assigned multiple roles to the compliance officer, must consider the following :

- If the compliance officer is assigned multiple roles and responsibilities, the DNFBP must ensure that the designated compliance officer does not have any daily responsibility for sales and customer relationship management.

- When a DNFBP is too small and adequate separation of duties is not possible, then the DNFBP should take the necessary steps to ensure that operational and AML/CFT policies and procedures are clearly formulated, documented, and adhered to during the establishment and ongoing monitoring of business relationships and the carrying out of transactions.

- DNFBPs must also ensure that all policy and procedural exceptions are documented, additional risk mitigation measures are undertaken, and these documents are retained as per the statutory record-keeping requirements.

- DNFBPs should also consider referring to any significant policy or procedural exceptions, along with their rationale, associated additional AML/CFT risk mitigation measures, and senior management comments, in the AML/CFT compliance officer’s required semi-annual reports to the relevant Supervisory Authorities.

- DNFBPs that are unable to establish a clear separation of duties need to consider taking additional measures like:

- Independent AML audit

- The independent AML audit should incorporate the audit of policies, procedures (Customer Due Diligence (CDD), Identification of suspicious transactions, High-Risk country CDD measures, and updating of local and UNSC sanctions list), and records related to deviation from the prescribed procedures.

- Increasing the frequency of independent audits and random audit inspections.

- Strict criteria for past transaction review (more number of transactions review, reduced threshold limits for transaction review, etc.)

AML Compliance Officer's duty to the Government

The compliance officer will ensure that the legal entity complies with the Government’s AML rules and regulations under different laws. They need to report the suspicious accounts to the FIU– Financial Intelligence Unit.

AML Compliance Officer's duty to the Employer

AML Compliance Officer’s duty to the employer under the UAE AML Law includes various functions. The compliance officer can make a correct evaluation of the risk assessment. A company might be exposed to risk due to the nature of business and use proper measures to create a robust AML compliance program.

The importance of Compliance Officer

The AML compliance officer must perform duties for the entity and the Government. The officers work in tandem with the management and staff to identify and manage the ML/TF risk.

A compliance officer must ensure that the business has an effective AML compliance program. Every business is unique, and the AML program should be tailored to adopt a risk-based approach.

The compliance officer should be well-versed in the regulatory framework that pertains to the business. He needs to identify any risk of non-compliance and use advanced solutions to eliminate the risks and help the business stay compliant with the AML rules and regulations.

The AML/CFT compliance officer helps companies carry out the Enterprise-Wide Risk Assessment, design the AML/CFT framework, implement the AML/CFT program, and submit various regulatory reports.

The AML/CFT compliance officer helps choose the right AML software to automate KYC, screening, risk assessment, and record-keeping requirements.

With his independent and objective insights, entities can ensure a successful AML/CFT program implementation and effectively fight various risks related to financial crimes.

Setting up an In-house AML Compliance department

Organizations must also appoint an AML Compliance Officer who monitors the activities of this department and ensures successful implementation of the AML programs and frameworks.

In addition to that, an AML Compliance Department within an organization is essential to ensure that the AML-specific rules and regulations are complied with and AML compliance programs are managed properly.

An AML Compliance Department in an organization is responsible for monitoring the application and compliance with AML-specific laws and regulations as mandated by the country’s regulators.

It identifies the money laundering risks business faces, suggests relevant internal controls and policies, monitors the implementation of each, and advises on risk management whenever the need arises.

The key objective of the AML compliance department is to create relevant AML compliance policies to adhere to relevant guidelines and internal controls and monitor the same to fight financial crimes.

Why should businesses hire a Compliance Officer?

The AML compliance officer has to perform duties for both the employees and the Government. The officers work in tandem with the management and staff to identify and manage the regulatory risk. They need to ensure that the organisation complies with the Government’s rules and regulations, internal policies, and by laws.

A compliance officer needs to ensure that the business has an effective AML compliance program in place. Every business is unique, and the AML program should be robust to identify the weak areas in which the company needs a strict compliance program.

The compliance officer should be well versed with the regulatory issues and AML laws that pertain to the type of business, identify any risk of non-compliance, and use advanced solutions to eliminate the risks and help businesses stay compliant with the AML rules and regulations. Companies can outsource the AML compliance services to a reliable service provider.

Companies can get the AML/ CFT Policy, controls, and procedures documentation and get an elaborate in-house AML compliance department set up, services including appointing an AML compliance officer. The service provider will help appoint a compliance officer who will undertake all the responsibilities for the AML/ CFT compliance for the business. The officer will ensure that the compliance department works seamlessly, and if necessary, a compliance team might be created to streamline the AML compliance function.

It would be best if businesses invested in the best AML software to automate the AML compliance process and help comply with all the AML rules and regulations. The software will aid the compliance team and the compliance offer to ensure the smooth functioning of the AML compliance department.

Role of AML Compliance Officer under UAE AML Regulations

Conclusion

The AML Compliance officers play an instrumental role in helping businesses avoid regulatory risks and help the company to be compliant with the AML laws. So, companies should appoint and rely on the compliance officer to eliminate the risk of non-compliance. The Money Laundering Reporting Officer (MLRO) needs to be aware of all the latest legislation to provide correct guidance, and businesses do not have to face non-compliance issues.

Our recent blogs

side bar form

Add a comment

Share via :

FAQs

An AML Compliance Officer is a person responsible for compliance of the company with national and international AML regulations. They detect suspicious transactions, conduct risk assessments, monitor the company’s activities, submit relevant reports to concerned authorities, and conduct AML training for employees.

The AML Compliance Office performs the following responsibilities:

- Detect any anomalies in transactions or customers

- Monitor suspicious customer accounts to check for any possibilities of money laundering

- Submit reports to the concerned authority

- Review internal controls, processes, and procedures

- Conduct AML training for employees

A compliance officer:

- Conducts regular risk identification and analysis

- Conducts training for staff members to educate them about AML regulations and other essential requirements

- Forms standards and policies for aligning processes with AML requirements

- Monitors processes, policies, and procedures to ensure compliance with regulations

- Acts as a point of contact between the AML department and senior management

A compliance officer can be a lawyer, but it is not a mandatory requirement.

The essential qualities that a compliance officer must have are:

- Attention to detail

- Communication skills

- Industry knowledge

- See the big picture

- Ability to interpret and assess

- Critical thinking

- Integrity

- Problem-solving attitude

- Risk assessment capability

- Analytical mindset

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.