A Guide to Avoiding Common Mistakes in AML Compliance for VASPs

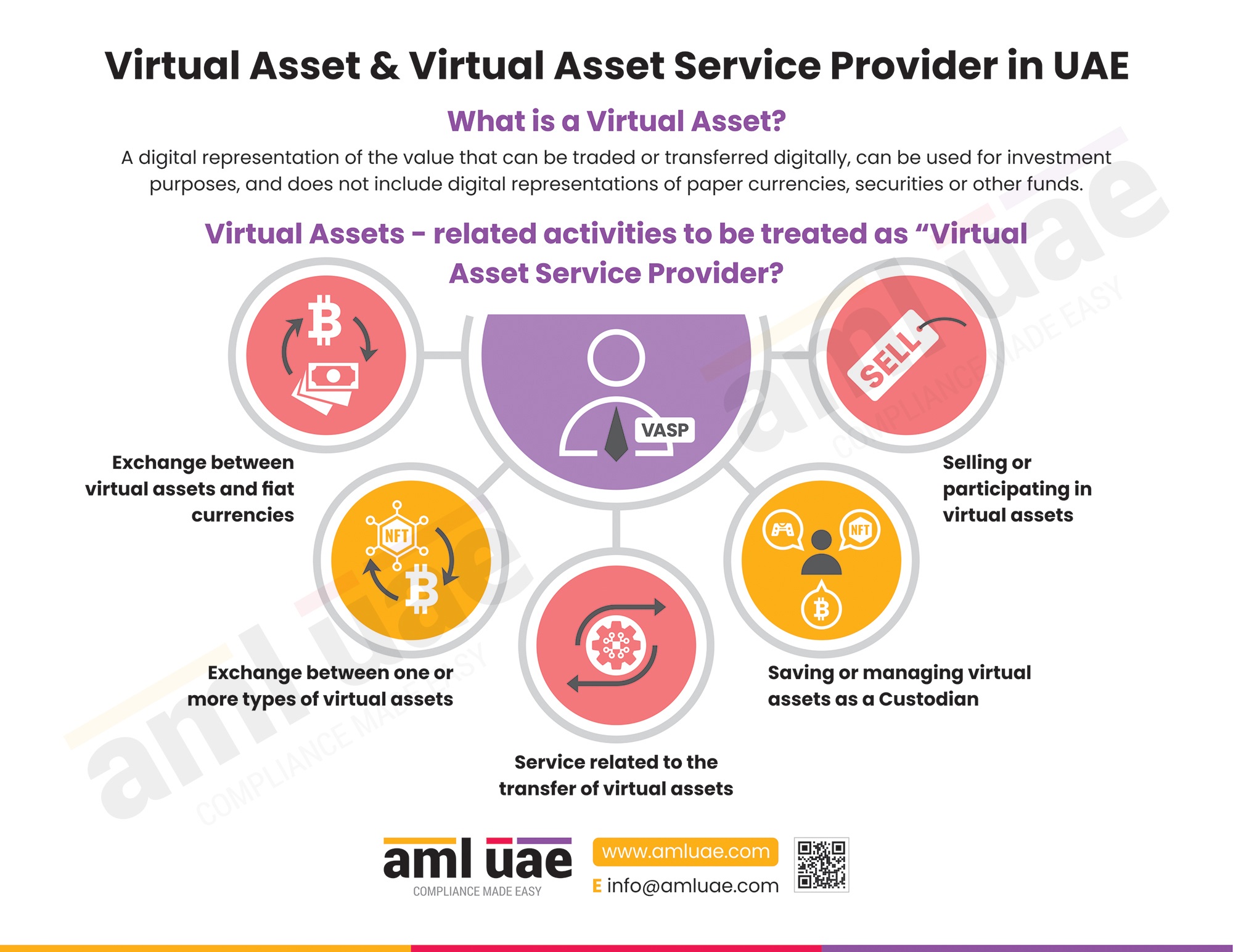

With the rise of instances of money laundering in the virtual assets ecosystem, the UAE government introduced anti-money laundering regulations to supervise and safeguard this sector. Virtual asset service providers (VASPs) operating in the UAE must know these rules. You must create a customised AML framework aligning with these rules and regulations, in sync with the nature and size of the virtual asset activities. While implementing them, be careful of the common mistakes to avoid in AML compliance for VASPs for effective results.

