AML compliance requirements for the real estate sector in the UAE

The real estate sector is one of the main non-financial sectors that is highly vulnerable to money laundering activities. Large sums of money are involved in real estate transactions with limited regulatory scrutiny, so money laundering activities and terrorist financing transactions are quite common in the real estate sector.

As per Central Bank of the UAE’s ‘Financial Stability Report, 2022’, the real estate sector (real estate and construction) contributed 18.5% of the UAE’s 2021 real non-oil GDP and 22% of UAE banking sector loans.

It becomes essential for the regulators to make the sector more regulated and controlled. It is also important to identify the possible suspicious transactions and conduct regular monitoring of real estate transactions. UAE has made special provisions for AML requirements in the real estate sector.

Suspicious transactions in the real estate sector that raise a concern for money laundering

- Payment of the entire amount of the value of property in cash

- People use complex loan structures or credit finance as a source of finance for buying property to launder money. In the repayment of these loans, the illicit money is forced into the legitimate financial system.

- Undervaluation or overvaluation of property or sequence of property sale transactions to get a higher value is a way of laundering money.

- Making frequent, unnecessary renovations and improvements in property are a sign of investment of illicit money.

- Customers (buyers or sellers of property) use unknown third parties with a clean criminal record to hide their identity as the owner of the property.

- Hiding the ownership of a property by the use of trust and company structures, shell companies, or front companies

- Multiple purchases or sales of property

- A legal owner of any property having an unusual nature of use or possession of assets, a mortgage with an unidentified lender, a strange rise in the financial funding, or an erratic relationship between income and living standards can be a suspicion of money laundering activity in real estate.

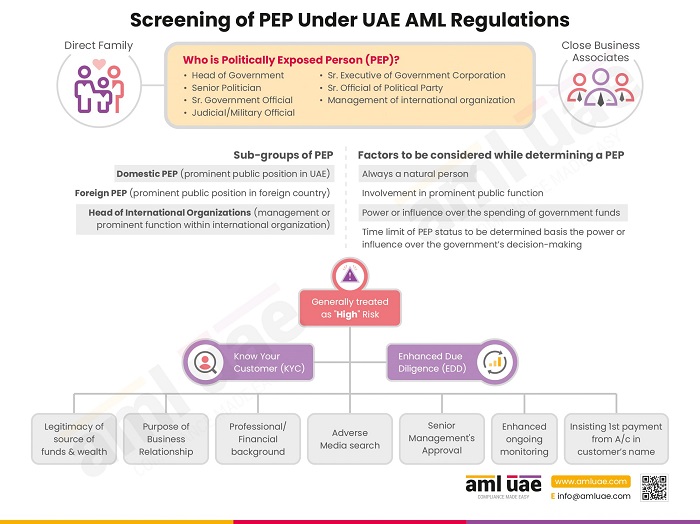

- Purchase of property by Political Exposed Persons (PEPs) or individuals with Sanctions by posing as high-ranking foreign officials or members of their families.

- Using the purchased property to carry out illicit or criminal activities such as drug production is a money-laundering example. Criminals use these revenues to buy more properties and thus hide the origin of illicit money.

- A property buying or selling transaction that does not make any commercial or professional sense because of a lack of interest exhibited by any party.

- Money launderers may buy a property in a third party’s name and show themselves as a tenant. Then they use illicit money to pay rent to the third party.

- Money launderers use the help of different professionals to launder money with no possibility of detection. They use the services of accountants, trust and company service providers, lawyers, or any others to make their criminal activity look legitimate.

- Buying real estate in a foreign country using illicit funds to hide assets from own country’s lawmakers.

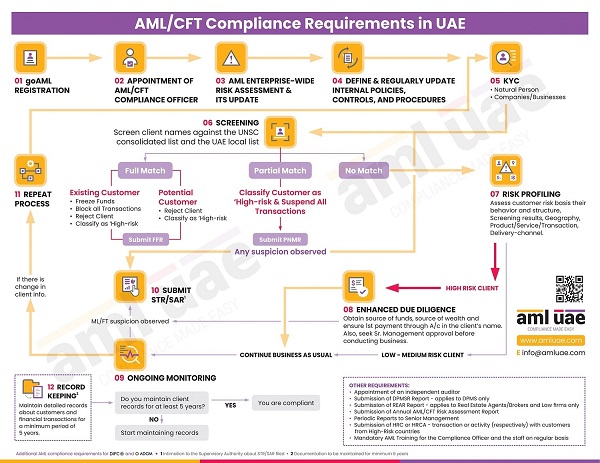

In regards to these possibilities, the UAE government introduced AML/CFT regulations. Let us look at the key regulations and directives that control the real estate sector’s compliance with AML/CFT.

