Sanctions Compliance Program: Step-by-Step Process to Manage the TFS Risk

Sanctions Compliance Program: Step-by-Step Process to Manage the TFS Risk

The regulated entities in the UAE must implement adequate measures to comply with the Targeted Financial Sanctions (TFS) regime.

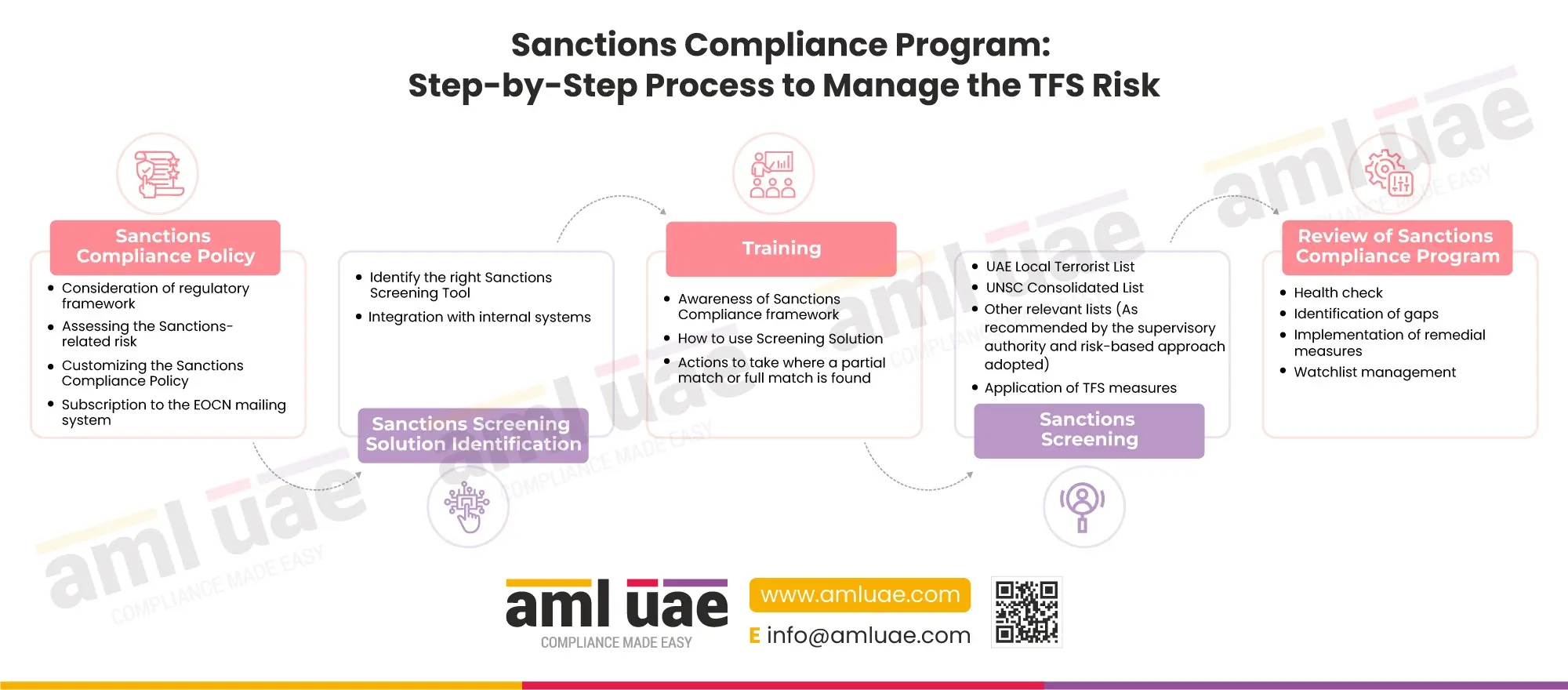

The following are the five core components of a robust TFS implementation program:

1. Sanctions Compliance Policy

The regulated entities must develop a Sanctions Compliance Policy in line with the applicable regulations and the assessed business exposure to TFS risks. During this step, the regulated entities must also subscribe to the EOCN’s Notification system to receive email alerts from EOCN when there is any update in the UAE Local Terrorist List or the UNSC Consolidated List.

2. Identifying the Sanctions Screening Solution

To ensure accuracy and speedy screening of the customers, beneficial owners and other concerned persons, it is crucial to implement the right AML screening tool. The regulated entities must evaluate the alternatives available in the market and identify the right fit for the entity’s Sanctions Compliance Policy. If possible, the solution must be integrated with the entity’s legacy system to ensure seamless data exchange.

3. Training

The Compliance Officer must ensure that the concerned staff in the organization is well trained around the entity’s Sanctions Compliance Program, use of the implemented screening tool, and understand their roles and responsibilities. Sanctions Training is crucial to effectively identify and manage the TFS risk across the business operations.

