AML compliance best practices for real estate agents in UAE

The nature of the real estate business makes it vulnerable to money laundering risks. So, UAE includes real estate agents and brokers in the list of DNFBPs that must follow AML regulations. To adhere to these laws, you must follow the AML compliance best practices for real estate professionals.

These best practices for real estate agents in UAE align business with Anti-Money Laundering and Countering Financing of Terrorism obligations. So, make them a part of your routine operations and remain compliant with the requirements of law.

Detect and deter money laundering in the real estate sector with

our expert AML compliance services.

Take action now!

Red flags of money laundering for real estate entities

The aspects of the real estate business that make it vulnerable to money laundering are:

- Rapid buying and selling of property at significantly lower or higher prices than the market rates.

- Artificial inflation of property values via property flipping schemes. It facilitates the laundering of money through several transactions.

- Large cash transactions with no specific reasons or obvious explanation.

- Transactions involving foreigners or non-residents from sanctioned, high-risk, or weak AML-regime countries.

- Concealing the property ownership using complex ownership structures or shell companies.

- The client focuses on transaction completion instead of property characteristics like location or neighbourhood.

- Movement of illicit money through cross-border real estate transactions.

- A good number of transactions with a single client in a short time with no obvious purpose.

- Client’s unusual requests before transactions

- Client not following standard procedures to avoid data points that can call for more scrutiny.

- Client’s refusal to submit identity documents or financial records per due diligence requirements.

- The property buyer is in an illegal business.

- Client engaging in repeated transactions valuing less than the threshold limit to avoid reporting and revealing the transactional details.

- Involvement of several parties through complex financing arrangements to hide funds’ sourcing.

- No match of the property’s location with that of the buyer or seller.

- Disguising the source of funds using unconventional payment methods like cryptocurrencies or third-party cheques.

- Hiding the true identity of beneficial owners through front persons acting on someone else’s behalf.

- Client’s inconsistent financial status or history, like sudden changes in income, finances, or employment.

- Inconsistency of client’s wealth with their financial history or source of income.

- Hiding the property’s beneficial ownership by providing misleading information like parties involved in the transaction.

- A transaction involving a person or entity in a foreign country of proliferation concern.

AML compliance best practices for real estate brokers

Note these warning signs for real estate businesses discussed in the previous section. Save yourself from such indicators in customers and transactions. Apply the following best practices for real estate businesses to achieve AML compliance:

Conduct Enterprise-Wide Risk Assessment (EWRA)

The real estate brokers and agents must carry out the Enterprise-Wide Risk Assessment to identify, assess, and mitigate ML, TF, and PF risks. The EWRA helps identify risk factors, their likelihood of materializing, the gross risk, controls deployed to counter ML, TF, and PF risks, and the residual risk.

If the residual risk is within the risk appetite of the real estate broker or agent, no further action is needed. If the residual risk exceeds the risk appetite, more controls must be placed to keep the risks in check.

One must be aware of the risks to the business. Be it from customers, transactions, or property locations, one must assess each risk. The risk environment in which one operates is critical to understand.

Comprehension of business risks guides you on preventive actions to apply. For example, if you find a customer suspicious, you can collect more details on their identity. In the case of a suspected transaction, you can report it to the authorities. All these actions are possible only if you understand the possible risk indicators for your real estate business.

Check out our video on Business Risk Assessment/EWRA.

