Three Lines of Defense under AML Program

Three Lines of Defense under AML Program

One of the crucial risk management frameworks for the regulated entities for creating a robust protective shield against financial crime is – Three lines of defense.

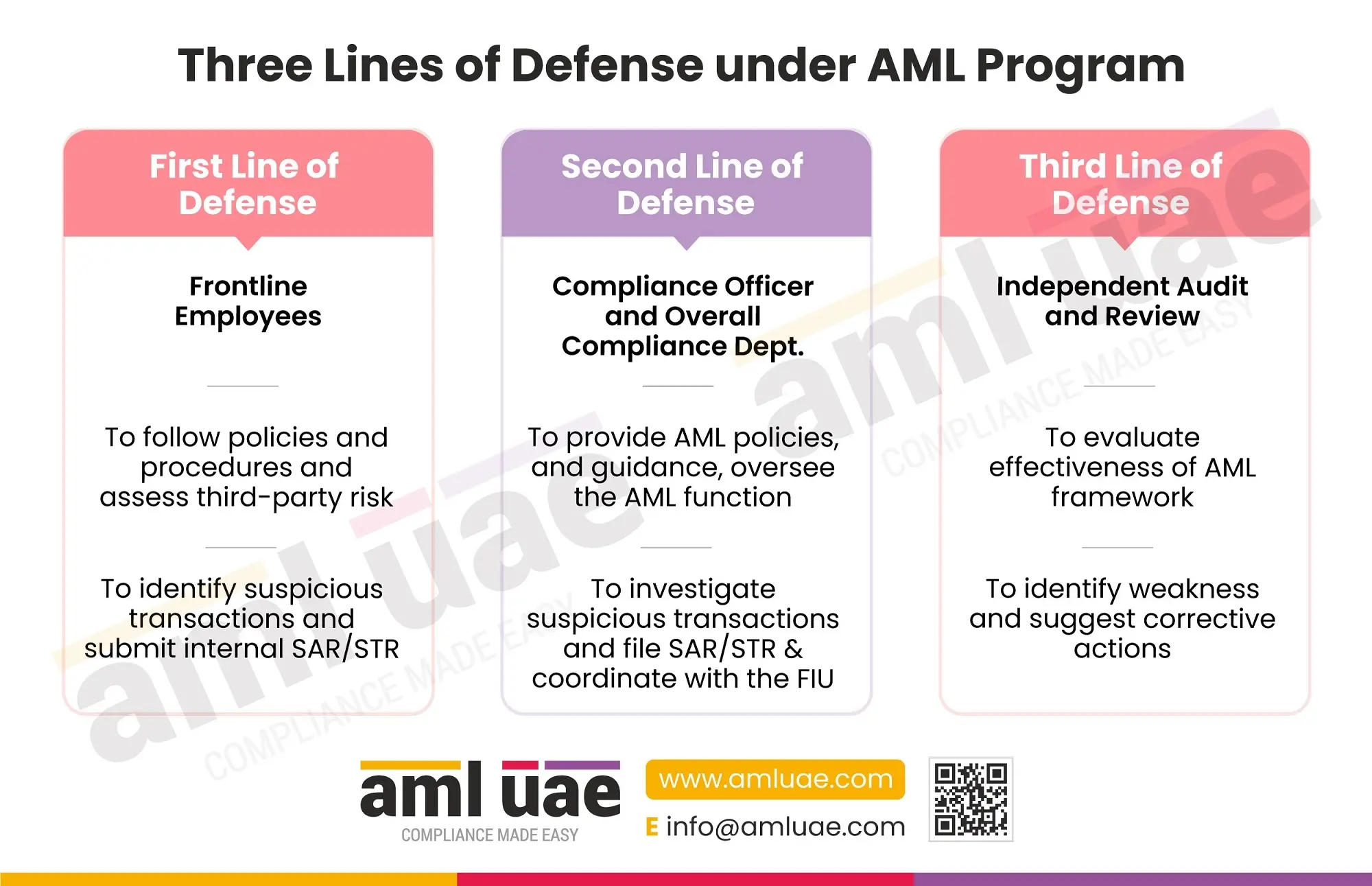

The first line of defense is Frontline employees of the entity who deal with customers and suppliers, engage in service delivery and manage overall customer relations.

The employees of the entity are expected to understand and adhere to the entity’s internal AML/CFT policies, procedures and controls to identify and assess the risk arising from a business relationship or transactions. The employees must know the ML/FT red flags and their role in detecting and reporting suspicious activities or transactions to the Compliance Officer.

As a 1st line of AML defense, the employees must ensure that no financial criminals can penetrate the business to misuse the entity for laundering funds or executing any other financial crime.

The second line of defence is the AML Compliance Officer of the entity, working towards implementing and streamlining the AML measures.

The AML Compliance Officer is responsible for developing the entity’s comprehensive AML/CFT program, aligned with its risk exposure. The AML Policies, Procedures, and Controls must be capable enough to promptly detect and deter the risk indicators and empower the regulated entity to stay AML compliant. Not just restricted to AML framework development function, the officer must ensure that it is well communicated across the organisation, people are trained on the same and oversee its overall implementation.

The AML Compliance Officer is ultimately responsible for reporting the Suspicious Transaction Reports (STR) or Suspicious Activity Reports (SAR). The officer must receive the internal STR/SAR and investigate the same thoroughly to trace down the suspicion related to financial crime, warranting reporting with the Financial Intelligence Unit and accurately reporting the same.

The third line of defense is the Independent AML audit. The critical aspect of the AML structure is an independent AML audit to ensure the quality, relevance and effectiveness of the AML measures implemented by the entity. AML audit provides an unbiased opinion on the entity’s AML program and identifies any gaps or weaknesses requiring immediate redressal for AML compliance and protection against financial crime.

Here is an infographic discussing the three lines of AML defence – an effective financial crime risk management structure.

Partner with AML UAE to develop these shields against financial crimes. We assist you in designing and implementing the AML policies and procedures in coordination with your AML Compliance Officer. We train your team and senior management, ensuring a robust compliance culture across the organization, and everybody comes together to combat money laundering and terrorism financing. We also independently review your AML health and help you strengthen the deficiencies and adhere to AML laws.