The Threat of Luxury Watches in Financial Crimes: A Growing Concern

Luxury goods like gold jewellery, precious gems and stones, high-end watches, art and antiques, boats and yachts, and luxury cars pose a significant threat of money laundering and terrorist financing. The ownership of such goods is a status symbol in society.

Owners of these high-priced items take pride in their ownership and use them to show off their wealth. But, one more thing is common between them. These have also become the preferred vehicles for money laundering. This article will discuss the threat of luxury watches in financial crimes.

Criminals often target the luxury goods market. Luxury watches are the latest victim of money laundering activities. There is a growing threat of high-end watches in financial crimes because of their inherent traits. Not only high-end watches but bulk purchases of watches are also common money laundering transactions.

So, luxury watch sellers and buyers must be careful about their transactions. Sellers must develop policies to check customers’ identities and report suspicious activities to avoid financial crimes.

Let’s understand what characteristics of luxury watches make them highly vulnerable to financial crimes. We also see the ways criminals use luxury watches in money laundering activities. Finally, we explore various AML measures to help spot and reduce suspicious transactions.

Protect your business of luxury watches from financial crimes.

Contact us to learn more about our AML services.

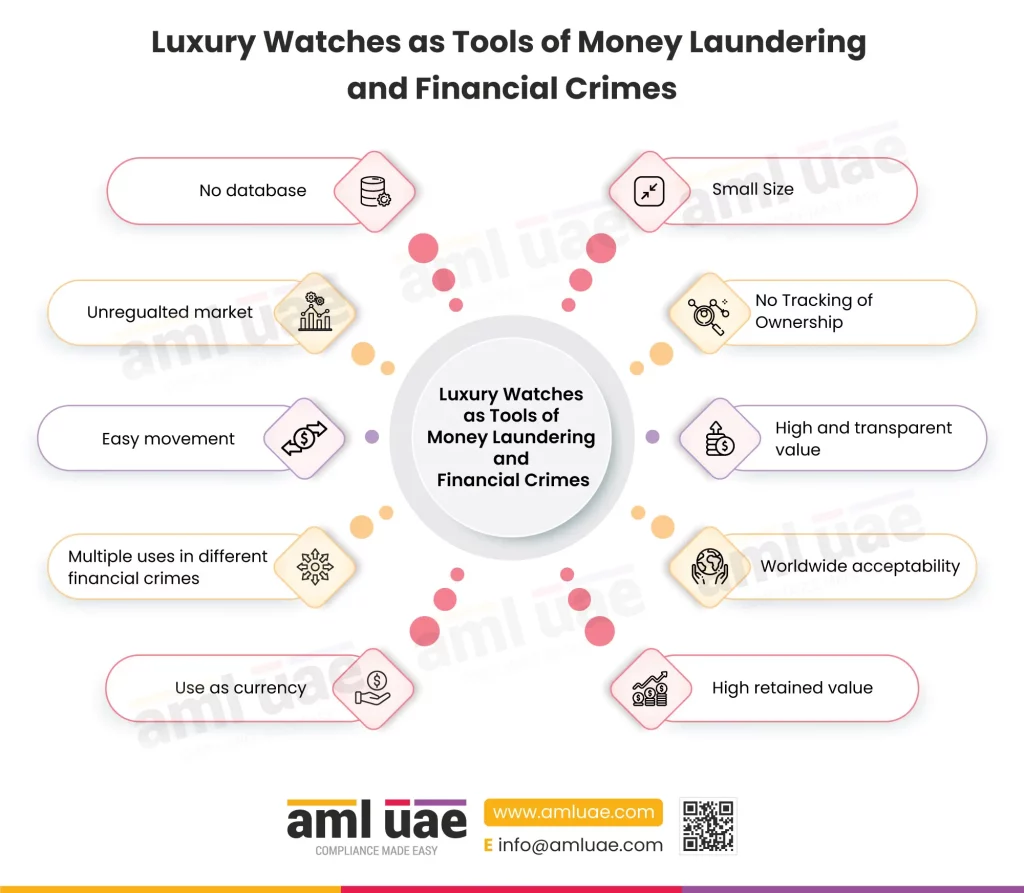

Luxury Watches as Tools of Money Laundering and Financial Crimes

Money launderers use luxury watches in financial crimes, such as money laundering, bribery, fraud, drug trafficking, and tax evasion. The following are the characteristics of luxury watches that make them susceptible to money laundering:

Small size

High-end watches are collectible items that are highly expensive. They are so small and compact that they invite less attention. Also, they are easy to transport and can be used as currency for illegal transactions.

No tracking of ownership

No ownership tracking is a prominent trait that increases the threat of luxury watches in financial crimes. Authorities do not track the ownership of such watches. So, it is easy to buy and sell these expensive watches easily.

High and transparent value

The value of these watches matches gold or diamonds, but they can escape scrutiny from the airport or local authorities. Their price in the market is transparent. You know the price of a designer Rolex or any other high-value collectible luxury watch. This characteristic enables launderers to use a luxury watch in money laundering.

