AML/CFT Remedial Action Plan (RAP) Implementation Steps and Best Practices

As a part of its supervisory function, the relevant Supervisory Authority conducts investigations on the level of AML/CFT compliance of a regulated entity (Financial Institution, Designated Non-Financial Business or Profession – DNFBP, Virtual Asset Service Provider – VASP). The Supervisory Authority often issues an AML/CFT Remedial Action Plan directing the reporting entity to fill the gaps in its AML/CFT compliance framework or implementation. The Remedial Action Plan (RAP) enumerates the actions to address these identified deficiencies. It mentions the applicable provision, area of concern, and required remediation.

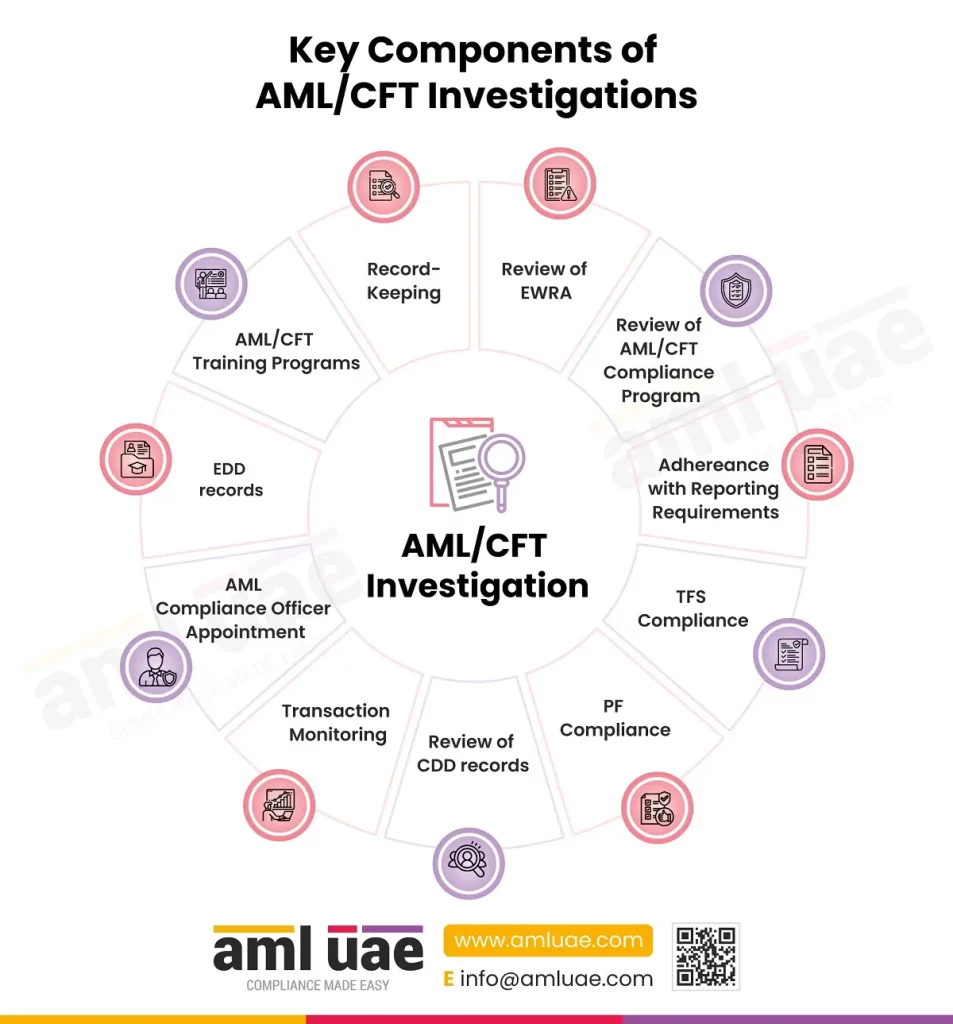

Some of these AML/CFT investigations carried out by the Supervisory Authority to include various aspects such as:

- Review of Enterprise-Wide Risk Assessment carried out by the entity

- Adoption of necessary policies, procedures, and controls for the AML framework

- On-time submission of STRs, SARs, DPMSR, REAR, HRC, HRCA, FFR, PNMR, and other sector-relevant reports to the FIU