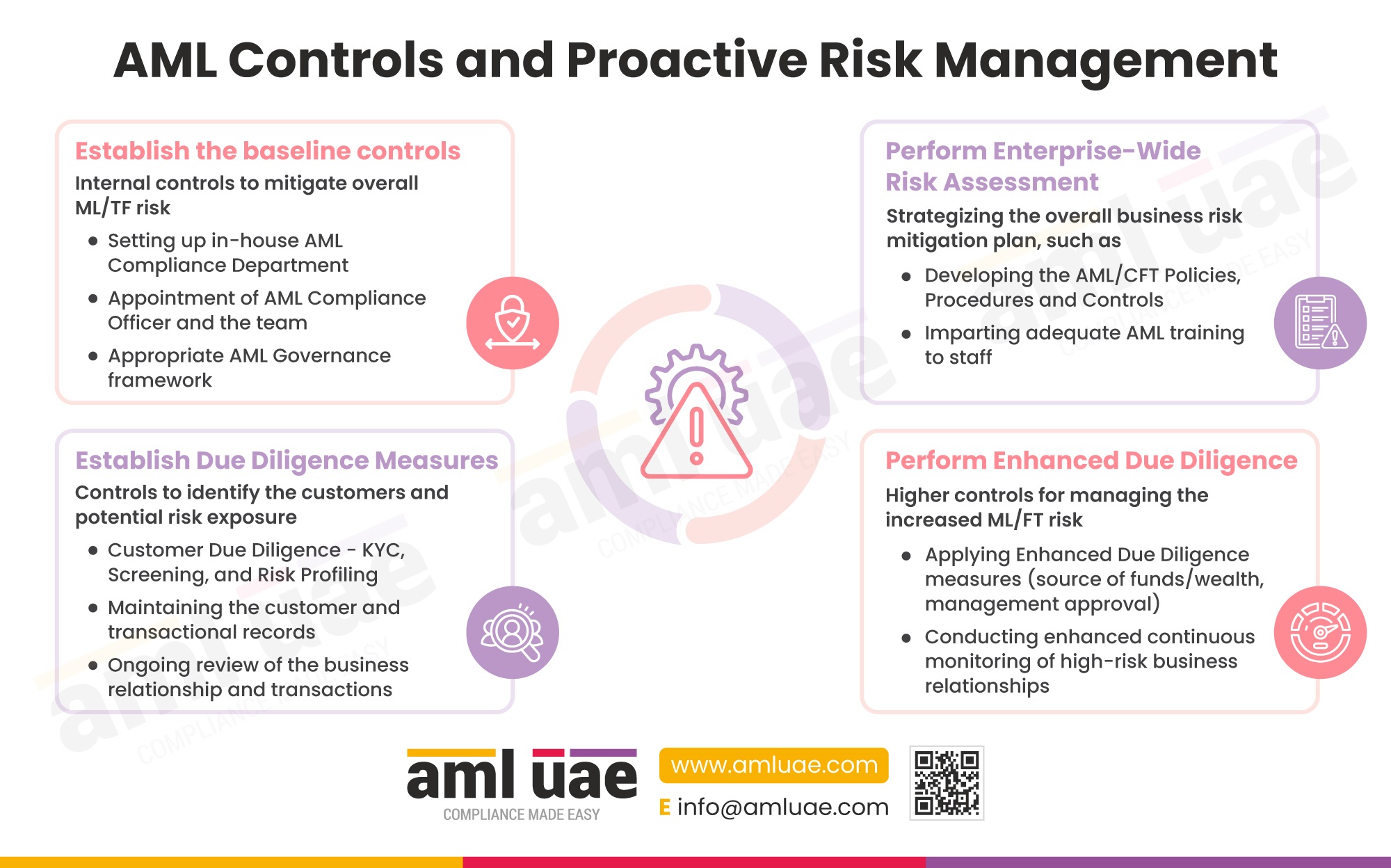

Implement an AML/CFT Compliance Program

Real estate businesses must design and implement AML/CFT and PF policies and procedures to guide the employees in carrying out their day-to-day compliance work. The AML/CFT compliance program must be aligned with the EWRA to counter various risks. The top management must sign the AML compliance program, and a complete trail of updates must be maintained.

Check out the infographics.

Perform KYC and CDD checks

Knowing your customers is essential. You must know their identities specifically before onboarding. Knowing your customers during the business relationship is a best practice for real estate entities in AML checks.

You must conduct KYC before onboarding them as customers. Collect their identity details and documents and verify those. Also, collect proof of the entity’s registration, office address, and finances. Only after all these verifications must you onboard them.

Such customer investigation mustn’t stop during the business relationship. You must conduct thorough due diligence to identify every client’s risks. Beneficial ownership, source of funds, presence in other countries, and type of product/service are vital factors to collect information on. You must also screen them against sanctions, terrorist lists, watchlists, and adverse media.

All these examinations help you build a customer risk profile. You must adjust your due diligence measures based on each customer’s risk level.

Be aware of the local property market

Be it real estate companies, professionals, or agents, it is crucial to know your industry. You must know the market norms to identify the what and who of an illicit transaction or business. The normalcies of the property market help you differentiate the abnormalities. So, awareness of the property market values is an AML compliance best practice for real estate professionals.

Such knowledge helps you identify suspicious transactions. You can detect when a transaction is out of the norm or shows an unusual pattern. So, increase awareness of the local property market for easier and faster reporting.

Develop a compliance culture

As a real estate business owner, you cannot comply with AML laws alone. You need the support of your management, employees, and other stakeholders. So, the entire entity’s recognition of the significance of AML is crucial. Develop a compliance culture within the company to tackle ML/TF and PF.

