AML Compliance for Online Jewellery Marketplace

Precious metals and stones and jewellery made from such precious metals/stones are prone to high risk of money laundering, irrespective of the channel through which commercial transactions take place. Thus, anti-money laundering (AML) compliance is equally essential for online jewellery marketplaces to safeguard the penetration of the launderers in the virtual commercial platform.

Before discussing AML compliance for the online jewellery marketplace, let us understand what an online marketplace is.

Detect and deter money laundering in the

online jewellery marketplace

With our expert AML compliance services

What is an Online Marketplace?

Online marketplaces are e-commerce platforms enabling sellers and buyers to connect and conduct business. Such platforms are often known as online, electronic, or digital marketplaces. These platforms act as intermediaries, facilitating transactions between buyers and sellers. Online marketplaces offer convenience to both buyers and sellers across the globe and usually allow for cross-border transactions, enabling sellers to reach buyers beyond their local or national borders. The operators of online marketplaces provide several services to buyers and sellers using their platform, such as payment processing, order placement and customer support.

Online jewellery marketplace

The online jewellery marketplace refers to the segment of the e-commerce industry that facilitates the purchase and sale of jewellery, providing a platform to various customers and dealers in precious metals and stones.

Who qualifies as a “Customer” for online jewellery marketplaces?

As we understand it, a customer is a person who purchases goods or services from a supplier who is engaged in the supply of relevant goods or services. A customer can be an individual or a business.

Since the online marketplaces provide services to buyers and sellers to connect and deal in transactions, it can be said that both-

- the sellers listed on the online marketplace to sell their products

- the end consumer using the platform to buy the listed items

would come under the umbrella of “customer” for an online jewellery marketplace.

Let us first explore why AML compliance is essential for online jewellery marketplaces.

Why is the online jewellery marketplace prone to ML/FT risks?

There is a high level of anonymity on online platforms, giving an opportunity to money launderers and making it difficult to track down the sellers and buyers involved in such activities.

In general, the jewellery market involves high-value transactions. With online platforms, dealing in high-value transactions for jewellery can easily be done across borders within a split of a second with less suspicion. Thus, it becomes an attractive medium for money launderers.

Fake transactions have risen with the advancement of online marketplaces. Money launderers can form fake or mispriced transactions through online jewellery marketplaces to move high-value funds. Further, the risk of impersonation or using fake identities is rising in virtual commercial platforms.

Globalisation has increased cross-border transactions. However, there isn’t a coherence between the regulatory frameworks of the countries. Different regulatory regimes in different countries affect global transactions. Some countries have strict regimes, while others have few to no restrictions. Also, some jurisdictions do not pay heed to the supervision and monitoring of every transaction. Thus, because of the lack of a standard regulatory regime across the globe, the possibility of attempted money laundering transactions through online jewellery marketplace may go unnoticed.

ML, FT and PF typologies associated with online jewellery marketplaces

a. How are online jewellery marketplaces used by Money Launderers to carry out “Structuring”?

Money launderers use a structuring methodology for conducting transactions, breaking down large transactions into smaller ones to avoid suspicion. Generally, a transaction involving a large amount attracts suspicion and regulatory attention. In the case of online jewellery marketplaces, money launderers might conduct multiple transactions below the reporting threshold under a regulatory framework to avoid detection and consequences. Additionally, money launderers use the layering method, in which small transactions are conducted using different accounts.

b. Trade-Based Money Laundering using online jewellery marketplaces

Money launderers often exploit online jewellery marketplaces to engage in ML/FT activities and conceal and circulate illicit proceeds easily. This is due to the convenience of conducting transactions from anywhere, the global reach, and the anonymity offered by online platforms.

- Circular transactions – Circular transactions refer to deceptive financial activities conducted among companies within a single group or under the control of a single owner. They are designed to obscure the origin and movement of illicit funds, posing a significant challenge to AML efforts.