This blog explores these common AML compliance challenges that a VASP must avoid. By avoiding them, you are adopting an effective methodology for achieving your AML compliance obligations and protecting virtual assets from ML/FT vulnerabilities. Before covering the mistakes, we’ll understand why the money laundering threats affect VASPs’ businesses.

Stay ahead in the fight against financial crimes.

Join AML UAE’s hands to sidestep common pitfalls.

Why is the threat of money laundering looming over VASP businesses?

What is the primary factor influencing money laundering activities? Disguised or concealed identities. By hiding their identities, money launderers bring illicit money into the legal financial system and layer it with other transactions.

This is so much possible in the case of cryptocurrencies and virtual assets. The reasons being:

- The virtual asset transactions are decentralised

- These transactions allow anonymity or pseudo-anonymity

- High-value and high-frequency transactions are common

- Easy and quick transfer of virtual assets from one person to another across boundaries

- Regulatory frameworks for VASPs and virtual assets are still evolving

All these reasons increase their vulnerability to money laundering threats. So, virtual asset service providers must stay alert to the standard red flags and ML/FT typologies. These indicators must warn you of suspicious activity, which you can investigate further and prevent financial crime. You can find these red flags in our blog: Unusual Transaction Trends for VASPs.

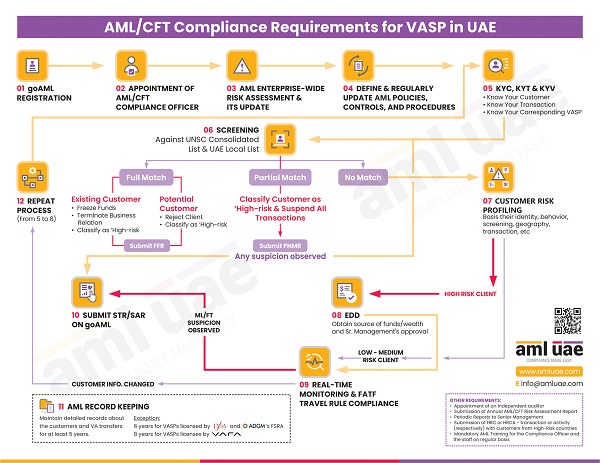

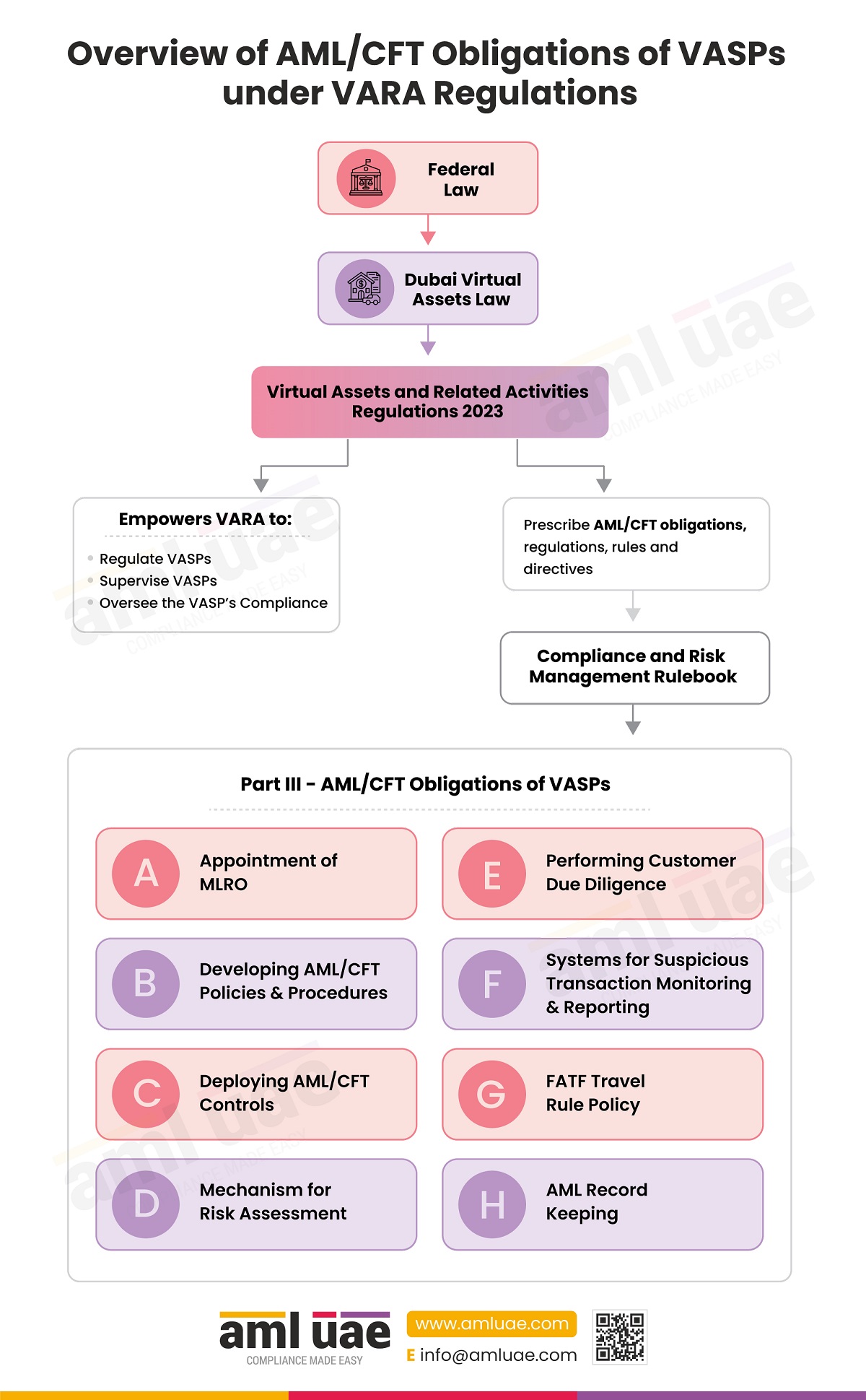

