Adverse media and social media checks under AML compliance

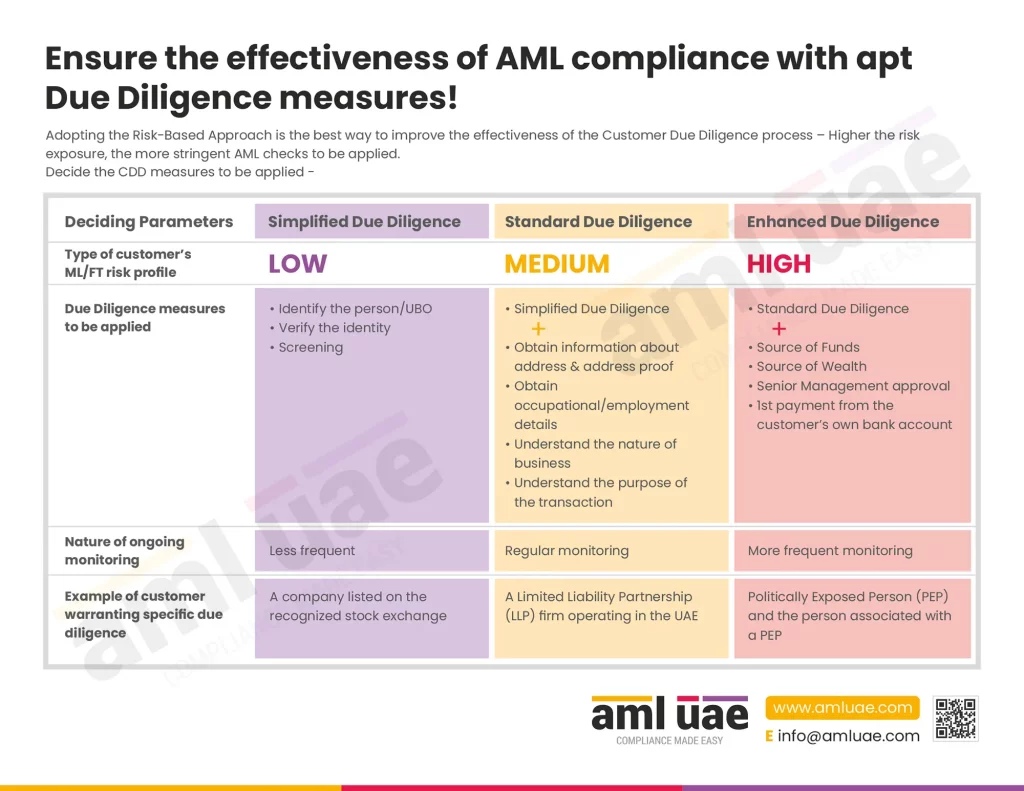

Customer Due Diligence (CDD) is the most critical element of an AML compliance framework. The purpose of conducting CDD is to collect information about customers and verify their identities and legitimacy around the proposed or executed transactions. Adverse media and social media checks can significantly assist in concluding your search for a customer’s identity and avoiding onboarding the customer involved in money laundering or any criminal activities.

Adverse media means negative news or information about customers in publicly available sources or articles. The media sources may include TV, newspapers, radio, magazines, web articles, blogs, etc. If there is any negative mention of the customer in such media sources, it is adverse media or negative news.

Social media platforms, such as LinkedIn, Facebook, Twitter, etc., contain the customer’s profile, known publicly. Also, such platforms sometimes contain references to negative news about the customer.

Though negative news screening has received very little regulatory attention, it is a critical part of CDD.

As a best practice, companies have incorporated adverse media screening and social media monitoring in their CDD processes. It helps you find your customer’s connections with or involvement in suspicious activities.

This article focuses on understanding its importance in CDD measures.

Regulations on adverse media and social media checks

The Financial Action Task Force (FATF) recommends that organizations include adverse media checks in their AML customer onboarding processes. Further, the AML regulations applicable in UAE also provide that the regulated entities look out for negative news for high-risk customers from reliable, independent sources.

Open media sources should be screened to gather the information around the following to build the customer risk profile effectively:

- Business Type

- Nature of business

- Past criminal investigations

- Regulatory penalties

Further, social media should be checked to ensure the customer information shared with the company matches the person’s social profile, such as the name the person is socially known by, the name of the employer, location, etc.

Importance of adverse media and social media screening

Building client’s risk profile

Any client can be a threat to your business or reputation. So, before forming a business relationship, you need to know them thoroughly.

Getting information about customers’ details from reliable and independent sources provides you confidence in the details furnished by the customer.

Not only during customer onboarding, but you can also keep a constant check on your customers. Frequent checks allow you to check for any change in the risks. If there is any change in data, you can update the risk profile.

Protecting oneself against reputational risks, penalties, and fines

Creating a fake profile and hiding the real identity is easier in the ever-evolving digital world. A fake identity is used to cover or carry out illegal transactions. Along with CDD measures, adverse media and social profile screening help you detect customers’ connections with criminal activities. If you turn a blind eye to this process and avoid the information known to the world, you would be exposing yourself to criminal activities, thus, resulting in the imposition of fines or penalties. Thus, you must monitor regular adverse news to avoid risks, AML penalties, and fines.