- Invoice tampering – Launderers can manipulate invoices related to jewellery transactions by increasing or decreasing prices, allowing them to move funds across borders.

- False Documentation – Money launderers use false documentation related to jewellery transactions to legitimise the movement of illicit funds, making them appear legitimate transactions.

These methods show how money launderers can exploit online jewellery marketplaces.

Regulatory Framework for Online Marketplace

Telecommunications and Digital Government Regulatory Authority (TDRA) regulates the e-commerce framework and transactions in the UAE. TDRA approval is sought after obtaining the necessary eCommerce business license from the respective licensing authority, such as the Department of Economic Development (DED) for the UAE Mainland entities.

Laws pertaining to e-commerce/online marketplaces

The online jewellery marketplaces are subject to e-commerce laws as prevalent in the UAE.

Federal Decree-Law No. 14 of 2023 Concerning the Modern Technology-based Trade outlines regulations governing modern technology-based trade (Federal Decree no. 14 of 2023) is the primary law governing e-commerce, including an online jewellery marketplace.

This broadly encompasses how business is carried out by online marketplaces, which provide a platform to buyers and sellers and enable them to buy and sell goods and services through websites and applications.

Is there any mention of AML compliance in such laws?

Laws regulating the online marketplace do not cover the requirements needed to combat ML/FT and PF. To address the risk of ML/FT and proliferation financing of weapons of mass destruction, the UAE government, in accordance with the Financial Action Task Force (FATF) recommendations, has enacted laws and regulations to combat these.

AML Compliance for online marketplace, including online jewellery marketplace, can be linked to the following AML regulations due to its nature of dealing and facilitating transactions that involve Dealers in Precious Metals and Stones (DPMS):

- The Federal Decree-Law No. (20) of 2018 On Anti-Money Laundering and Combating the Financing of Terrorism and Financing of Illegal Organisations, as amended by the Federal Decree-Law No. (26) of 2021.

- Cabinet Decision No. (10) of 2019 concerning the implementing regulation of Decree-Law No. (20) of 2018, as amended by Cabinet Resolution No. (24) of 2022.

- Cabinet Decision No. (74) of 2020 Regarding Terrorism Lists Regulation and Implementation of United Nations Security Council (UNSC) Resolutions on the Suppression and Combating of Terrorism, Terrorist Financing, Countering the Proliferation of Weapons of Mass Destruction and its Financing and Relevant Resolution.

Additionally, the UAE authorities have issued Supplemental Guidance for Dealers in Precious Metals & Stones (DPMS) as part of Guidelines for Designated Non-Financial Businesses and Professions. These guidelines help DPMS, including the online jewellery marketplace, better understand and implement the AML compliance measures.

AML Compliance measures to be undertaken by online jewellery marketplaces

An online jewellery marketplace should set certain requirements for both buyers and sellers to ensure smooth transactions and a safe environment. By implementing these requirements, an online jewellery marketplace can provide a safe and transparent environment for transactions, enhancing trust and confidence among users. Here is the list that should be considered before facilitating any transaction:

Requirement for Buyers and Sellers

- The online jewellery marketplace should create a system allowing buyers to create an account on the platform and provide necessary information such as name, email address, and password to continue with transactions. Only with such a personal account would buyers be allowed to make and buy jewellery.

- The online jewellery marketplace should create a system allowing sellers or suppliers to create an account on the platform. The platform should also have a system for necessary business information and documentation as per the country’s law.

- The online jewellery marketplace shall establish a system for identifying buyers who need to verify their identity. This requirement is necessary to ensure security and prevent fraud, as jewellery involves high-value purchases.

- The online jewellery marketplace should provide clear terms and conditions for buyers & sellers to establish rights and responsibilities when using the platform. The language of such terms and conditions should be simple for a clear understanding.

- For listing sellers, the platform must carry out verification to ensure compliance with platform standards and regulations before allowing sellers to engage in business through its platform.

- The online jewellery marketplace makes sure that sellers on its platform are able to provide the necessary information, records, and documents for inspection, especially concerning compliance with AML laws and regulations.

