A Quick Guide to AML Compliance

Money Laundering is a global concern, and governments are trying to combat financial crimes. Criminals try to generate proceeds by carrying out illegal activities, concealing the origin of the illicit money, and transferring the same into the legit financial system.

Criminals have become innovative and are using new ways to launder money. The digital space is evolving fast, and criminals are using it to launder their illicit money and fund criminals and terrorist activities. The global and local AML laws and regulations lay down the provisions that financial institutions and businesses should adopt to ensure their business is AML compliant and follows the best AML compliance practices. Adherence to the AML laws helps prevent money laundering activities or minimizes the exposure and the impact it could have on the business.

The global business landscape is changing, and businesses must proactively combat compliance challenges with AML laws. Moreover, the pandemic has forced enterprises to rethink their AML compliance strategy and keep pace with the evolving threats and strict AML regulatory compliance. There are various processes involved in AML compliance laws, such as Know Your Customer (also known as ‘KYC’), sanction screening, identification of UBOs, and many more. In addition to managing the business and keeping the company profitable in a competitive marketplace, the firm must stay AML compliant and avoid the risk of being exposed to financial crimes.

Financial institutions and designated non-financial entities are responsible for preventing money laundering by deterring criminals from misusing the legal system to infuse illicit money into the mainstream economy. With a robust AML compliance framework and assistance from an AML consultant, these companies can effectively comply with the AML rules and regulations.

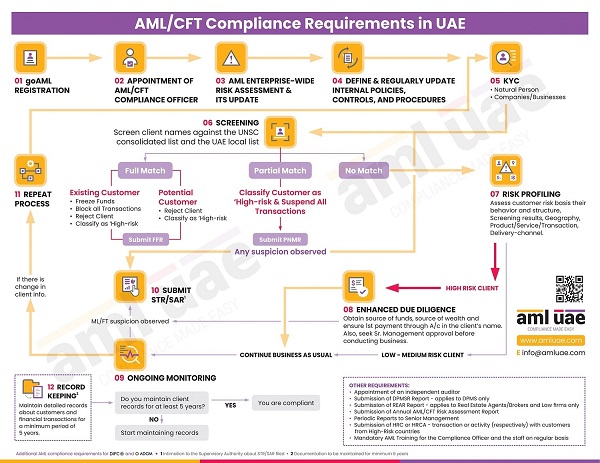

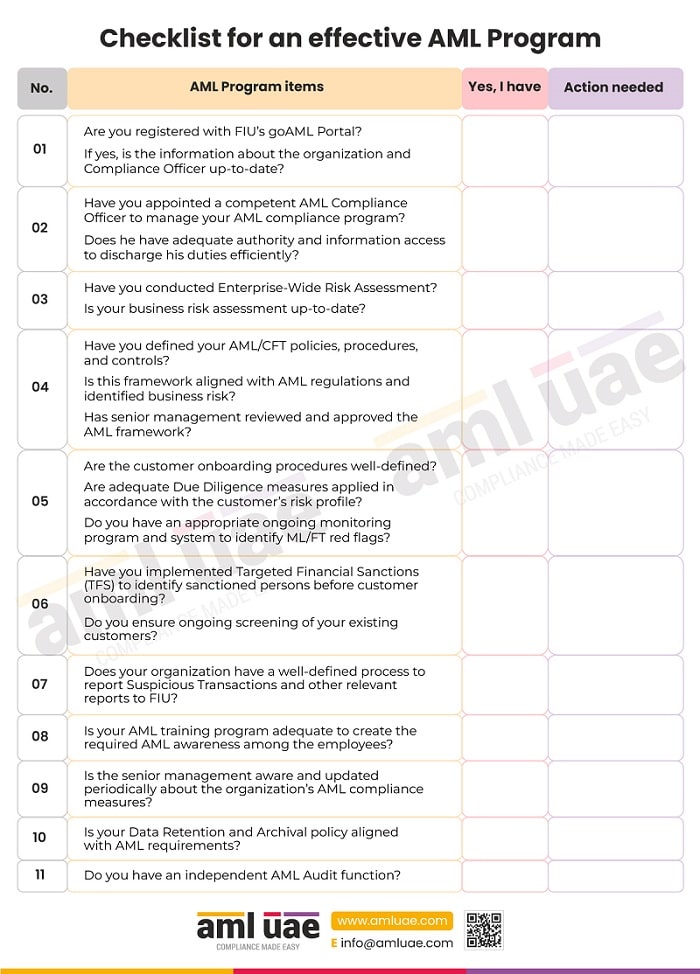

We have highlighted vital compliance elements under the AML/CFT compliance program.