These red-flag indicators help you spot a suspicious customer or transaction. After spotting, you can avoid or stop them. Besides this, you must follow the AML regulations as applicable to the VASPs (such as the Compliance and Risk Management Rulebook issued by VARA or the rulebooks issued by the ADGM’s FSRA or DIFC’s DFSA, along with Federal AML regulations). Per these regulations, you can achieve AML compliance by applying the following AML measures:

- Creating AML framework, including policies, procedures, and controls

- Applying appropriate customer due diligence measures, including KYC, screening and risk profiling

- Applying adequate KYT (Know Your Transaction) measures

- Training your employees on AML and CFT

- Complying with FATF travel rule requirements

- Maintaining adequate records and information

- Monitoring customers and transactions

- Reporting your suspicious activities to the FIU

Mistakes to avoid in AML compliance for VASPs

VASPs invest in these measures and implement them in their operations. But during their planning or execution, you might face challenges. The following are the common mistakes to avoid in AML compliance for VASPs:

Inability to manage changes per AML regulatory updates

The world of virtual assets is a new and emerging business territory. People are still understanding its uses and benefits. Meanwhile, money launderers have already started using it for their illicit activities. They are leveraging the characteristics of virtual assets to launder dirty money. That is why the rules for VASPs are still evolving in the UAE to manage criminals’ new and sophisticated money laundering methods.

With such an evolutionary nature, you must keep track of regulatory changes. As and when laws change, you need to adjust your AML policies to them. If you miss these changes, your compliance will be incomplete or inaccurate, leading to penalties.

