AML Case Management Software: Significant element of AML Compliance

With changing times where automation is impacting every aspect of business, anti-money laundering is no exception. The regulated entities in UAE – Financial Institutions, DNFBPs and Virtual Asset Service Providers (VASPs) must implement adequate financial crime risk mitigation framework to safeguard the business and comply with the applicable regulatory landscape. In this pursuit, the entities are moving towards AML Case Management solutions to bring efficiencies and effectiveness to their fight against money laundering and terrorist financing.

In this article, we will understand what AML Case Management software is and how it can revamp the face and quality of the entity’s AML efforts.

Understanding the AML Case Management Software

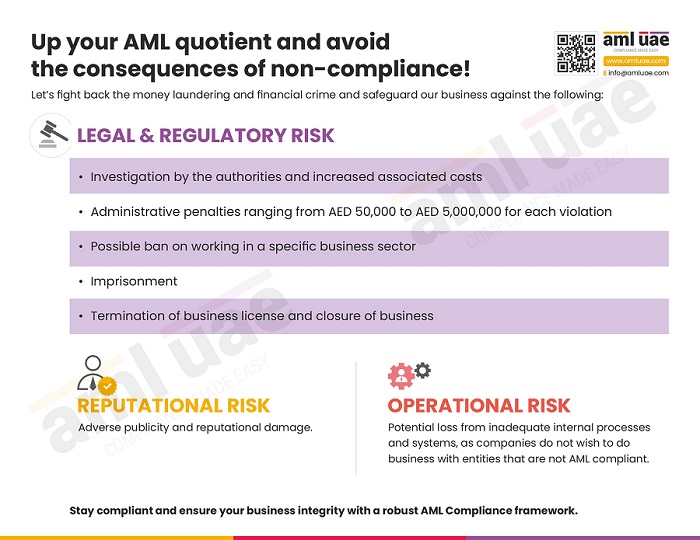

With emerging ML/FT trends and newer and more sophisticated methods, the timely identification of financial crime attempts is becoming challenging. In such situations, robust AML case management software can be a saviour for regulated entities to prevent financial crime vulnerabilities and avoid regulatory non-compliance consequences.

What is AML Case Management Software?

AML case management software is a platform offering automated capabilities to the regulated entities to efficiently manage the entire AML compliance cycle – from Customer Due Diligence to monitoring the transaction and identifying the potential suspicious transactions.

AML case management software is a comprehensive solution developed using advanced technologies, like artificial intelligence and machine learning, to facilitate regulated entities to navigate the AML compliance journey smoothly.

What are the Core Features of AML Case Management Software?

The following are the core features or functionalities of a robust AML case management software that fosters the AML compliance program of any regulated entity:

Customer Due Diligence:

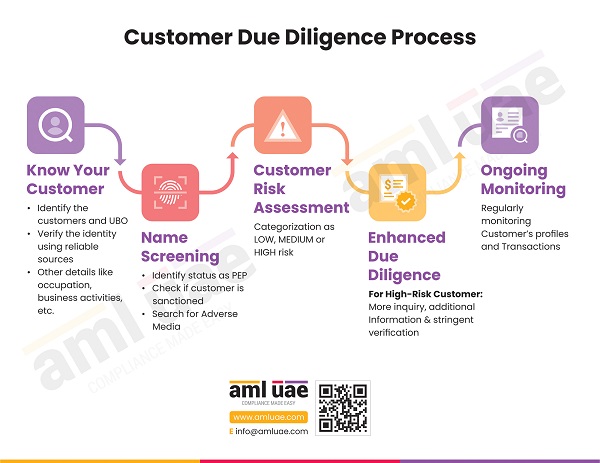

Identification and identity verification of the customers and the beneficial owners, screening, and customer risk profiling to determine the nature and degree of the Customer Due Diligence (CDD) measures to be applied.

The CDD module of the AML case management solution is fundamental to identifying and preventing any potential financial criminals from sliding in and exploiting the business for laundering illicit funds. CDD functionality assists the regulated entities in determining the risk profile of each customer and business relationship and the CDD measures to be applied, considering the outcome of the customer identity verification and the screening against sanctions and other relevant databases. It will help in the optimal utilisation of resources, adopting the risk-based approach.

