Entities Subject to AML Compliance in Abu Dhabi Global Market (ADGM)

Entities Subject to AML Compliance in Abu Dhabi Global Market (ADGM)

The ADGM’s Financial Service Regulatory Authority (FSRA) provides for a class of businesses, professions, and entities that must comply with the AML Rulebook or AML Module issued by FSRA to combat money laundering and terrorism financing, while protecting the integrity of the business and of the financial free zone.

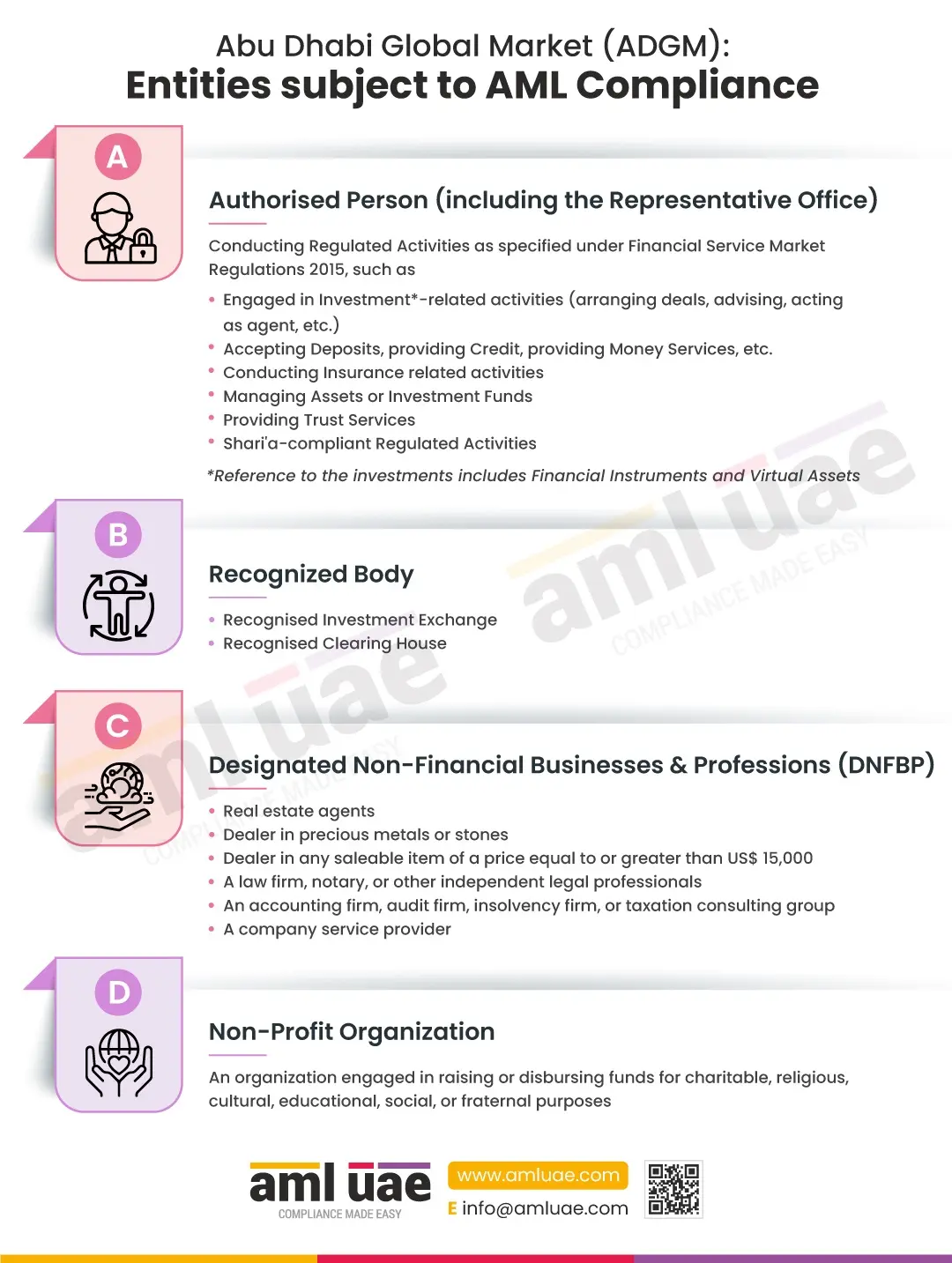

Here is an infographic discussing the entities that are to be considered “Relevant Persons” subject to AML compliance in ADGM, which includes:

Authorised Person (including the Representative Office)

An entity engaged in Regulated Activities as specified under Financial Service Market Regulations 2015, such as Investment (Financial instrument and virtual assets) related activities, acceptance of deposits, providing credit, providing money services, etc. It also covers persons conducting insurance-related activities, managing Assets or Investment Funds on behalf of clients, or providing Trust Services or any other Shari’a-compliant Regulated Activities.

The list of Regulated Activities is captured as a separate infographic.

Recognized Body

A person operating a recognized Investment Exchange or a recognized Clearing House.

Designated Non-Financial Businesses and Professions (DNFBP)

The ADGM AML Rulebook considers the following persons or entities as DNFBPs:

- Real estate agents

- Dealer in precious metals or stones

- Dealer in any saleable item of a price equal to or greater than US$ 15,000

- A law firm, notary, or other independent legal professionals

- An accounting firm, audit firm, insolvency firm, or taxation consulting group

- A company service provider

Non-Profit Organization

NPOs are also subject to AML compliance, which is engaged in raising or disbursing funds for charitable, religious, cultural, educational, social, or fraternal purposes.

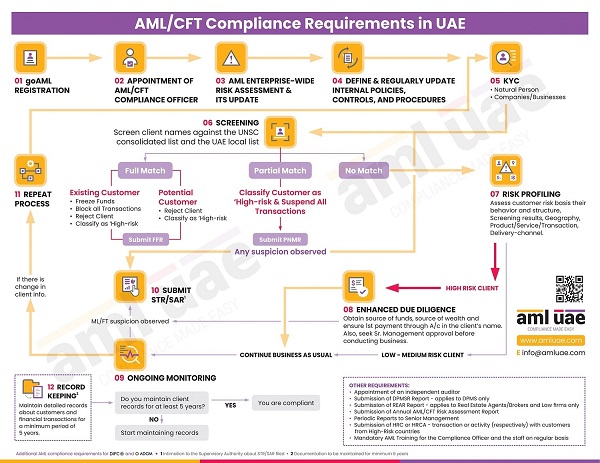

ADGM entities must comply with the FSRA-issued AML Rulebook and Federal AML/CFT laws and regulations and design a robust AML framework to identify and manage financial crime risks.

Let AML UAE assist you in navigating ADGM’s AML regulations and implementing the necessary AML policies and procedures to safeguard the business and stay compliant.