It helps you detect any suspicious transactions with your customers. It also helps you recognize any characteristics or patterns in a customer’s profile that may lead to suspicious activities in the future. So, you can remove any possible chances of attacks on your reputation due to association with money laundering activities.

Sources for negative news and social profile screening

Companies refer to many official and unofficial data sources for finding information about their clients. You can find insights on the customers from the following data sources:

- Government databases

- Newspaper articles

- Online forums

- Corporate websites

- Social media feeds (LinkedIn, Facebook, Twitter, etc.)

- Blogs

- Legal prosecutions

- Research portals and Private databases

You may not trust some of these unstructured data sources. But the onus lies on you to check the credibility and quality of information. You must confirm the information with other sources to check if it is fake, biased, or partial.

Best practices to implement negative news & social media screening

Some of the best practices to adopt to improve your process of collecting adverse media and checking the social profile of your clients are:

Keep your customer data up-to-date and complete

Ensure completeness and correctness of basic demographic information about your customers. Inaccurate and incomplete information serves no purpose while conducting an advanced search on your clients. When checking negative media mentions in a tool, companies use these primary details to match the new-found information. Thus, core customer data has to be complete and accurate to determine the relevancy of the negative news found or the customer’s social presence.

Create a sound negative news & social media screening policy

You cannot just collect their information and conduct adverse media checks when onboarding new customers. You need a well-laid-out policy and methodology for conducting these searches to ensure effectiveness and quality in less time.

You can prepare a standardized template to collect the necessary information and document the same. It must have fields like:

- Customer details

- Name of the individual who performed the screening

- Date and time of the screening

- Information found, along with source and URLs

- Context of information

- Conclusion

- Possible actions to take.

Basis the research and conclusion, you can recommend relationship termination or filing of suspicious activity report if you suspect the customer’s involvement with money laundering or terrorism financing.

Engage in regular adverse media monitoring

Your job does not end with a one-time screening of adverse media at the time of customer onboarding. You must regularly check your customers’ social profiles and negative remarks on public sources.

There is a possibility that during onboarding, the customer was fair. But they may engage in money laundering or similar financial crimes later in their operations. So, regular adverse media or news checks on your customers are vital.

Invest in an online tool to screen negative news

In some companies, adverse media check is a manual process. But it is time-taking, tedious, and tiresome, sometimes resulting in errors or missing essential information.

Tech solutions and software are in trend that screens numerous news sources worldwide to generate more accurate results. These tools generate negative news for every category of financial crimes and provide the source details of such news.

The paramount need is for the solution to track many media and news sources and generate complete, verifiable information.

Companies have started using AI-based media monitoring solutions. The tool sifts through credible and current media and news to find any material on customers. You can set parameters for a relevant search, analyze the results, and take necessary action.

Thus, your customer onboarding process becomes faster and more trustworthy with an intelligent technology solution.

The technological tool must have the following features and functionalities:

- Customized alerts

- Fast research and retrieval of information

- Comprehensive list of worldwide data sources

- Supports multiple languages

- Batch processing

- Real-time updates and notifications for changes in the risk status of existing customers

- Access to updated watchlists, Sanctions, and PEPs

- Intelligent category tagging

How can AML UAE help you streamline your CDD process with robust negative and social media screening?

You must conduct regular negative media and social media searches to check for any possible connection of customers with financial crimes. Make it a practice before onboarding new customers, during regular monitoring, and in event-triggered exercises. It makes your customer due diligence efficient and effective.

To ensure you do not go wrong with adverse media screening and social media checks, it is best to engage an expert AML services provider – AML UAE, to set your processes right.

AML UAE is a leading provider of the following professional services related to AML:

- Carry out a business risk assessment

- Develop a customized AML/CFT policy

- Assist in setting up an in-house AML compliance department and team

- Conduct AML training for employees

- Manage KYC and CDD

- Support in selecting a suitable AML software

- Assist in regulatory submissions

- Conduct AML/CFT health checks

Contact us if you need assistance managing your KYC and due diligence processes. We verify your customer’s details, including negative news screening, and share the customer’s risk profile with you. We ensure you precisely know whom you are dealing with to reduce the threats of financial crimes. So, manage or mitigate your risks well with AML UAE’s team.

Make your Customer Due Diligence process effective with

actionable insights from AML UAE.

Reach out to our team.

Our recent blogs

side bar form

Share via :

About the Author

Dipali Vora

Associate Company Secretary

Dipali is an Associate member of ICSI and has a Bachelor’s in Commerce and a General Law degree. She has an overall experience of 7 years in the compliance domain, including Anti-Money Laundering, due diligence, secretarial audit, and managing scrutinizer functions. She currently assists clients by advising and helping them navigate through all the legal and regulatory challenges of Anti-Money Laundering Law. She helps companies to develop, implement, and maintain effective AML/CFT and sanctions programs. She knows Anti-money laundering rules and regulations prevailing in GCC countries and specializes in Enterprise-wide risk assessment, Customer Due-diligence, and Risk assessment.