It is not a one-time activity. Instead, the AML case management solution comes in handy in KYC remediation and periodic review of the customer’s profile, including tracking the changes in the customer’s identification details.

Transaction Monitoring and Alert Management:

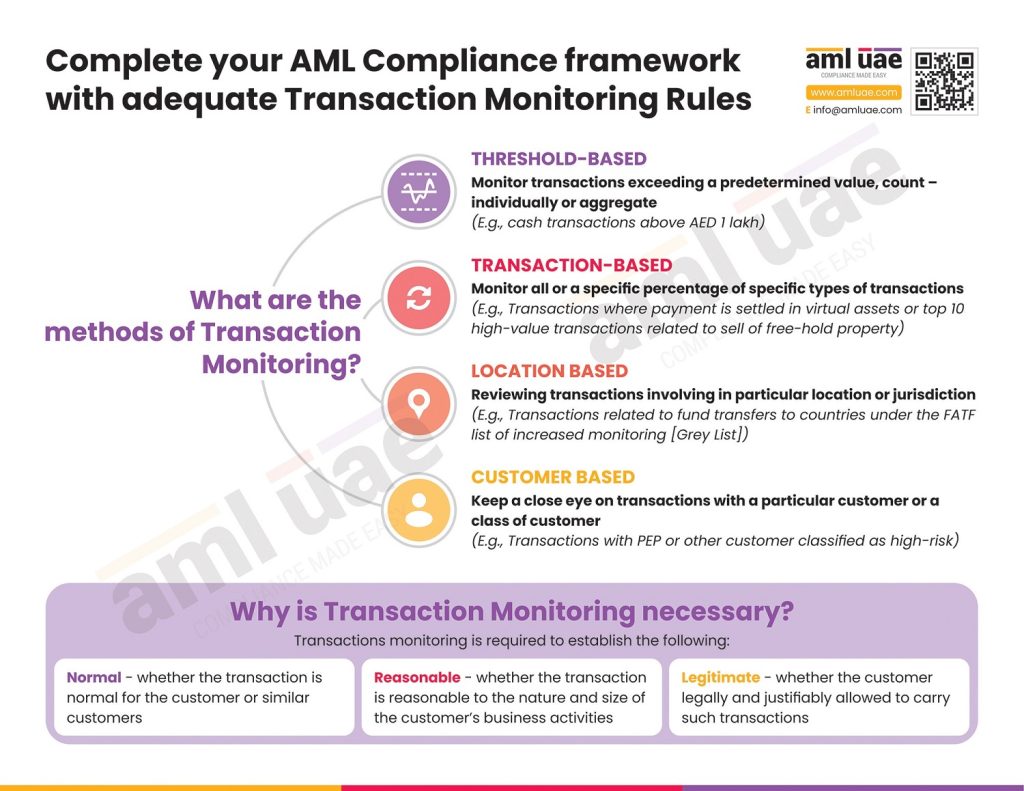

Real-time processing of a huge volume of financial transactional records and generating alerts for potential suspicious transactions or any unusual trend.

The AML case management software supports continuous monitoring of the transactions to detect anomalies and suspicious trends in customer activities and promptly flag the same basis the predefined rules and logic. The power of technologies like machine learning and blockchain reduces false positive alerts, allowing more time for the compliance team to focus on genuine suspicious warnings. This can be used to prioritise the alerts generated based on the nature or count of deficiencies or suspicions observed and help the entity address these alerts efficiently.

Managing the Alert Investigation Workflow:

Structured methodology and approach to investigate the flagged transactions, ensuring accuracy and consistency in the review process.

As the name suggests, the AML case management software enables the entity to manage the workflow of any alert as a “case”, starting from alert generation to its disposition, including thorough investigation capabilities. The software guides the compliance team to gather the flagged transaction-related data at one point and critically review the same. Case management software enables systematic analysis of the alerts, maintaining the audit trail and necessary records.

The standardization approach in investigation enables evaluation of all the critical information, ensuring that no ML/FT attempts go undetected and, simultaneously, no efforts are wasted on genuine transactions flagged as suspicious.

