A guide to sanction and PEP screening in customer onboarding process

Sanctions are basically the penalties imposed on institutions or organizations that fail to comply with laws and regulations. Government or global organizations usually apply a sanction decision to other individuals or states. A sanction check is taken in order to prevent transactions with persons prohibited from certain activities and transactions.

There could be various reasons behind sanctions. However, the primary reasons behind sanctions could be economic or political disputes. Economic and political conflicts between two or more countries lead to

sanctions against each other.

In this article, we will discuss the importance of sanctions and PEP screening during the customer onboarding process.

What are the various types of sanctions?

There are undoubtedly many types of sanctions. The sanctions are based on different reasons. The reasons and various kinds of sanctions are significant for business enterprises.

1- Economic Sanctions

- Undermining the target country

- Punish the target country

- Change the behavior of the target company.

2- Military Sanctions

3- Diplomatic Sanctions

Compliance. Trust. Transparancy

Customized and cost-effective AML compliance services to support your business always

Sanctions on Individuals

Many local and global regulators effectively control financial institutions. The sole purpose of these sanction checks is to combat financial crimes. Regulators need these financial institutions to know their customers. Therefore, regulators regularly publish new customer guidelines.

Sanction and politically exposed person screening - PEP screening in customer onboarding process

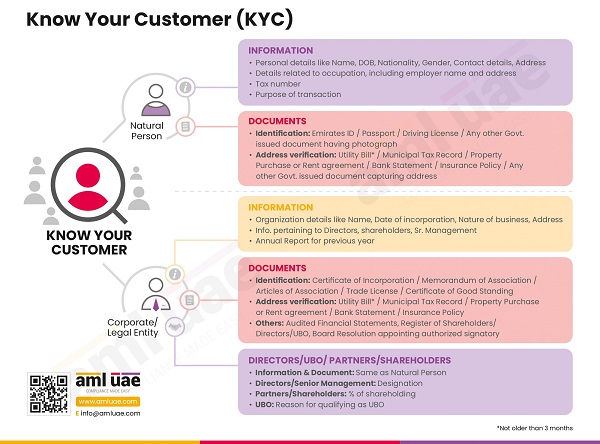

For financial institutions (FIs), and Designated Non-Financial Businesses and Professions, the customer onboarding process is quite tedious and challenging. As per the know your customer (KYC) requirements, enterprises have to make some checks in the process of onboarding the customers.

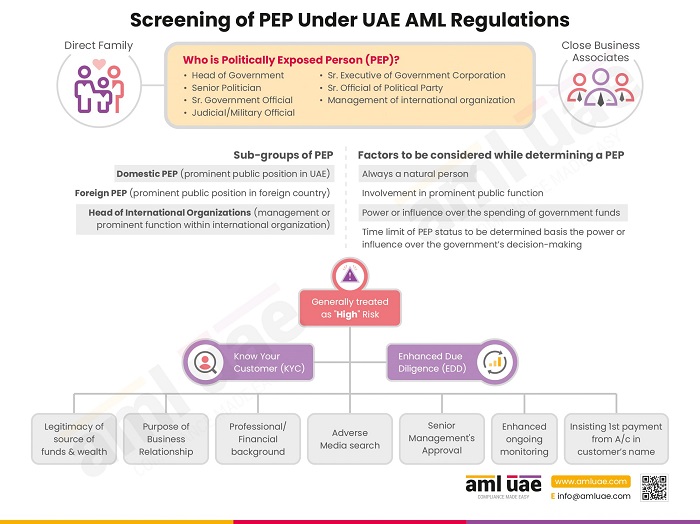

The purpose behind PEP screening is to identify the ability of the customers to pose any threat or risks. The accuracy of the information of the customer is verified at the first stage. Once the customer identification information is confirmed, the level of risk of that particular customer is also identified.