- The online jewellery marketplace should allow buyers to make payments only through secure payment options available to them, ensuring convenience and security during transactions. Additionally, restrictions should be imposed on cash transactions involving high-value transactions.

- The online jewellery marketplace should incorporate a robust customer support system to assist buyers with inquiries, issues, or disputes they may encounter during the purchasing process. It should also include a system for sellers to leave reviews to provide feedback on their experiences and reporting of transactions where the buyer is suspected of being involved in ML/FT cases.

Insistence on AML Compliance from DPMS listed on the Platform

An online jewellery marketplace platform should ensure that all suppliers willing to list themselves comply with AML obligations defined under the respective country’s AML regulations before allowing them access to the platform to execute commercial transactions.

Before listing themselves on an online marketplace platform, jewellery suppliers must take necessary measures to mitigate ML/FT risks. One key measure is implementing strong and effective internal policies, controls, and procedures. Suppliers of jewellery must periodically assess these policies for effectiveness and update them accordingly as and when the need arises to ensure that no criminals exploit their business under the guise of the online marketplace.

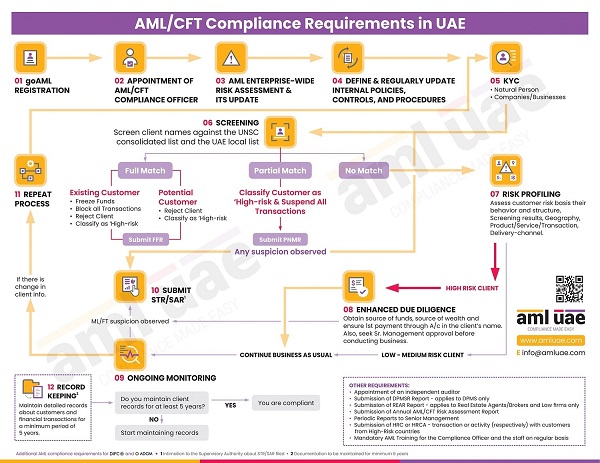

The following is the list of policy requirements that jewellery suppliers on an online platform must include in their AML/CFT Policy Manual:

- The identification and assessment of ML/FT risks using a risk-based approach.

- Know Your Customer (KYC) and Customer Due Diligence (CDD), along with details of situations and means of carrying out the Enhanced Due Diligence (EDD) and Simplified Due Diligence (SDD) measures.

- Customer and transaction monitoring and the reporting of suspicious transactions.

- AML/CFT governance, including compliance staffing and training, senior management responsibilities, and the independent auditing of risk mitigation measures.