So, one key AML compliance challenge for a VASP to avoid is operating in an uncertain regulatory market. This leads to inconsistent AML practices. To cover this challenge, monitor the AML updates. As and when new rules are introduced, understand them and make relevant changes in your AML strategies. Thus, you can bring consistent and AML-compliant business practices to your virtual asset activities.

Difficulty in keeping pace with the technological innovations and developments

One common mistake to avoid in AML compliance by VASPs is not upgrading their technologies related to the compliance function.

Blockchain, cryptocurrency, and virtual asset worlds witness new technologies daily. Such technological innovations are a big challenge for VASPs.

You must up your game in the technological development space to bridge the gaps between the tools deployed by the criminals and the technologies you use for combating these crimes. Keep your systems updated and in alignment with the market requirements and the newer money laundering trends and patterns. Upgrade your system’s security and work on data protection. Investing in cybersecurity measures can reduce your vulnerability to security breaches and help mitigate ML/FT exposure.

Failure to assess risks to your business

You are a virtual asset service provider. So, you must know the potential risks to your business. If not, it is one of the severe mistakes around AML compliance. You must immediately get it done to identify and understand the risks and plan their AML control measures accordingly.

You must conduct an enterprise-wide risk assessment (EWRA) to identify the potential exposure to all aspects of your business. The risks can be from any or all of the following-

- Customers and other parties involved

- Products and services

- Geographies of your business or where your customers are from

- Delivery or distribution channels

- Nature, size and complexity of the transactions

- Technologies deployed

These factors might expose you to money laundering or terrorism financing risks. So, identify them, analyse their possible impact, and their level. You must be able to build your own business’s risk profile. A comparison of the risk profile with your risk appetite is the gap you want to fill with your AML efforts.

Remember to repeat this exercise regularly to stay on top of your business’s potential risks. You must update the risk assessment when business conditions and elements change.

The absence of a well-defined, customised AML framework

One of the critical aspects of AML compliance is the documented comprehensive AML framework. Without an AML framework, you do not have the policies, strategies, procedures, and controls. You must have a well-defined AML framework tailored to your business and the outcome of the ML/FT business risk assessment. These help you follow the AML compliance requirements and safeguard your virtual asset activities.

After the risk assessment, you need an AML compliance program to mitigate or manage these risks. It must have the following:

- Relevant AML policies per your AML goals

- Procedures for due diligence before customer onboarding and during business relationship

- Checklist of red flags and process to spot them

- Record-keeping and reporting systems for AML

- Internal controls to combat these risks

- Norms to comply with KYT and travel rule requirements

- Procedures for ensuring effective implementation of the targeted financial sanctions

You must communicate these to all your departments and employees. Also, get approval from the senior management. Also, you must update the framework with regulatory amendments and revisions in business risks.

No focus on the customer due diligence

Customer due diligence is a critical part of any AML compliance program. Its correct and on-time performance is a vital AML compliance challenge for VASPs. However, this process is crucial for identifying suspicious customers and managing vulnerabilities.

Your CDD process must include:

- Knowing your customer: You must collect the identity details of your customer, along with evidence. For legal entities, collect information on beneficial ownership, nature of business, etc.

- Knowing your transaction: You must know the originator and beneficiary of a virtual asset transaction. Collect details on wallet addresses, transaction hashes, device identifiers, and other points that help you know it better.

- Customer screening: The pseudo-anonymity of a virtual asset transaction makes it riskier. So, you need to be extra careful with whom you are dealing. You must match your customers against lists of sanctions, PEPs, terrorists, and adverse media. If matched, make informed decisions to ensure compliance with laws and management-approved risk appetite.

- Customer risk profiling and enhanced due diligence for high-risk customers: The above three assessments help determine whether a customer or a transaction is high, medium, or low risk. Once you know the high-risk customers, you must apply enhanced due diligence for extra care. Seek information on the source and destination of funds, check their legitimacy, and double-check beneficial owners. Do not form a business relationship or conduct the transaction if it is doubtful.