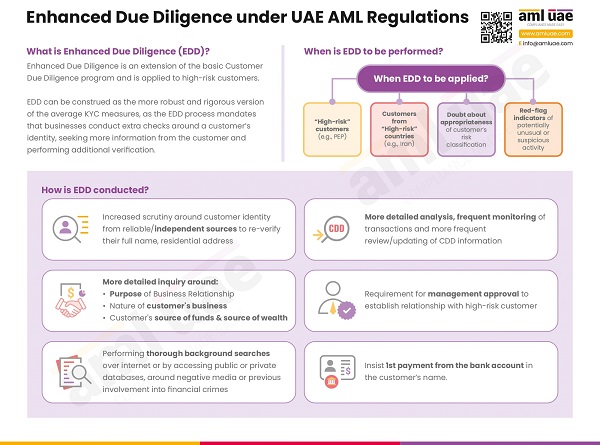

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) procedures enable the FIs and DNFBPS to identify the overall risk level involved.

PEP Screening Process

During the PEP Screening process, the customer is screened against the global list of PEPs. The relatives and close associates (RCA) of a PEP are also screened. If there are positive matches, EDD is performed and depending upon the risk appetite of the management; customer onboarding is performed.

Ongoing monitoring of PEPs is one of the most crucial aspects of PEP screening. PEP screening tools support ongoing monitoring and help comply with legal obligations.

Why is the sanction check and PEP check required for business companies?

Bribery, financing of terrorists, money laundering, and corruption are financial crimes that are considered highly hazardous all over the world. The majority of these financial crimes occur because of the loopholes in the law and economic systems.

Regulators try to prevent all of these financial crimes by thoroughly regulating the companies in the financial sector. Many anti-money laundering regulations have been published to serve this purpose individually.

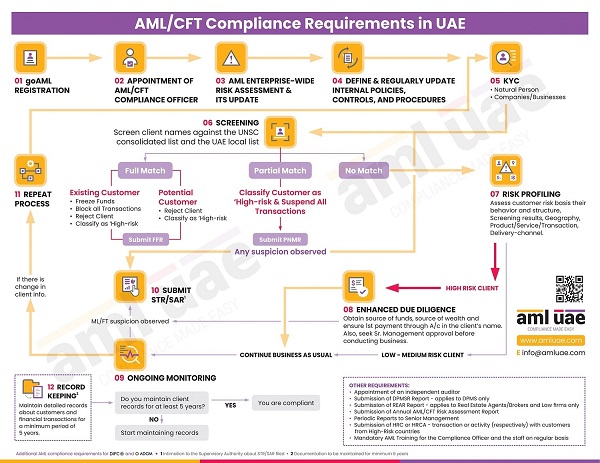

In order to comply with these anti-money laundering regulations, financial institutions and DNFBPs should get involved in some sort of control process. Therefore, a sanction search and PEP screening are essential processes for financial institutions and DNFBPs to ensure AML compliance. PEP and Sanctions checks help businesses take a risk-based approach and determine if they want to onboard a customer or continue with a business relationship.

Sanction and PEP screening in the process of transaction screening

Quite a lot of transactions take place throughout the day in your financial systems. Therefore, as per the anti-money laundering regulations, financial institutions should monitor the financial operations of their clients. If the financial transactions are not monitored, severe financial crimes like money laundering and terrorist financing come into play.

However, manually monitoring all your financial transactions can be a cumbersome and time-consuming process. Hence, you can use automated

tools to carry out sanctions and PEP screening.

Compliance. Trust. Transparancy

Customized and cost-effective AML compliance services to support your business always

Politically exposed person screening in the process of background check

The most essential thing for companies or business enterprises is their reputation. If any business enterprise loses its reputation, it directly loses its customers or clients.

Enterprises make internal controls regularly in order to avoid all of these risks. Pre-employment background checks, employment background checks, and company background checks are taken by the companies in

order to protect the reputation of the company.

PEPs screening is performed performed against the politically exposed person list on the employees in order to check for the possibility of any sort of risk for the company.

Watchlist and PEP screening helps regulated entities implement necessary controls while onboarding high-risk customers.

How do business enterprises comply with anti-money laundering regulations?

Financial institutions (FIs) and DNFBPs have to apply PEP sanctions checks on their clients in order to comply with anti-money laundering regulations.

Financial institutions need sanction screening in order to protect the reputation of the company and not to violate any sanctions-related decisions. With the ever-evolving technology, manual sanction checks and PEP screening have lost all the points and have become merely a way of wasting time.