- Compliance with Targeted Financial Sanctions (TFS) requirements

- Compliance with Proliferation Financing (PF) requirements

- Identification and verification of customers through KYC, CDD, and AML screening

- Ongoing monitoring of transactions and business relationship

- Appointment of an AML compliance officer and dedicated team to ensure AML compliance

- Measures for understanding the reason and type of business relationships

- Implementation of enhanced due diligence measures against high-risk customers

- Training programs for employees for AML awareness and methods

- Record-keeping requirements compliance

Entities receiving such remediation action plans from the Supervisory Authority must understand their importance. It is an opportunity for you to improve your AML Compliance Program. Such improvements can lead to the prevention or mitigation of money laundering threats. So, you must commit to following and implementing the action plans in your business.

Worried about the deficiencies in your AML compliance framework?

Talk to our team for a complete, effective, and efficient AML action plan.

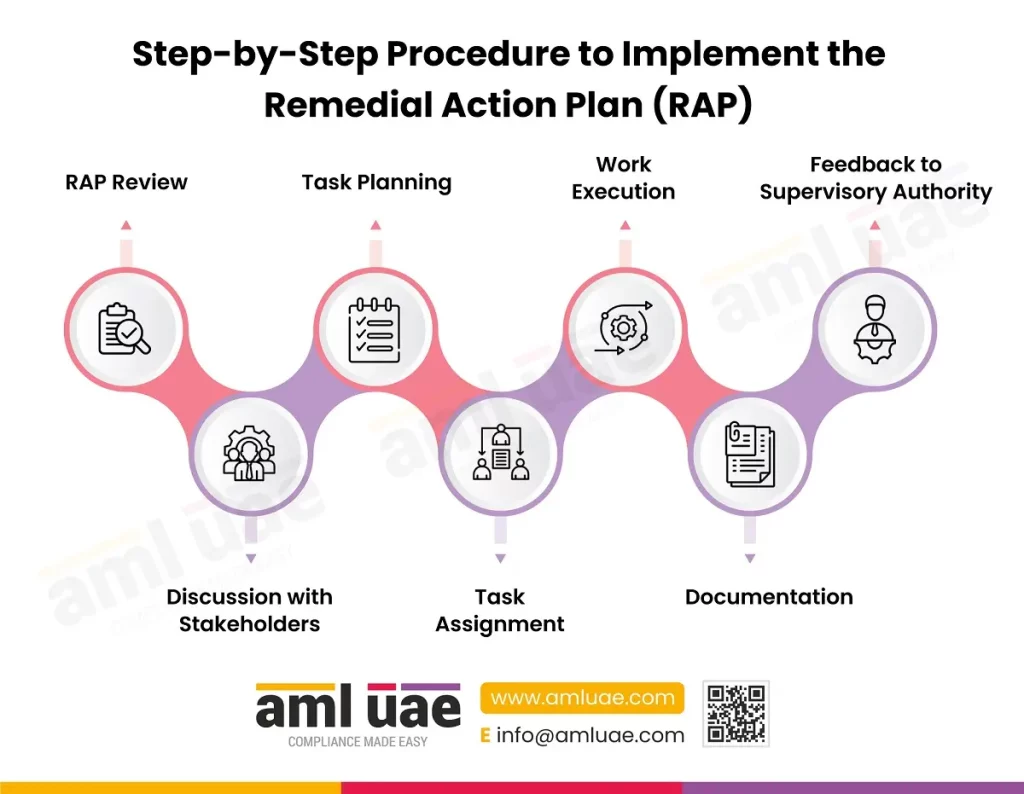

Step-by-Step Procedure to Implement the Remedial Action Plan (RAP)

Once you receive the RAP, you may take the following steps:

1. Review the complete remedial action plan word-by-word

The first thing that you must do is review the remedial action plan thoroughly. Read every word of RAP and try to understand. Specifically, focus on the remediation strategy suggested by the Supervisory Authority. Make a note of the submissions you need to make to the authorities.