- Record-keeping requirements

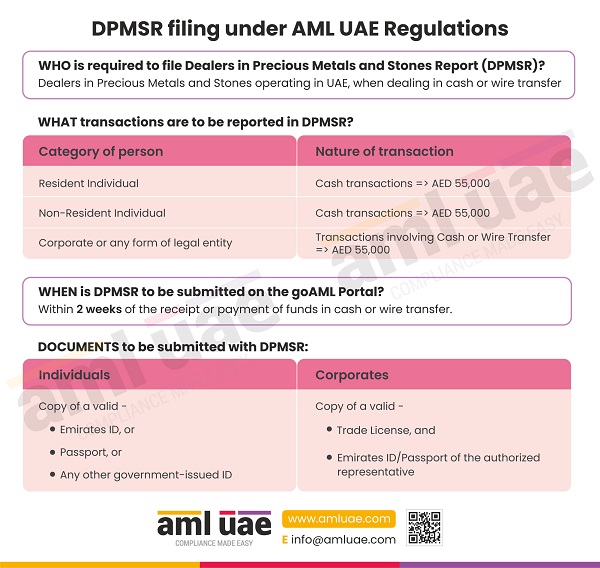

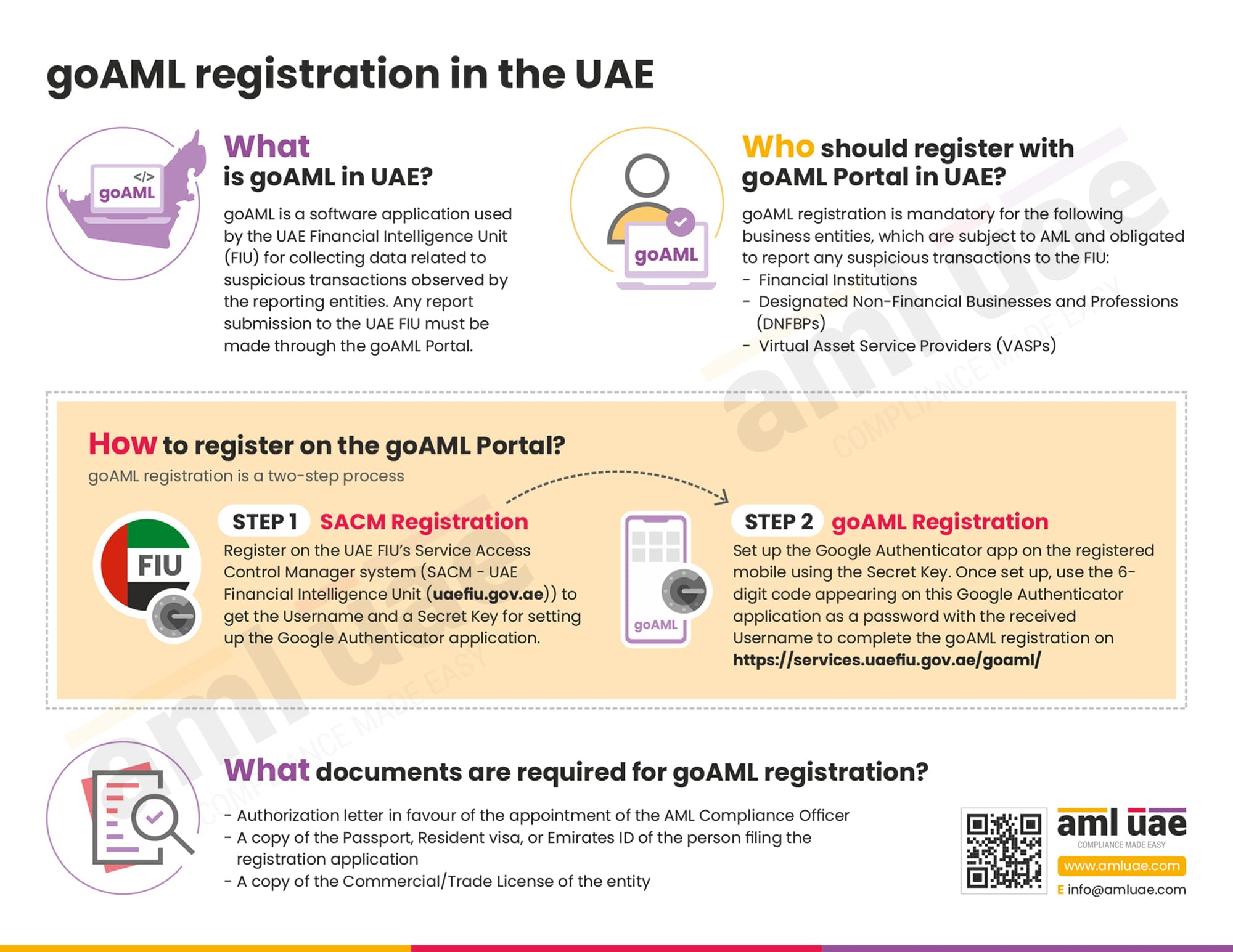

Additionally, an online jewellery marketplace should check that all DPMS sellers listed on its platform comply with the requirement of filing the Dealers in Precious Metals and Stones Report (DPMSR) on the goAML portal for the specified transactions exceeding a certain amount.