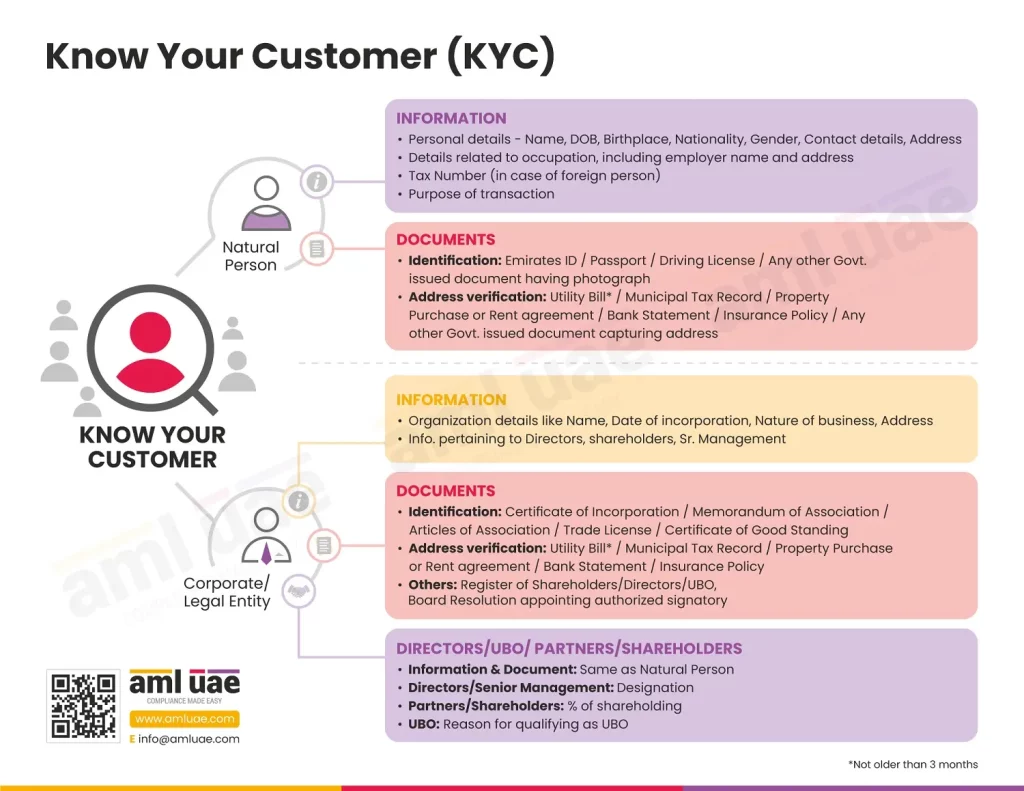

KYC

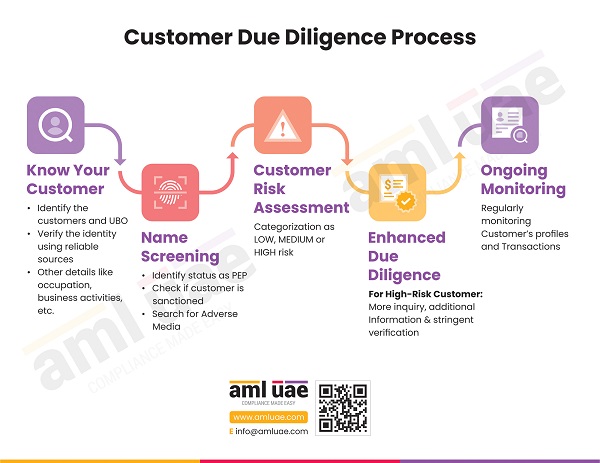

KYC details help businesses verify the authenticity of customers’ profiles and detect any suspicious transactions designed for carrying out money laundering activities. It enables the companies to understand their customer base and decide the risk exposure associated with each customer or client. These verification task makes the identification of suspicious transaction easy, guiding businesses as to carry out a transaction with a customer or not.

When a legal person has to carry out a transaction, it has to submit company information such as registration number, name, address, management composition, etc. While in the case of a customer being a natural person, complete data such as name, date of birth, and government issues unique identification number must be sought and verified.