Ask the Supervisory Authority for more guidance if you do not understand any part of it. Also, discuss with the AML compliance team and the officer if they are unclear on any topic. The senior management and AML compliance team must understand every plan aspect and discuss the execution amongst themselves.

2. Deliberate over the plan with stakeholders

The compliance team and the relevant manager must have all information on this remedial action plan. So, it would be best if you discussed it with everyone involved in AML compliance tasks. They must know the loopholes and participate in deciding the actions you need to take.

It’s equally critical to discuss the impending changes for employees. To prepare for them, employees must know what changes will come in the processes. They must also learn about their roles in executing these remedial actions and how they can contribute to better AML compliance for the entity.

3. Make a list of the tasks and set priorities

When you review and discuss the remedial action plan with stakeholders, you must list the tasks. You must assess the remedial activities to understand their importance and urgency. Now, list them per their priority.

You can define a strategy, including the tasks, resources required, and time needed. You will be clear on what to do and how long it will take. Thus, you can take a proactive approach to address the serious issues first, followed by the unimportant ones.

4. Form a team focused on the execution of the RAP

Already, you have an AML compliance team handling all the specific tasks related to AML. For RAP, make a special team focusing on implementing the recommendations. The other AML team members must pay attention to the daily AML tasks and activities.

Once you select the remedial action plan execution team members, define their roles. Allocate responsibilities to each to manage every single task mentioned in RAP. Also, ensure the appointment of a manager or auditor who will oversee the quality performance of these tasks.

5. Execute the remedial measures

Once you form the team, you are ready for the actual action. You must manage it quickly and accurately to comply with the RAP before the deadlines. So, start the execution.

Implement each of the actions as mentioned in the RAP. Monitor each action and check the quality of deliverables. Keep assessing the deliverables at every step to ensure compliance with the law and RAP.

6. Maintain enough records and documents

The RAP will need you to submit some reports or documents by a specific date. You must prepare these reports in the required format and structure. Be ready with them for submission to the Authority before the deadline date.

Also, maintain records and documents of each action you have taken per the RAP. You might be asked for them during audits or if the Authority wants to check the compliance with the Remedial Action Plan. Keep track of the deadlines mentioned by the Supervisory Authority, as compliance before that is mandatory.

7. Update the Supervisory Authority on the progress and support needed

You must stay in constant communication with the Supervisory Authority. Regular communication lets you clarify your doubts on any point mentioned in the RAP. You must also update the Authority on the actions taken and the success achieved. The Authority must know the effectiveness of the remedial measures you took. The Compliance Officer and the Senior Management must sign the RAP.

Best Practices to Implement Remedial Action Plan:

Make continuous improvements in AML processes

The remediation strategies mentioned by the Supervisory Authority are an opportunity for you to improve your AML program. You know the usual mistakes you make. Also, you know the expectations of the Authority from you.

So, revamp your AML compliance program. Include steps of constant monitoring and improvement to align with the regulatory expectations. Review the areas with gaps and improve them. Monitor the internal processes and AML controls and tweak them for higher effectiveness.

Thus, the RAP gives you a direction to follow to make your operations AML-compliant.

Conduct training and awareness programs for employees

If you want to have a smooth experience of AML compliance, it is necessary to prepare your employees. They need preparation in terms of:

- Awareness of the importance of AML compliance

- Training on the different tasks to achieve AML compliance

- Change management programs to accept the changes in operations due to new regulatory requirements

You must engage in such awareness and training programs to prepare your employees for the impending changes. They must have the necessary skills and expertise to work on AML compliance processes. They must also be ready for such supervisory engagements of authorities in AML compliance assessments.

Engage in internal audits to check AML compliance

The RAP from the Authority is helpful in understanding the importance of implementing a strong AML/CFT compliance program. Since you didn’t give it a serious thought earlier or lacking in your efforts, you have to face the RAP. So, now you must take a proactive approach to reviewing your AML compliance.

For this, you must engage in regular internal audits. Such audits will reveal where you lack and what areas need improvement. You can implement the corrective actions and be fully compliant with AML regulations.

Implement relevant advanced technology solutions

Technology solutions can be a big help in making your AML compliance a reality. Explore what are the possible uses of technology in AML processes. You can use it in the following:

- Risk assessments

- KYC and CDD

- Transaction monitoring

- Record-keeping and reports

Use solutions for these processes to automate them, leading to more efficiency and accuracy. These systems make your compliance with AML regulations faster and easier.