Collaboration amongst the team:

Facilitating smooth communication and coordination among various teams involved in AML compliance function.

For managing the AML compliance function effectively, collaboration and integration of various business functions are crucial – such as customer relationship manager, customer service executive, the finance and accounts team and, importantly, the AML compliance team. AML case management software enables a seamless exchange of information between the concerned teams, allowing the timely disposal of the case, be it a transaction monitoring alert or CDD process during customer onboarding.

Serves as Document Management System:

Maintenance of AML records in an organised manner, with utmost security and easy retrieval.

AML case management software is a document management system that retains the records and information in a tamper-proof system. The regulated entities can use this as an audit trail to check the progress and disposition of the alerts.

Further, it also acts as a single data repository of all AML-related documents and information, including CDD files and customer documents, transaction-related information, and records, including alerts generated and suspicions observed.

AML Reporting and Analytics:

Capabilities to generate AML reports required for submission with the AML authorities or for internal management to draw insights around AML compliance.

AML case management software empowers the regulated entities to generate AML reports required to be filed on the goAML portal – such as Suspicious Activity Reports (SARs) or Suspicious Transaction Reports (STRs), transactional reports like Dealers in Precious Metals and Stones Report (DPMSR) or Real Estate Activity Report (REAR), sanctions related reports like Fund Freeze Report (FFR) or Partial Name Match Report (PNMR).

Not limited to regulatory reporting, the AML case management solution can also offer capabilities to extract insights into an entity’s AML compliance. This may include information about the customers and their risk profile; the transaction flagged as suspicious and the outcome of the investigation; the number of reports filed with the Financial Intelligence Unit during the period; the ML/FT related trends and patterns, enabling Compliance Officer and the management to determine the actions to enhance the relevance and quality of AML efforts.

What factors should be considered while evaluating AML Case Management Software?

The selection of the right AML case management software is significant for advancing the AML compliance program of the entity. Thus, the entity must consider the various factors while identifying the right fit for the AML function, such as:

- The solution must be feature-rich, aligned with the applicable AML regulations and offer necessary customization to work in tandem with the entity’s business operations. This requires the software to support the end-to-end AML compliance journey of the regulated entity, including AML reporting and analytics.

- The module interface must be intuitive and user-friendly – easy to use and navigate. It is necessary to ensure that the software boosts compliance efficiency and productivity rather than attracting resistance from the users owning to its complex functioning mechanism.

- Integration capabilities of the software, the integration between the existing system and the AML case management systems is essential for seamless transfer of data for ensuring completeness and accuracy of the data relied upon for AML compliance.

- The software must be easy to scale as and when the volume and complexity of the customers and transactions increases. The solution must be capable of handling the evolving regulatory amendments and new AML compliance obligations.

- The software must adhere to robust information security standards that can protect the entity’s sensitive and confidential information.

All the points mentioned above must be well considered while evaluating the AML case management software, including the pre- and post-implementation support for its successful deployment and implementation.

What are the benefits of AML Case Management Software?

The following points highlight the significance of AML case management software:

- It streamlines the AML compliance activities and automates the manual tasks, improving compliance efficiency and reducing human errors.

- Timely detection of the red flags enables the entity to implement necessary risk mitigation procedures.

- Structure planning and deployment of resources to manage the risk, using risk-based algorithms and reduced false positive alerts.

- Compliance with the UAE AML regulations, avoiding non-compliance consequences like imposition of fines, damage to the business reputation and loss of customer trust.

- Provide actionable insights on AML compliance to the AML Compliance Officer and the senior management, highlighting the areas that need immediate efforts for strengthening the AML controls.

How can AML UAE help you bring in the benefits of the AML Case Management Software?

AML case management software can be an excellent tool for regulated entities looking to upgrade their AML compliance structure. And AML UAE is here to help you select the right AML case management solution. We understand your business operations, identify the AML compliance obligations and map them to the required AML capabilities to ensure compliance and protection against ML/FT vulnerabilities.

Let’s leverage the power of AML case management solution to detect the ML/FT attempts and timely prevent them before they influence the economy.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 6 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.