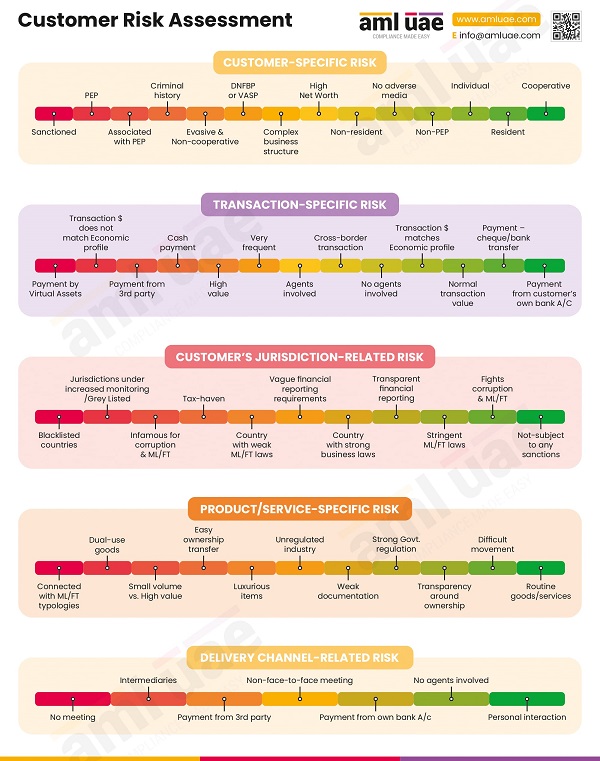

Implementation of a Risk-Based Approach

The online jewellery marketplace that facilitates jewellery transactions should have policies, procedures, systems, and controls in place in accordance with the risk-based approach (RBA) as prescribed by the UAE federal laws and FATF while supervising the transactions between buyers and sellers that it facilitates. The RBA calls for applying risk mitigation measures proportionate to the ML/FT and PF risk the business is exposed to.

As part of the risk assessment process, an online jewellery marketplace must identify specific areas of business that customers are more likely to use in order to conduct any ML/FT or PF. The online marketplace must consider the following risk factors:

- Customer risk – In any online jewellery marketplace, customer risk refers to customer categories based on the assessment of factors that may expose them to potential financial crimes. This risk may arise from dealing with PEP (Politically Exposed Persons) or Sanctioned Individuals.

- Geographic risk – Geographic risk for an online jewellery marketplace would mean the risk associated with transactions from which the seller/buyer originates. This may relate to jurisdictions with a higher likelihood of financial crime or inadequate regulatory frameworks.

- Product risk – Product risk means assessing how vulnerable the product is to the online jewellery marketplace. Naturally, dealing in precious metals and stones is a risky affair, and the probability that sellers or buyers will engage in unethical or illegal activities must be assessed by the online jewellery marketplace.

- Transactional and Delivery-Channel Risk – This relates to the potential risk for financial crime facilitated by the method of delivery, mode of payment or transfer of funds within and to the online jewellery marketplace by using wire transfers, virtual assets, routing transactions through multiple accounts and complex web of transactions.

Establishing AML Governance within the online jewellery marketplace

An Online jewellery marketplace should ensure that ML/FT and PF risk is minimised through the platform and establish a robust AML governance by formulating and implementing comprehensive AML/CFT policies and procedures to safeguard the platform from illicit activities.

- An Online jewellery marketplace should enforce stringent AML/CFT policies and procedures encompassing customer due diligence (CDD) processes, including verifying customer identities and monitoring transactions for suspicious activities.

- It should also employ such technologies to enhance the detection of irregular or high-value transactions and ensure compliance with regulatory requirements.

- Additionally, suppliers’ role in maintaining the integrity of the marketplace is very critical. An online marketplace should also conduct periodic assessments and audits of suppliers to ensure ongoing compliance and mitigate potential risks.