AML regulation for real estate sector in UAE

Decree-Law No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations is the primary law for AML in UAE. The Cabinet Decision No. 10 of 2019 concerning the Implementing Regulation of this Decree-Law makes real estate agents and brokers subject to the AML law. This means that the AML law applies to real estate agents and brokers in the UAE.

The Cabinet Decision provides a list of Designated Non-Financial Businesses and Professions (DNFBPs) that includes real estate brokers and agents. These define the various CDD obligations of the real estate industry and ways to identify risk factors. Let us look at the AML/CFT compliance requirements for the real estate sector in the UAE.

Feeling lost due to ever-increasing AML demands?

We assure you full AML/CFT compliance

AML/CFT compliance requirements for real estate brokers and agents in UAE

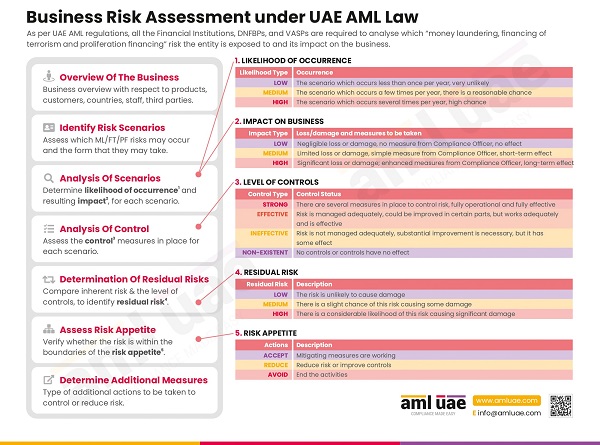

Understand possible ML/FT risk exposure

You must have a detailed understanding of how your real estate business can be exposed to ML and FT risks. For this:

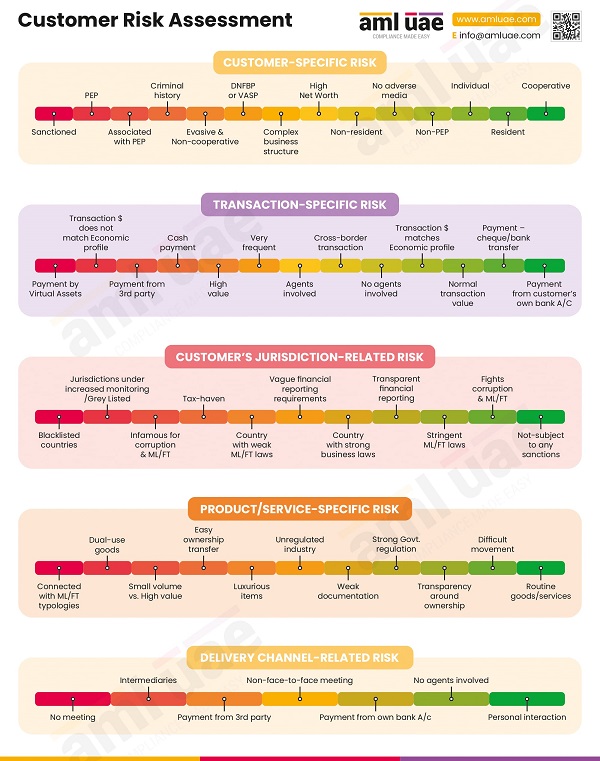

- You must adopt a risk-based approach to identify risks in your business transactions. These risks may be of different types based on business nature, type of service, the operational environment, and other factors. Accordingly, you must adopt risk mitigation measures.

- You must be aware of the source of ML/FT risks and the phase in which the money laundering risk is high.

- You must know the latest ML/FT trends and understand the various customer risks, channel risks, and geographic risks to the real estate industry. You must be able to identify each type and strategize for their elimination.

- You must be aware of the type, size, complexity, transparency, geographic origins, or any unusual nature of financial arrangements or instruments related to the buying and selling of property.

- Brokers and agents must have full information on a customer’s residence status, type of real estate transaction, and speed and frequency of transactions to gauge the risk.

- You must keep all this information related to risk profiling documented and saved. The information must include methods of risk identification used, models used, and overall risk score.