Thus, all these steps of customer due diligence ensure you are in a better AML compliance position. You know your customers and their risk profiles so that you can decide accordingly. Such risk assessment allows you to take a risk-based approach to AML compliance.

No plan in place to Know Your Counterparty VASP

A virtual asset service provider sells, holds, exchanges, converts, safe-keeps, or transfers virtual assets on behalf of other legal or natural persons. So, in such virtual assets activities, more than one VASP is involved, and thus, such counterparty VASP may also pose a certain degree of risk, influencing the transaction. So, knowing your counterparty VASP is crucial for any virtual asset service provider.

Failing to do this is a crucial mistake to avoid in AML compliance for VASPs. So, you must make it a practice to check and know your VASP before engaging in a transaction. You can check the importance of this requirement on our blog: FATF Travel Rule and Know Your Corresponding VASPs.

Like customer profiling, check your counterparty VASP’s beneficial ownership. Make it a practice to check their compliance with the AML regulations. All these details will give you a better view of how legitimate or illegitimate their business is and what sort of risk it can bring to the virtual asset transaction.

Lack of AML training for employees

You must be aware of the applicable AML regulatory landscape. Besides, everyone in your team handling customers, transactions, or any other AML compliance procedure must learn about the process, including the senior management. All this knowledge enables the adequate performance of your business responsibilities while considering the AML measures and compliance obligations.

So, you must design a comprehensive AML training program for your employees. Include theoretical and practical training to facilitate a better understanding of procedures. Provide practical examples of cases with relevant live training on CDD, transaction monitoring, and sanction screening. It makes the conceptual clarity better and more accurate.

If not internally, you can hire an external AML consultant for imparting training. Partner with someone with expertise and experience in training different industries. Missing such training is a big mistake to avoid in AML compliance for VASPs.

Inability to find the right balance between user privacy and AML compliance requirements

The design and delivery of virtual assets is such that you can ensure anonymity. However, AML compliance requires you to gather all details on your customers. So, a proper balance between the two is essential. This is a big AML compliance challenge that VASP must avoid.

Virtual asset transactions sometimes enable the concealment of true identities. Some cryptocurrencies, like privacy coins, enhance anonymity and privacy.

This is in contrast to the AML requirements that VASPs must adhere to. You must get the customers’ identity and other details to fulfil the needs of KYC and CDD under AML. So, you need to find a balance between this anonymity and AML requirements.

Insufficient and incomplete records and reports

Another mistake to avoid in AML compliance for VASPs is insufficient recording and reporting. If you don’t keep records, it would be treated as non-compliance with record-keeping requirements, and also, you won’t have evidence to prove your regulatory compliance. Also, you’ll be unable to submit reports to authorities without such records. So, pay close attention to maintaining records and submitting reports to authorities.

Maintain records of KYC, CDD, customer screening, EDD, KYT, transactions executed, etc. Also, create and save records of transaction monitoring and suspicious transactions identified. These records must be up-to-date, comprehensive, and accurate. Authorities might ask for them during audits and investigations.

Another need is to create comprehensive reports of your AML measures and submit them to the necessary authorities. One mandatory provision is submitting a report on suspicious transactions and activities. Forgetting to do so leads to non-compliance and penalties. So, comply with the reporting and recording requirements of AML compliance in UAE.

You must be aware of and avoid these common mistakes in AML compliance for VASPs. By avoiding them, you make your AML compliance practices effective.

AML UAE – your partner for professional AML consulting services

AML UAE is one of the leading providers of AML consulting services to the VASPs operating in the UAE. We help clients face AML compliance requirements with complete preparations. You can find help with:

- Conducting the ML/FT enterprise-wide risk assessment

- Creating and implementing AML policies and procedures

- Training your employees

- Monitoring transactions

- Managing your KYC and CDD compliance

For any help in AML compliance, you’ll have the support of AML UAE.

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.