- An online marketplace should appoint an AML Compliance Officer, who would be responsible for designing, implementing, and monitoring our AML/CFT policies and procedures. Further, an online marketplace shall also make sure that its suppliers appoint an AML Compliance Officer to oversee their respective AML/CFT efforts.

- As regulatory compliance, an online jewellery marketplace should register themselves on the goAML portal. It must also mandate the goAML registration of the listed suppliers.

Customer Due Diligence (CDD)

An Online jewellery marketplace should conduct comprehensive CDD procedures for customers and suppliers engaging in transactions on an online platform to verify their identities and assess the nature of their activities. Similarly, the suppliers listed on the platform must apply necessary CDD measures to mitigate the risk arising from buyers who are proposed to be onboarded through the online platform.

Know Your Customer

Know Your Customer (KYC) is a process of identifying and verifying customers before commencing a business relationship.

- Online Marketplace:- To combat ML/FT threats, Online jewellery marketplaces must implement an adequate KYC program. An online marketplace must identify the natural or legal person with whom the business is proposing to transact, including their background, so it does not expose the platform to such criminals. For verification of identity, necessary documents must be obtained, such as identity and address proof.

- Supplier:- An online marketplace should also ensure that its suppliers implement KYC measures and monitor their customers obtained through online and offline jewellery marketplaces. For verification, the supplier can use and rely on the documents obtained from the buyer by the online marketplace.

Customer Risk Assessment

The Customer Risk Assessment is all about identifying and evaluating the ML/FT risk the buyer and seller pose to the business.

- Online jewellery marketplace:- An Online jewellery marketplace must conduct a Customer Risk Assessment by evaluating various factors such as transaction volume, geographical locations, frequency of transactions, and the type of jewellery sold. Additionally, the buyers must be segmented based on risk levels such as low-risk, medium-risk, and high-risk. It should also assess supplier risk based on factors like location, reputation, compliance history, and the nature of the jewellery supplied and classify the suppliers into different risk categories.

- Supplier:- An online jewellery marketplace should also ensure that its suppliers are performing customer risk profiling to better understand the risks involved with customers obtained through the online marketplace. The risk assessed by the online marketplace and the supplier for the same buyer may differ, considering each of their business risk assessment.

Enhanced Due Diligence (EDD)

As part of CDD, if the customer’s risk is identified as high, the online jewellery marketplace must implement EDD measures to further mitigate risks associated with ML/FT. This would include the application of enhanced checks on the identity of the customers, seeking additional documents pertaining to the customer’s sources of funds, and onboarding customers only after senior management approval. Similar EDD measures must be implemented by the suppliers when the customer risk profiling suggests increased ML/FT risk.

Ongoing Monitoring of Business Relationships and Transactions

Ongoing monitoring of business relationships within an online jewellery marketplace should include the continuous evaluation of customer interactions and transactions to assess the legitimacy of these relationships. This includes keeping detailed records of customer profiles, transaction histories, and communication exchanges to facilitate ongoing monitoring and analysis.

The fundamental goal of this ongoing monitoring is to uncover suspicious activity.

- Online jewellery marketplace:- An online jewellery marketplace must engage in continuous surveillance of transactions occurring on its platform to identify and mitigate potential risks associated with financial crimes. Transaction monitoring must include monitoring for unusually large transactions, transactions involving the same parties, and transactions that deviate from typical customer behaviour. Upon detection of suspicious activity, it should conduct reviews and take necessary actions to mitigate the risk, including reporting the same on the goAML Portal. Similarly, it must monitor business relationships with suppliers on an ongoing basis to ensure compliance with regulatory requirements and mitigate risks associated with financial crimes. This includes regular reviews of supplier performance, transactional performance, and compliance with contractual obligations.

- Supplier:- Additionally, an online jewellery marketplace should ensure that its suppliers have an ongoing monitoring program in place for their customers and that such procedures are mentioned in their AML/CFT policies and procedures.