There are pretty many sanctions listed across the world, and enterprises can practically and logically not check them all manually.

Hence, the need and importance of anti-money laundering screening software come into the picture. This type of software automates the complete compliance process of the enterprises.

In addition to that, financial institutions and DNFBPs can quickly check their clients with the help of automated compliance software. This type of PEP and Sanctions check software scans the sanction lists and instantly intimates the positive matches.

PEP Screening Software: Enhancing Due Diligence and Regulatory Compliance

To comply with the UAE AML Regulations, it’s essential that regulated entities carry out screening before onboarding a customer.

There are PEP Screening Tools available in the market which maintain a global database of politically exposed persons. The database is refreshed every hour making sure you always have access to the latest list. PEP Screening Software also supports ongoing monitoring of PEPs and Relatives and Close Associates (RCA) of PEPs. PEP Screening solutions help you meet legal obligations, and take a risk-based approach while onboarding a customer or entering into a transaction with him and record-keeping requirements.

In order to identify individuals holding prominent public positions or persons associated with individuals, the implementation of Politically Exposed Persons Screening Software is a must. PEP Screening Software helps regulated entities to identify and mitigate risks associated with PEPs.

Politically Exposed Person Screening under UAE AML Regulations

AML compliance services

For FIs and DNFBPs, it is of utmost importance to apply sanctions and PEP screening mechanisms. AML UAE, with its team of professionals, provides expert advisory services in AML compliance. Get in touch with us to simplify your anti-money laundering compliance.

Our recent blogs

side bar form

FAQs - A Guide to sanction and PEPs screening

Here are a few frequently asked questions About Sanction and PEP Screening

AML PEP check means screening individuals against an already existing register of Politically Exposed Persons (PEPs) with their names, associates, and close family members.

The PEP screening process is a part of the AML and KYC program of entities. It is a process by which companies can conduct due diligence on any individual or company with which it is entering into a business relationship to compare with the global lists of politically exposed persons.

PEP means Politically Exposed Person. These are some high-profile roles, such as government leaders, politicians, military or judiciary officials, etc., who can be involved in money laundering or financial fraud activities because of their high-profile positions, which create prominent influence.

Companies must collect information on their clients, such as their business name, registration details, geographical presence, beneficial owners, etc. You can match this information with the list of Politically Exposed Persons and identify if the client is a PEP or not.

PEPs are of three types:

- Domestic: A high-profile person in the national government body

- Foreign: A high-profile person in a foreign government body, including foreign PEPs working in the domestic country.

- International: A high-profile person in an international organisation

It is critical for organisations to know about the risks from customers or suppliers. For this, you need to collect information from them and verify it against the lists of PEPs or Sanctioned individuals. If they do not feature in the list, you can have a business relationship with them; if they feature, you are supposed to carry out Enhanced Due Diligence (Obtain information about their source of funds), and with the management’s approval you can enter into business with them.

PEPs can be any one of the following:

- Heads of countries or Government

- Senior politicians

- Officials holding senior positions in the Government

- Military or judiciary officials

- Officials of key political parties

- Senior executives from government companies

Companies collect data on their customers, employees, and suppliers to check their names against the list of terrorists, PEPs, or Sanctions. This screening process helps to know your customers/clients better, serving as the best tool to avoid money laundering and terrorism financing activities.

Pep screening means verifying an individual’s presence in the list of Politically Exposed Persons (PEPs) to identify them as high-risk customers.

Sanction checks mean checking whether an individual or a company features in a list of sanction databases of governments to prohibit the possibility of money laundering or terrorist financing.

Sanction list screening means verifying individuals and entities against the Sanction lists of countries to check if they are prohibited from carrying out certain activities.

Customer screening to verify the data on customers against external data sources such as PEP list, Sanction list, Watch list, or adverse media to check their risks to the company.

- Integrate with a wide range of and high quality trusted data sources

- Follow a risk-based approach

- Conduct ongoing monitoring in the most effective and deliberate manner

- Relying on best technological platforms

Share via :

Add a comment

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.