A guide to Enhanced Due Diligence under UAE AML regulations

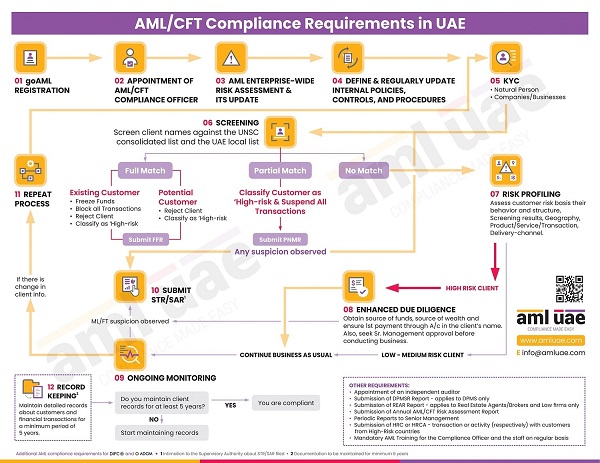

Enhanced Due Diligence (EDD) is one of the critical elements of the entire customer onboarding journey, forming part of the AML compliance program.

EDD is a higher version of the standard customer due diligence process, requiring extra checks and verifications to establish the person’s identity or any related information.

Let’s learn about enhanced due diligence, its purpose, the process involved, and its significance in complying with AML regulations and safeguarding the business against financial crime risks.

What is Enhanced Due Diligence (EDD)?

EDD is a part of the Know Your Customer (KYC) process, adopted as part of the AML framework while onboarding new customers/clients.

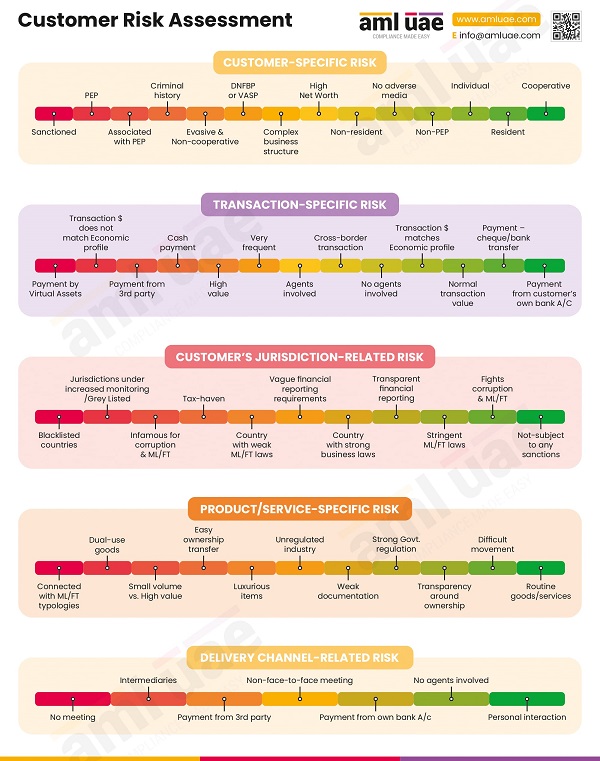

While conducting the risk profiling of the customer/client as part of the standard Customer Due Diligence (CDD) process, if the designated entities identify the person as “high-risk,” it calls for taking enhanced measures to assess the legitimacy of the person’s identity and other related information.

For low-risk customers, it is enough to conduct a standard CDD process, such as obtaining and verifying the customer’s identity, address, etc. However, it becomes critical for high-risk customers to dive a little deeper into the process and seek additional information or perform additional verifications.

Performing EDD is necessary as it is a regulatory requirement in case of customers classified as “high-risk,” requiring increased scrutiny and higher verification standards. It also becomes pertinent to safeguard yourself from being exposed to money laundering or terrorism financing activities.

An illustrative list of red flag indicators suggesting the need for EDD measures

– Customers hailing from jurisdictions notified as “high-risk” or subject to increased monitoring (FATF grey list countries)

– The customer is a Politically Exposed Person (PEP) or associated with PEP

– A person having a criminal history or has been charged for any financial crimes and proceedings are underway

– The customer insists on settlement of the transaction in virtual assets

– Doubt about the appropriateness of customer’s risk classification

– Customer is a non-profit organization (NPO)

– Red-flag indicators of potentially unusual or suspicious activity, such as –

- When intermediaries are involved in the transaction without any logical reasoning