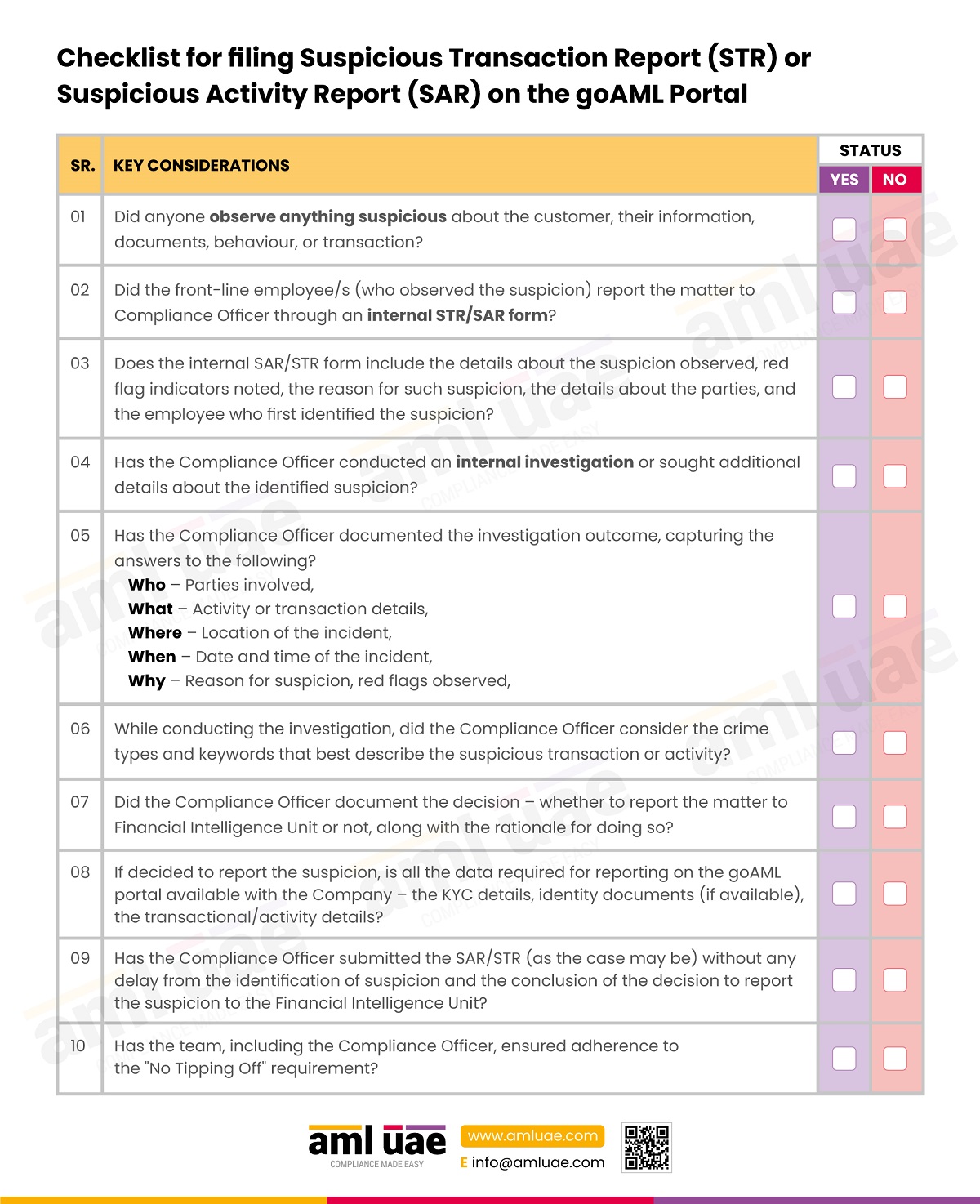

Reporting of Suspicious Activities/ Transactions

An online jewellery marketplace shall ensure that all transactions likely to be part of an ML/FT and PF deal are reported to the regulatory authority in a manner prescribed by law. Thus, an online marketplace should document the relevant red flags that suggest the transaction’s likely association with ML/FT activities.