Seek help from professional AML consultants

Besides all these best practices, one tip that can help you the most is seeking professional assistance. AML compliance is not an easy task. A lot is on your plate to manage and handle, so you can’t achieve AML compliance.

In such a case, the best action to take is to hire a specialist AML consultant. They give a professional touch to your AML compliance procedures. They ensure all your systems, procedures, and internal controls meet the AML requirements. With their expert help, you will not face remedial activities from the authorities.

AMLUAE – your partner for professional AML consulting services

AMLUAE is a leading provider of AML compliance services to clients in different industries. Our offerings include the following:

- Business risk assessments

- Execution of KYC and CDD measures

- Transaction monitoring

- AML training

- Creation of AML framework customized to your business

- Selection of AML software

- Submission of relevant reports to authorities

- Responding to authorities on concerns, submissions, or reviews

- Forming an AML compliance team and appointing an AML compliance officer

- Monitoring of AML policies, procedures, and controls

- Audits of AML operations to suggest corrective actions

- Legal advisory services

We can even help you implement the RAP received from the Supervisory Authority. We understand the requirements of such RAPs and their importance. We review the findings, discuss them with your management, and get down to the real action.

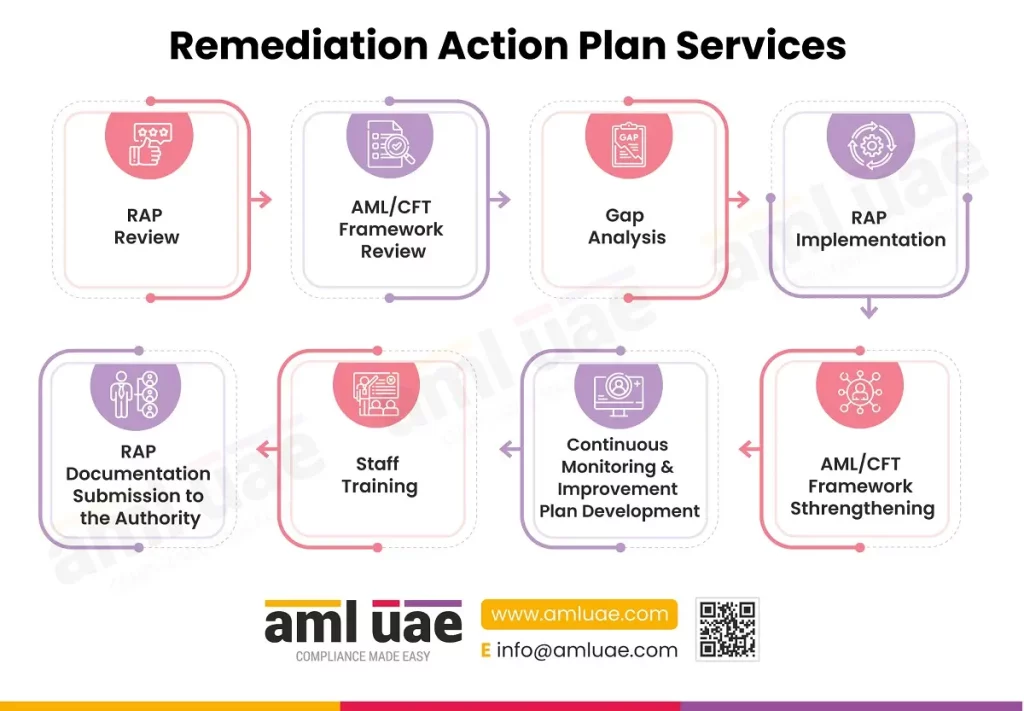

On receiving RAP, our services include the following:

- RAP Review

- AML/CFT Framework Review

- Gap Analysis

- RAP Implementation

- AML/CFT Framework Strengthening

- Continuous Monitoring & Improvement Plan Development

- Staff Training

- RAP Documentation Submission to the Authority

Scared of the consequences of AML non-compliance?

Get started with our AML compliance services now.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.