Implement Customer Due Diligence measures

These due diligence measures include the following:

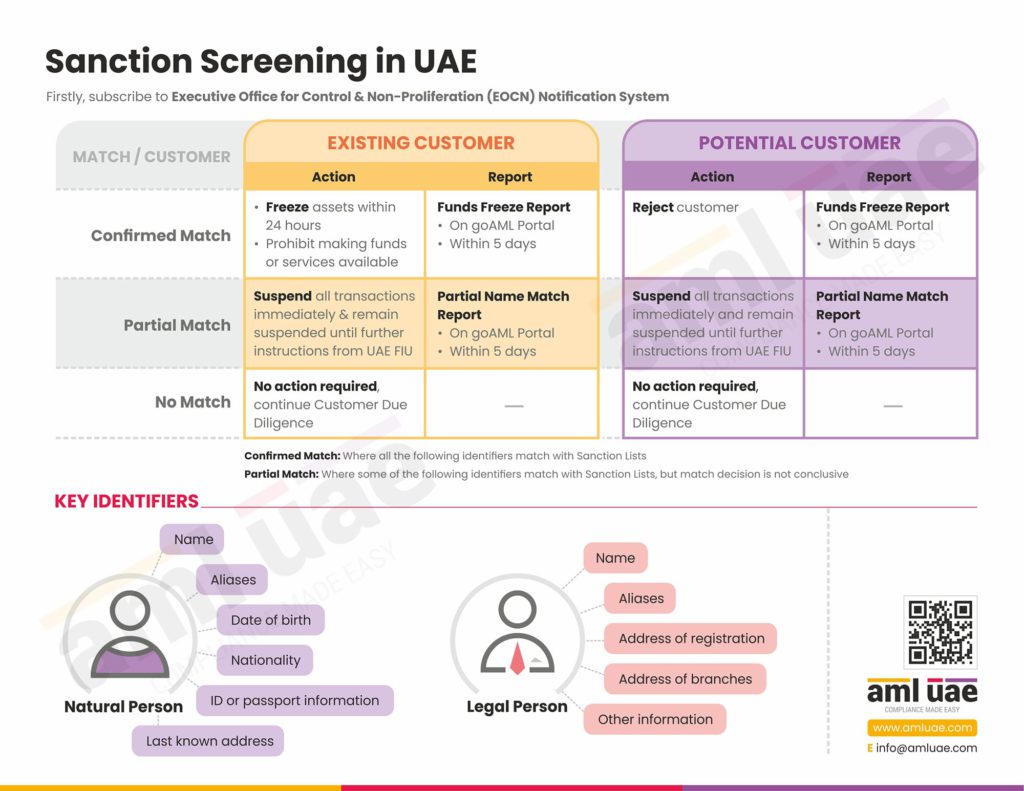

- You must have in place a defined process for screening customers and prospects against Sanctions Lists. You must conduct background checks on your customers and prospects to identify any association with financial crimes.

- You must be vigilant of the identity of the beneficial owner of your client. You must obtain all relevant proofs for establishing their identity and the source of funding.

- You must check for the compatibility of the customer’s profile with the relevant real estate transaction to see if it suits their financial stature and professional circumstances.

- You must track the legal arrangement or structure used in the transaction, as it may result in hiding the identity of the owner or source of funds.

- You must also keep an eye on any association with Political Exposed Persons (PEPs), specifically in the case of foreign buyers or sellers.

- You must check for any previous business transaction or relationship between buyer and seller.

Ongoing monitoring of transactions

Put in place internal policies, controls, and procedures

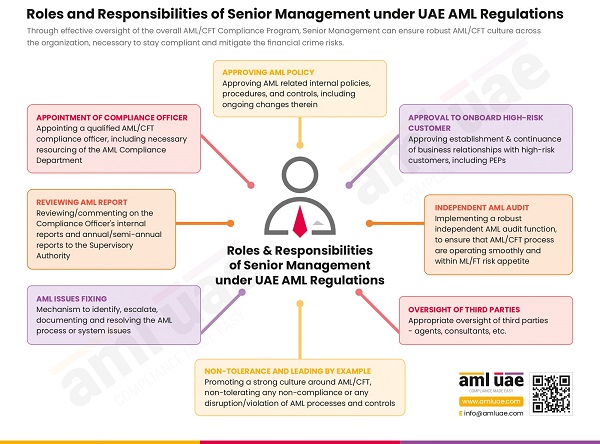

The real estate brokers and agents must implement necessary measures to manage and mitigate the ML/FT risks. One of the key measures is the implementation of strong and effective internal policies, controls, and procedures. You must assess these policies for effectiveness and update them accordingly as and when the need arises.