Red flags and the Importance of Red Flag Warning

Red Flags are indicators that can help identify illegal activities like ML/FT. They are also called suspicion indicators or risk indicators. Generally, red flags are warning signs that businesses should remain alert for potential money laundering and terrorists.

The growing online jewellery marketplace has made jewellery dealings diverse. This interconnectedness of the online jewellery system has created opportunities for criminals to engage in ML/FT and PF.

List of Red Flags applicable to online jewellery marketplace

- Customer uses more than one national or foreign bank account under his name.

- The seller is selling products to selective customers.

- Sudden change in the mode of payment at the time of conclusion of the transactions without any explainable or logical reason.

- DPMS sellers frequently enter transactions of an abnormally large amount.

- DPMS has multiple bank accounts without any business sense or DPMS entities operating bank accounts in the employee’s name.

- Unreasonable behaviour of large complex transactions by newly formed/listed DPMS entities.

- Irregular shipping methods inconsistent with the standard business practice of DPMS.

- Inconsistent documentation or forged documents to disguise the transaction.

After being aware of red flags, an organisation needs to take action to report such transactions. Online jewellery marketplace and the suppliers should keep track of questionable transactions and customers and if any ML/FT/PF suspicion is observed, reporting the same with the FIU by filing suspicious transaction report (STR) or a suspicious activity report (SAR).

Sanctions Compliance Program

To ensure complete regulatory compliance for AML/CFT requirements, an online jewellery marketplace should develop a comprehensive Targeted Financial Sanctions (TFS) program that is designed to ensure adherence to relevant sanctions regimes and mitigate the risk of engaging with sanctioned individuals, entities, or jurisdictions.

- online jewellery marketplace must have its sanctions compliance policy, which provides the procedures to carry out screening of the customers and suppliers against relevant sanctions lists and implement appropriate controls to prevent engagement with sanctioned entities.

- A similar sanction compliance program is expected to be implemented by the suppliers, ensuring dual checks for the sanctions and restricting the access of the platform to such criminals.

Maintenance of Records

Entities subject to AML compliance must retain all records, documents, data, and statistics for all transactions for the period required under the applicable law.

- Online jewellery marketplace needs to maintain comprehensive records of AML policies, relevant documents, transaction monitoring activities, and any remedial actions taken in response to identified risks. These records should be securely recorded and regularly reviewed to ensure accuracy and completeness and must be made readily available to the authorities when requested.

- Further, the supplier must also retain all the records of the e-commerce transactions routed through the online jewellery marketplace.

With AML UAE, let’s make your online jewellery marketplace a safe business spot!

An online jewellery marketplace demands a vigilant approach to AML/CFT compliance due to the expansion of digital platforms, which may facilitate illicit activities. Therefore, it’s important for online jewellery marketplaces to implement AML/CFT measures in accordance with relevant regulatory frameworks.

Implementing a dedicated framework to combat ML/TF safeguards an online marketplace, upholds regulatory standards, and maintains trust among suppliers and buyers. Thus, by prioritising AML/CFT compliance, online jewellery marketplaces contribute to a safer and more secure digital marketplace for the global jewellery industry.

FAQs on AML Compliance for Online Jewellery Marketplace

An online marketplace is a centralised online platform where buyers and sellers of goods and services conduct business.

The Telecommunications and Digital Government Regulatory Authority (TDRA) regulates the licensing and supervision of online marketplaces, and the Central Bank of the UAE (CBUAE) and the Securities and Commodities Authority (SCA) govern and supervise the digital currency transaction services provided by such online marketplaces.

Online jewellery marketplaces, because of their nature of dealing in jewellery, are required to register themselves on the goAML Portal.

Begin your AML compliance journey with a positive first step.

Contact our team to handle your goAML registration process.

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.