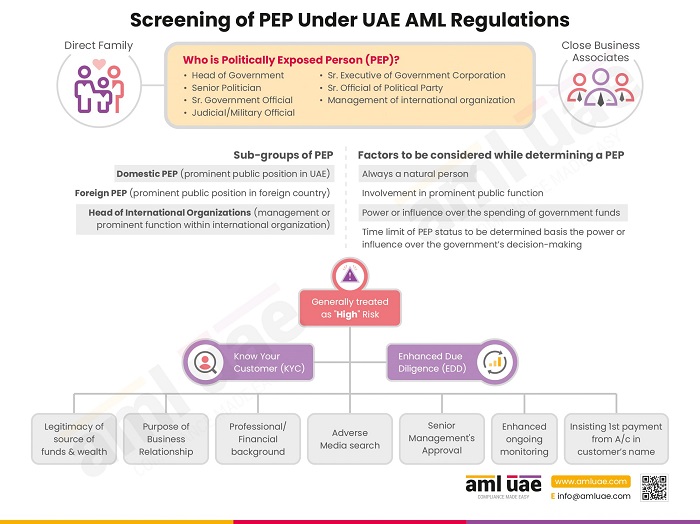

Screening

Businesses should have a strict program to screen customers against the sanctions list (local and international). Further, screening should also be carried out to understand the customer’s status as a politically exposed person or previous history of any involvement in financial crimes. Basis the screening outcome, the decision is made to report the person, freeze the funds, or continue the business transaction.

Risk profiling and Enhanced Customer Due Diligence

Businesses use Customer Due Diligence (‘CDD’), which offers an in-depth analysis of the customers’ data and verifies whether the documents submitted are genuine. Basis this analysis, the customer’s risk categorization is done, and additional measures are carried out if needed. For example, in the case of high-risk customers, enhanced due diligence is to be performed, where specific details regarding the source of funds are obtained.

Continuous monitoring

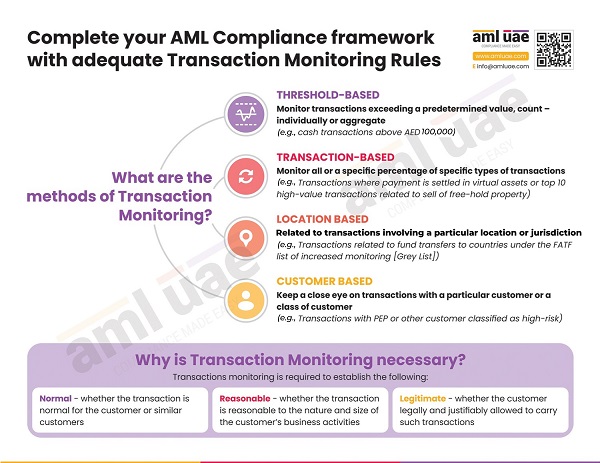

It is essential to continuously monitor the customers’ profiles and keep the same updated with the latest information. Basis the monitoring of the profiles and updates therein, the risk categorization of the customer should be changed and kept aligned with the latest profile. Further, businesses should constantly verify the transactions to keep a close eye on the customers’ financial patterns and transactions suggesting money laundering involvement. Here, it is recommended to rely on robust AML software that can automatically schedule a periodic verification of the customer’s profile.

Businesses need to monitor the volume and value of transactions involving a series of transactions or a large sum of money. In collation of the data and watching the same, an advanced technology, such as Blockchain, can be used to ensure timely and accurate AML compliance. Such technology will help businesses detect financial crimes instantly and eliminate the chances of criminals laundering money.

AML Software

Organizations with a progressive mindset and a proactive approach will create an effective AML compliance program in the digital era. With the help of comprehensive AML compliance services and the AML software selection, they can automate the AML process and reduce the dependency on manual efforts, which reduces the risk of human errors. The AML software is highly effective and cost-efficient in preventing money laundering. It would be the best method to stay vigilant all the time and avoid the risk of non-compliance.

AML Training

With thorough AML training, organizations can empower employees with updated knowledge and skills to detect suspicious transactions. It would ensure compliance with AML regulations and minimize the organization’s vulnerability to the risk of money laundering.

Getting the AML/ CFT Policy, Controls, and procedures documentation complete and creating an in-house AML compliance Set up are some steps towards becoming AML compliant.

Conclusion

With the help of AML consultancy providers, businesses can prevent financial crimes and fight the menace of money laundering and terrorism financing. You can approach an expert firm like AML UAE, which can help select the right AML software and assist in documenting AML/ CFT policies. AML UAE can also help with AML training services and annual risk assessment reports. To create a full-fledged in-house AML compliance department setup, professionals will assist you in implementing the AML department. To avoid the risk of non-compliance, businesses can also get AML/ CFT health check-up services. Grab detailed information on getting the right and robust AML compliance framework to avoid the risk of non-compliance

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.