- When the customer’s legal structure is unnecessarily complex

- Customer hesitant is sharing the details of the ultimate beneficial owner

Enhanced Due Diligence Procedures

Following for conducting adequate EDD measures:

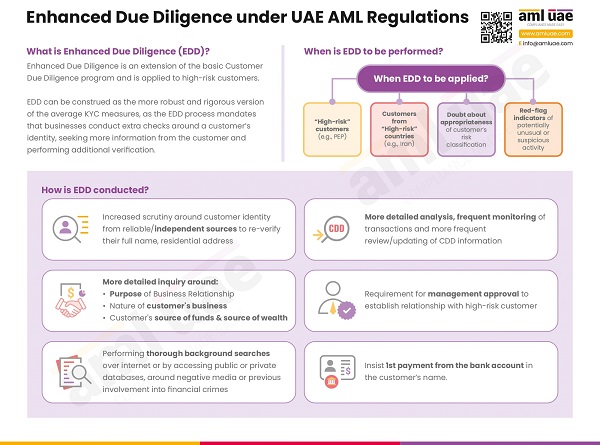

Seeking additional details

Once a customer has been classified as “high-risk,” the following additional information is to be sought from the customer:

- Nature of business

- Source of funds

- Source of wealth

- Purpose of transaction

Such information should be backed up by substantial documentation, such as obtaining bank statements or audited books for determining the source of funds/wealth, etc.

Additional verification and establishing the legitimacy of the information received

- Relying on third-party databases (e.g., cross-checking the identity of the foreign national with the country’s embassy or consulate)

- Evaluating the reasonableness of the purpose of the transaction

- Verifying the professional and financial background of the person

These verifications should be based on credible and independent sources such as private databases or official government websites to avoid bias or wrong information.

Adverse Media and Social profile check

Reviewing the open source information for the adverse media or negative news about the person helps to understand the person’s history and reputation. It corroborates your verification and overall risk categorization of the person.

Along with this, social profiles like LinkedIn or Facebook, etc., of the person should be looked for and reviewed to understand that social presence and association with other organizations. It helps in understanding the person’s social stature, as it is seen that a person indulging in financial crimes may not have strong social prominence.

Senior management approval

Before onboarding a high-risk customer, approval from senior management is mandatory.

Enhanced or frequent monitoring of customer information and the transactions

Given the high risk associated with the customers subjected to EDD, the AML regulations also require the designated entities to monitor the customer information and their transaction more frequently. Such enhanced monitoring would help in identifying and reporting the following:

- Change in customer information contradicting the information shared earlier

- Unusual pattern of transactions

- Sudden change in terms of transactions,

- Customer behavior suggesting money laundering-related suspicion, etc.

Why are EDD measures necessary?

As mentioned above, the primary purpose of EDD is to conduct detailed assessments of the customer’s identity, the purpose of the transaction, and the source of funds. These additional measures are critical:

Combat financial crimes

The additional information collected and rigorous verification measures performed as part of EDD help you and the government keep a tab on transactions of high-risk customers and identify any suspicious behavior beforehand, helping you prevent financial crimes.

Comply with regulations

EDD is a prominent part of the AML compliance framework. You conduct due diligence on your customers to avoid the risks of money laundering or other financial crimes. Thus, you follow these requirements by implementing EDD procedures, avoiding resultant fines and penalties.

Build your reputation

When you put in place proper CDD and EDD procedures, you not only adhere to the AML regulations but also safeguard your business from being vulnerable to money laundering and financial crime risks. It also conveys your ideologies and support to fight these financial crimes. It brings you customer loyalty and public trust, improving your reputation.

Avail AML UAE’s expert services in implementing EDD procedures

Safeguarding your business against the increased risk of financial crime becomes possible when you know your customers better before establishing a relationship. And for this, adopting Enhanced Due Diligence measures become very pertinent.

AML UAE helps clients implement adequate due diligence measures. We help clients understand their customer’s businesses, verify their identities, and conduct complete checking of their risk levels. We manage all the checks and verifications to develop your customer’s risk profiles.

AML UAE is one of the leading AML consultants in the UAE. We assist our clients in complying with AML regulations and safeguarding their business against financial crime risk. We train their employees, develop the AML policies and procedures, and set up an in-house AML compliance department, including managing the customer onboarding cycle (KYC, CDD, EDD). We provide end-to-end services to stay compliant with AML regulations in the UAE and safeguard your business against financial crime risks.

Manage your money laundering and terrorism financing risk with AML UAE’s consulting services.

Get in touch now.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.