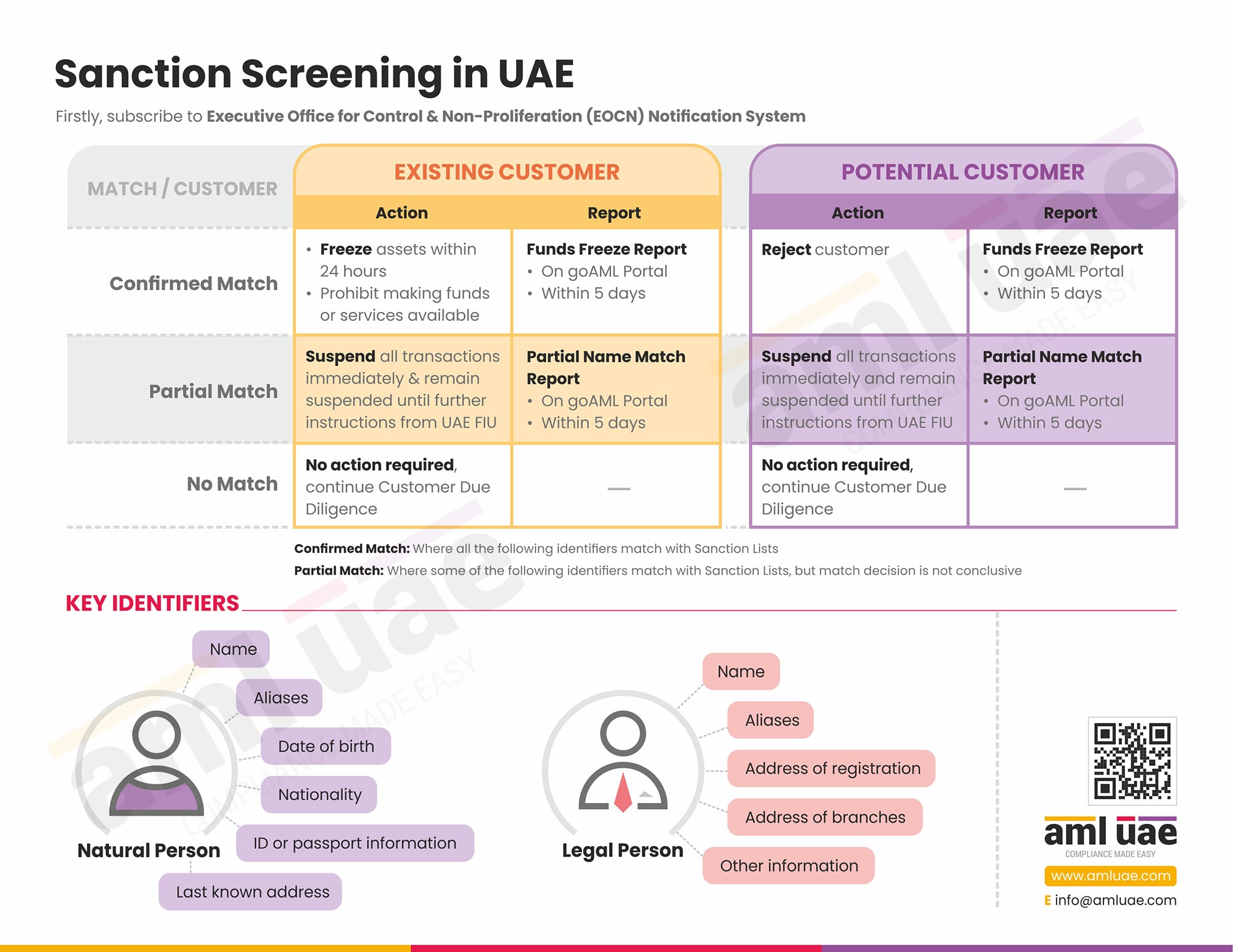

4. Sanctions Screening

All the customers, beneficial owners, etc., must be screened against the UAE Local Terrorist List, UNSC Consolidated List or any other relevant sanctions lists before establishing a business relationship and also on an ongoing basis. Further, in case of any matches identified with the sanctioned individual or organization, the regulated entity must apply required TFS measures like freezing the funds and terminating the business relationship. Further, depending on the nature of the match identified, the entity must file the Fund Freeze Report (FFR) or Partial Name Match Report (PNMR) on the goAML Portal.

5. Review of Sanctions Compliance Program

To maintain the relevance and efficacy of the implemented sanctions compliance program, the regulated entity must periodically review the same to identify any gaps or deficiencies. These gaps must be addressed immediately, and necessary controls or enhanced measures must be deployed. Further, the Compliance Officer must also pay attention to Watchlist Management to ensure the comprehensiveness of the database for screening and reducing the number of false positive hits.

Here is an infographic discussing the stepwise process to implement an effective Targeted Financial Sanctions Program to detect and mitigate the TFS risk.

Let AML UAE, one of the leading AML consultancy firms, assist you with developing a customized TFS Compliance Policy for your business and identifying the proper sanctions screening solution. We can also impart training to the team to ensure compliance with TFS requirements, avoiding any non-compliance consequences.