Report suspicious transactions to Financial Intelligence Unit (FIU)

- Unnecessary complex transactions whose purpose or beneficial owner is not known

- Transactions that are inconsistent with the customer’s risk profiling

- Large transactions (relatively large to a customer’s income or turnover)

- Unexplained changes in the ownership of entities or unnecessary involvement of a third party

- Transactions involving high-risk countries or third parties with no relationship with customers

- Unclear or dubious sourcing of funds for a transaction

- Refusal of customers to provide relevant information or proofs required for due diligence measures

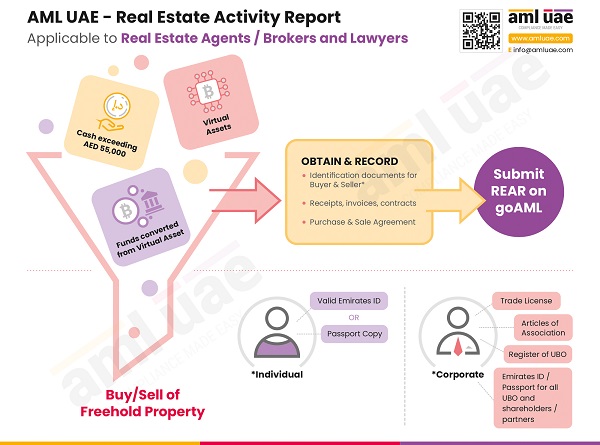

Real Estate Activity Report Submission

Ministry of Economy has recently issued a Circular (No. 05/2022 dated 24th June 2022), requiring the real estate brokers to report the specified transactions pertaining to real estate in the new report named as – Real Estate Activity Report (‘REAR’). The reporting entities have to submit REAR with the FIU UAE.

Read more about REAR here.

Devise and implement a sound governance structure

Anti-money laundering regulations for real estate transactions

The compliance with the anti-money laundering regulations for real estate transactions will enable you to save yourself and your business from any fraudulent transaction or business relationship. This, in turn, helps you to minimize your exposure to money laundering and terrorism financing risks. These measures also help you to be in congruence with international AML/CFT regulations and best practices.

Role of AML UAE

AML UAE is a leading AML compliance services provider in UAE. We help you with fulfilling all the requirements for AML and CFT in UAE. Our spectrum of AML compliance services is not restricted to national boundaries, but we also make sure that you comply with the global regulations of AML.

- Creating firm-specific AML policies, procedures, internal controls, best practices, and guidelines for your smooth business operations

- Setting up an expert AML compliance department for your firm that can handle all AML-related activities

- Selecting the most effective and appropriate AML software for your business needs to ensure AML compliance

- Helping you in filing and submitting annual AML/CFT risk assessment reports with the UAE government

- Conducting training for your employees in handling KYC, screening, risk profiling, CDD, EDD, and filing of STRs

Our recent blogs

side bar form

FAQs - AML Compliance Requirements for Real Estate

Here are a few frequently asked questions About AML For Real Estate Sector.

There are AML regulations for estate agents in the UAE, including implementation of necessary CDD measures, identification of ML/TF risks and reporting, internal policies, and sound governance structure.

Yes. The primary reasons for the high risks of money laundering in the real estate sector are transactions involving large sums of money and limited regulations and laws. Also, more cash transactions, undervaluation or overvaluation of property, and involvement of PEPs or unknown third parties as investors expose the industry to higher risks.

It is essential to conduct customer due diligence in the real estate sector to comply with know your customer, know your business, and ultimate beneficial owner regulations. For this, collect clients’ information, verify them with identity documents, verify UBO, check against PEPs or Sanction lists, and prepare risk profiles.

Anti-money laundering in the real estate sector is essential. So, estate agents must do AML checks to identify customers, transactions, and their links with any financial crimes.

Estate agents must do AML checks to avoid the possibility of engaging in business transactions with financial criminals, drug traffickers, money launderers, or terrorism sponsors.

The factors that contribute to the vulnerability of the real estate sector to money laundering and other financial criminal activities are:

- It is possible to launder big amounts of money in buying, selling, and leasing property.

- The prices are subjective like some prime locations have high property prices, leading to no suspicion based on prices.

- It is seen as one of the best investment options.

- There is a lesser degree of regulatory oversight and regulations for the real estate sector.

In the case of undervaluation of a property, the seller agrees to sell the property to the buyer at a lesser price than the market value. The buyer pays the difference between the two amounts with illicit funds to the seller.

In the case of overvaluation of a property, the buyer buys the property at a higher price than the market value. This allows the buyer to obtain a large loan from the bank. Then the buyer uses illicit money to repay debts, thereby laundering illicit money into the legal financial system.

Share via :

Add a comment

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.