Worldwide acceptability

Luxury watches are valued everywhere. They are desirable items in every corner of the world. The branded, high-priced watches are tradable anywhere because people expect them to find a high resell value. So, you escape the eyes of customs, earn a profit, and use a luxury watch in money laundering.

High retained value

The value retention of such branded luxury watches is high and stays for a long time. It helps one resell it after some time has passed to its purchase to avoid suspicion. On top of that, its retained value is the same or higher in every corner of the world. Because of their exclusivity, one can sell some high-end watches at 2x or 3x value in the secondary market.

Use as currency

Organised criminals and drug traffickers use high-end watches as currency to sell drugs or smuggled goods. They are also using these watches to settle debts. This is because the value of luxury watches does not decline much. It is also a new form of running-away money. One can sell the watch when one needs immediate cash to escape a country. Thus, its use as a currency boosts the threat of luxury watches in financial crimes.

Multiple uses in different financial crimes

Criminals use them as means of payment in drug purchase transactions. Criminals may also be using luxury watches as collateral to get loans. It is also used in bribery transactions. Since it is small, can be worn on the hand, and does not invite much attention, criminals give it as a bribe to others.

When a new collectible item is introduced in the luxury watch market, an organised crime group buys it in huge numbers. It reduces the supply in the market. Then, this gang brings it back in circulation at higher prices to gain profits from its sale.

Easy movement

Watches are a commodity that can escape customs. One can move luxury watches easily from one place to another without any suspicion. Thus, its easy movement leads to the threat of luxury watches in financial crimes.

Unregulated market

Luxury watches are also a great money laundering avenue because of an unregulated and fragmented grey market. Money launderers always have the option to sell watches in this grey market to make money. Since there is no need for registration to participate in trading luxury watches and no authority supervises these transactions, one can buy and sell them easily.

No database

There is no reliable database on luxury watches noting every item with its specific details. So, it is easier to trade them many times at equal or higher values. No database means no records, lending a helping hand to the growing threat of luxury watches in financial crimes.

Use of luxury watches in money laundering: How?

Launderers can sell these high-value watches later to get legal money.

Or, they may exchange it with drug suppliers. Or, they may use the watch to get a loan, thereby reducing the tax liabilities with the deduction of interest payments. That is how the threat of luxury watches in financial crimes increases.

The thing is that financial criminals cannot take tons of money in cash across borders. They cannot even transfer it to a bank without authorities suspecting its source. So, money launderers use it to buy expensive watches.

And then, they can fly to other countries to sell it in the grey market without raising suspicion.

Now, authorised watch dealers are unaware of the source of funds used in the watch purchase transaction. So, they are unaware if they are selling it to criminals. Money launderers use shell companies to make the purchase a legitimate transaction. They don’t buy in cash but use a cheque from the shell corporation to buy high-priced watches.

All these transactions occur through legitimate dealers. The client’s identity is kept a secret. These dealers may represent the buyer or seller in watch auctions. It is one of the biggest loopholes money launderers use for criminal activities.

