Red flags associated with High-Risk Jurisdictions

Red flags associated with High-Risk Jurisdictions

The regulated entities in the UAE must take a risk-based approach and manage their money laundering, terrorist financing, and proliferation financing risks. One important risk factor is the jurisdictions the entity works with. In this infographic, we will understand the red flags associated with high-risk jurisdictions. The regulated entities must take appropriate countermeasures while dealing with such high-risk countries.

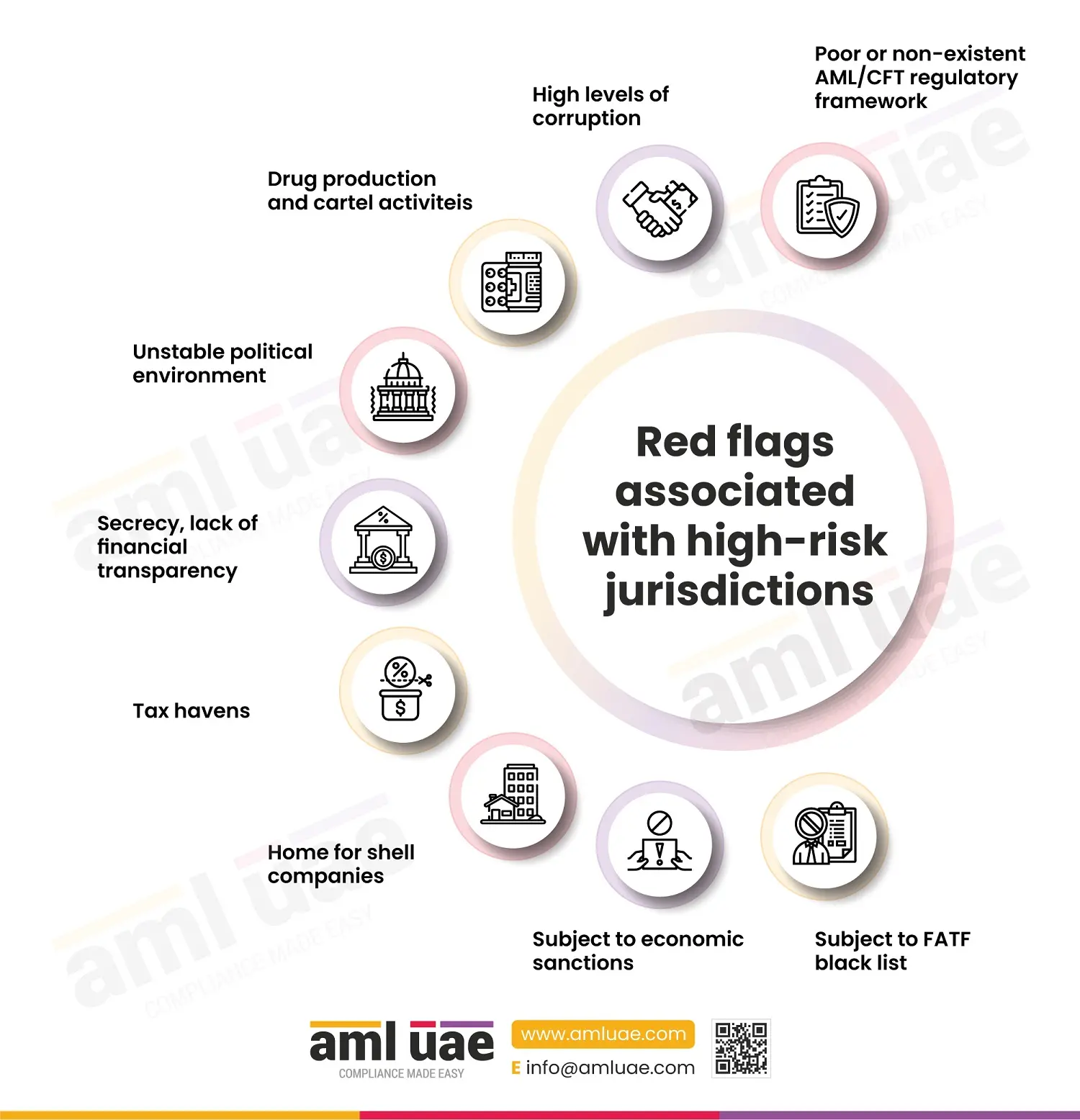

Geographic risk is associated with countries with poor AML/CFT framework, high levels of corruption, drug production and cartel activities, unstable political environment, and lack of transparency. Such countries are also known as secrecy or tax havens.

Red flags are potential risk indicators for money laundering, terrorist financing, or proliferation financing. This infographic lists red flags associated with high-risk countries and jurisdictions.

Businesses dealing with such high-risk jurisdictions must watch out for the red flags to safeguard themselves from various risks such as fraud, theft, reputational damage, and regulatory fines and penalties. Depending upon the risk-based approach adopted by the regulated entity, the entity needs to identify, assess, and counter jurisdiction risk.

Jurisdiction risk must be considered while performing the Enterprise-Wide Risk Assessment and Customer Risk Assessment. If the entity observes any red flags associated with high-risk jurisdictions, it must employ countermeasures such as enhanced due diligence, ongoing monitoring, and regulatory reporting (HRC and HRCA reporting).

As per the FATF blacklist, Iran, North Korea, and Myanmar are treated as high-risk jurisdictions. For more understanding about FATF blacklist and grey list, Read our article What are FATF Blacklist and Grey list countries? February 2024.