Emphasise the importance of AML compliance for avoiding penalties and reputational harm. Educate them on how AML compliance creates a transparent and secure market. Train them in the fundamental processes and procedures of the AML framework. Give them all the necessary information on the following:

- KYC and CDD

- Transaction monitoring

- Sanction screening

- Business risk assessment

- Implementing AML controls

Recognising the worth of AML compliance for your business helps build an AML culture. Employees understand that they must contribute to executing AML policies and procedures. They commit to performing their AML responsibilities to prevent money laundering activities. This is how you can create a culture of compliance in your entity. Also, the senior management must focus on AML compliance and be proactive in its efforts.

Perform transaction monitoring

An AML compliance best practice for real estate professionals is continuous transaction monitoring. You already know the warning signs of money laundering in real estate transactions. To detect them at the right time, you must scrutinise them at regular intervals. If suspicious, you can stop those transactions and report them to authorities.

For this, you can install transaction monitoring software. You can set the red flags in transactions as rules. The system will generate alerts if it identifies any of these red flags. Report any occurrence of unusual patterns or discrepancies to higher authorities. Based on the suspicions, you can investigate further and decide further action.

Create and maintain records and reports

UAE regulations require you to maintain AML documents and records for a specific period. These are essential during audits or when asked by supervisory authorities. So, maintaining proper records is an AML compliance best practice for real estate professionals.

These records serve as a guide for your future AML policies. Also, you need them as proof of your AML compliance initiatives in the entity. You will need to show them to authorities during external audits. Moreover, supervisory authorities may ask for documents as evidence against customers or transactions. So, you must be ready with proper record-keeping.

AML regulatory requirements ask you to submit reports like STR, SAR, FFR, PNMR, HRC, and HRCA. Besides, as a real estate entity, you must also submit a Real Estate Activity Report (REAR) if you are dealing in cash or crypto.

Know your employees

Knowing your customers and transactions is critical. But you also need to know your employees, which most entities ignore. An AML compliance best practice for real estate professionals is knowing your employees. You never know; they might be dealing with criminals to launder money through your business transactions. It would be best if you prevented such interventions.

The best practice for real estate is AML checks of employees. Check their background and employment history. Investigate their family to identify any association with money launderers. Observe their behaviour to determine involvement in suspected illicit activities or illegal linkages.

Independent audit of AML efforts

You perform all these AML activities to follow UAE regulations. You create an AML framework with each process’s necessary policies and controls. So, it’s also critical to see how this AML framework functions. If it can achieve AML goals or you are still non-compliant.

For this, you must audit your AML efforts. The audit shall cover your AML/CFT program, procedures, records, controls, and various quantitative and qualitative aspects concerning the AML/CFT obligations. Appraisal of the AML framework is a best practice for real estate AML checks. Identify the weaknesses. Check what is working and what is not. Track the submissions to authorities.

Once you know the weaknesses, you can improve upon them. You can implement corrective actions to improve the effectiveness of your AML compliance. So, regular assessment of the AML framework is an AML compliance best practice for real estate professionals.

Collaborate with authorities and industry players

One best practice for real estate AML checks is collaboration with regulatory authorities. Such collaboration facilitates information sharing. You can contribute to authorities’ investigations by providing timely reports. These show your commitment to preventing money laundering in the real estate industry.

Such collaboration helps you stay up-to-date on regulatory changes and updates to laws. With regular tracking of these amendments, you can adjust your internal controls. Also, you get to know about emerging risks and industry-specific guidelines.

Interactions with other real estate entities and professionals also help you know the best practices. You can learn about the industry-specific red flags to spot and avoid. Participation in industry conferences helps you with information on AML trends. Thus, collaboration with industry players, regulatory authorities, and legal professionals is beneficial.

Implement a governance framework

Implement a governance framework and establish clear authorities and responsibilities around AML compliance. Lay down detailed guidance on who does what and the procedures to make changes to the AML/CFT program.

There are eleven AML compliance best practices for real estate businesses. You must adopt them in your business to streamline your AML compliance. These best practices for real estate in AML checks empower you to prevent financial crimes. If you need support in AML compliance, we at AMLUAE are here to make your journey smoother.

AMLUAE – your partner for professional AML consulting services

AML UAE is a well-known provider of AML compliance services to clients in different industries. We have been helping clients frame AML policies, procedures, and controls. We handhold you through the execution of these procedures. We create a culture of AML compliance in your entity to ease compliance with all regulations.

Our offerings on AML compliance for real estate professionals include the following:

- Performing KYC and CDD

- Monitoring transactions to detect suspicious ones

- Imparting training to employees

- Creating a customised AML framework

- Executing AML policies, procedures, and controls

- Finding the right AML software for your business

- Business risk assessment

- Health Check

- Submitting STRs, SARs, and other relevant reports

- Creating and maintaining documentation and records

Worried about money laundering threats to your

real estate business?

Adopt our AML compliance best practices for real estate professionals.

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.