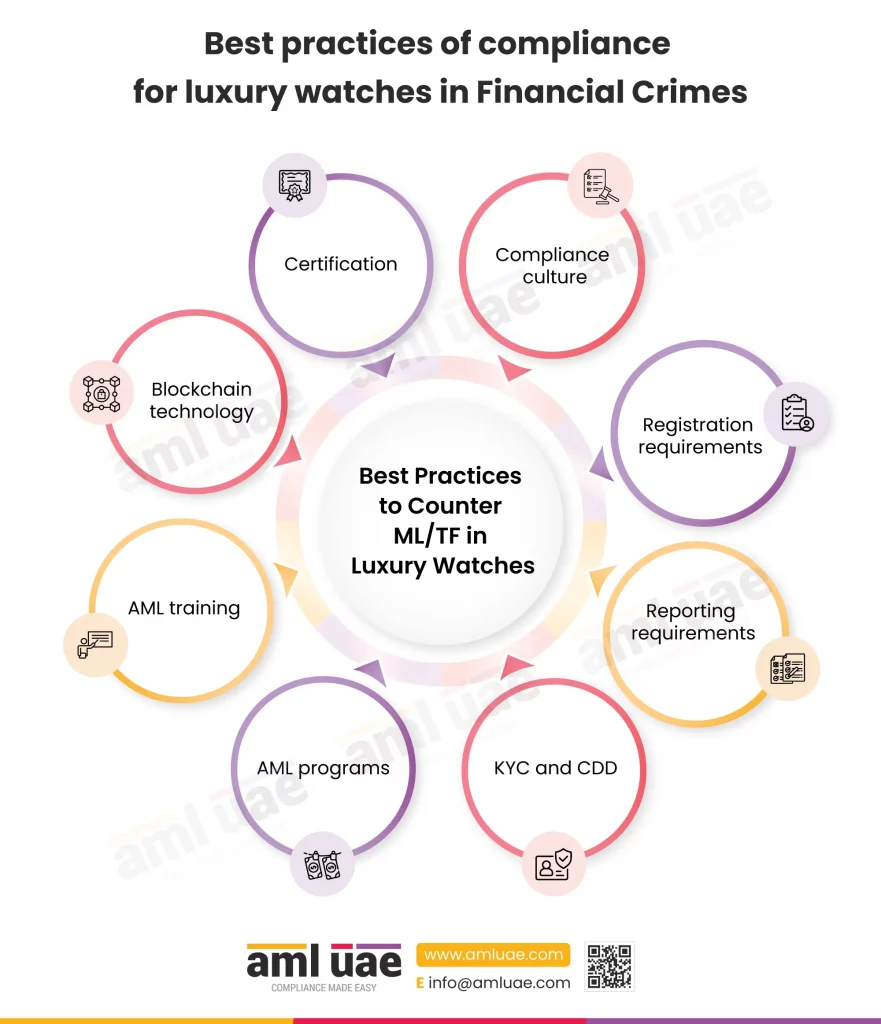

Compliance best practices for financial crimes in luxury watches

Some of the key compliance measures that you must be aware of and adopt to counter money laundering in luxury watches are:

Compliance culture

It is necessary for firms in the luxury watch market to build a culture of AML compliance. The senior management must abide by the rules and motivate employees to do the same. Everyone must agree to live by AML compliance and integrate it into business decisions. It helps to reduce the threat of luxury watches in financial crimes.

Registration requirements

Countries must make it compulsory for dealers and sellers to be registered businesses. Not anyone and everyone can enter the market and start a business. They must register themselves with the relevant regulatory authorities.

It helps authorities to manage a database of registered sellers and dealers in the luxury watch market. Registration and licensing allow authorities to supervise their operations and record transactions. Such regular monitoring and supervision can deter criminals from conducting luxury watch money laundering activities.

Reporting requirements

A possible solution is extending AML reporting requirements to the luxury watch dealer market. Any financial transaction valuing more than a specific amount must have relevant documents to prove its legitimacy. This rule leads to businesses keeping and maintaining records of every transaction.

Also needed are regulations to control the trade of luxury items across borders. For this, international authorities and AML watchdogs need to introduce a law. Also, constant monitoring of local and cross-border transactions helps to eliminate luxury watch money laundering.

KYC and CDD

One of the most effective AML measures is KYC and due diligence of market participants. Sellers of luxury watches must know their customers. They must collect identification documents from customers and verify their identities. Names, addresses, ID proofs, business types, sources of funds, etc., are vital data points in customer identity verification.

One must follow the following best practices while carrying out Customer Due Diligence (CDD):

- Obtain ID documents

- Verify ID documents

- Obtain address proof

- Verify Address proof

- Identify UBOs

- Perform Sanctions, PEP, and adverse media checks

- Perform Customer Risk Assessment

- Perform Enhanced Due Diligence in case of suspicion and obtain source of funds and source of wealth

AML programs

Internal controls, policies, and monitoring systems are essential to control luxury watch money laundering. An AML program helps. Such a program can help you and your employees protect your business against such vulnerabilities. You can build well-defined procedures for monitoring transactions and screening sanctions.

Implementing high-end technologies helps to reduce luxury watch money laundering activities. Such technologies help you spot suspicious transactions and raise timely alerts. These technologies ‘ machine learning, predictive analytics, and artificial intelligence features boost your AML measures.

Such AML frameworks and policies should be proportionate to the identified risks. The threats to a luxury watch seller can be from customers, geography, product, and local and global supply and distribution chains. One must implement proportionate controls based on these risks and their occurrence probability.

AML training

AML training for sales staff and other employees is a key measure to reduce the use of luxury watches in financial crimes. All your employees, and specifically the sales executives, must be aware of money laundering, red flags of suspicious transactions, reporting procedures, and KYC and CDD procedures. They must know the significance of AML compliance for their firm and the economy.

Employees must also agree to adjust to the changes in processes because of integration with AML compliance needs. They must give due importance to money laundering issues and report them promptly.

Blockchain technology

Another way is to have the technology to track all luxury watches of different brands. Blockchain technology can work best to lessen the use of luxury watches in financial crimes. Each luxury item can have a unique registration number, which must be registered in such blockchain database. It must have information on the sale price, selling data, owner, price in the secondary market, etc.

Certification

Another way is to have a certificate attached to a luxury watch. The certificate confirms the ownership, originality, and price of the watch. The absence of a certificate can help you identify the threat of luxury watches in financial crimes.

The Role of AML UAE

Sellers of luxury watches must adopt these AML measures to reduce money laundering risks. If they unknowingly get involved in such transactions, their reputation goes for a toss. Also, non-compliance can lead to penalties, fines, or harm to the reputation. So, it’s essential to implement AML practices, sanctions laws, and advanced AML technology to fight financial crimes. Compliance improves your reputation and might increase your customers and sales.

One such company that can help you combat money laundering is AML UAE. We are a leading provider of AML consultancy and compliance services to clients in the UAE. We help you imbibe these best practices to reduce the threat of luxury watches in financial crimes. We take every possible step to discourage criminals from using luxury watches in money laundering.

Protect your business of luxury watches from financial crimes.

Contact us to learn more about our AML services.

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.