Suspicious Transactions around Precious Metals and Stones: Timely Identification and Reporting

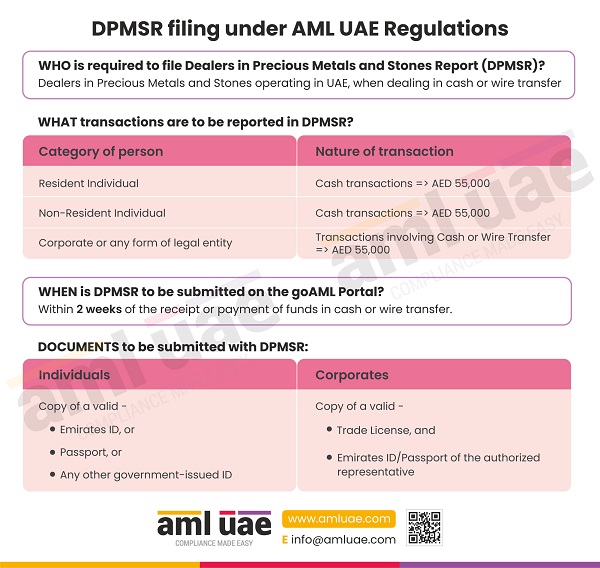

To prevent the misuse of the precious metals and stones sector, the UAE authorities have brought the sector under anti-money laundering regulations. These AML regulations mandate the Dealers in Precious Metals and Stones (DPMS) implement necessary measures and controls to detect unusual transactions and activities appearing as an attempt to launder funds through the sector and immediately report the same to the Financial Intelligence Unit (FIU).

Precious metals like gold, platinum and precious stones such as diamonds and pearls have been common typologies exploited by money launderers to circulate illicit funds through the layers and make it look like they were generated from legitimate sources. Awareness of the anomalies and uncommon activities is critical for the DPMS to spot the red flags promptly and take necessary actions to prevent the laundering of funds through precious metals and stones.

In this article, let us discuss some unusual transactions that trigger an alert, internal and external reporting mechanism, and some of the best practices the dealers in precious metals and stones must adopt.

Identifying the Unusual Transactions involving precious metals and stones

Identifying suspicious transaction patterns is essential for the DPMS to protect their business from being misused for routing illicit money through the precious metals and stones mode. The UAE AML regulations mandate that dealers in precious metals and stones develop and implement a robust monitoring system to detect unusual transaction patterns and customer behaviour inconsistent with their risk profile.

One important aspect of detecting unusual transactions is knowledge of the common methods through which the launderers can exploit the industry. Only when the DPMS is aware of such trends and techniques can they be cautious towards the customer’s buying and selling activities to recognize the financial crime signals. Some of the commonly observed methods to be used by criminals to launder the funds are:

Structuring of transactions

The customer undertakes multiple weekly cash transactions, each valued between AED 50,000 and AED 53,000. This red flag indicates the customer’s intention to avoid the reporting threshold.

Involvement of high-risk jurisdictions

Frequent transactions where payment is released through a bank account located in high-risk jurisdictions.

Inconsistency with the nature of business activities

A corporate customer is making high-value purchases of precious metals with no logical connection with the business activities it is engaged in. For example, a non-profit organization buying diamonds.

Sudden change in the volume and value of transactions

A regular customer (in the case of a B2B business relationship) suddenly purchases double the value it has typically been undertaking without any economic rationale.

Abnormal customer requests for precious metal conversion

The customer makes an unusual request to convert precious metals like gold into ordinary objects to disguise the identification of gold.

Series of transactions in different names

The same person carrying out multiple transactions involving the purchase of precious metals furnishing different identity documents claimed to be close relatives. Though appearing genuine initially, it is a red flag suggesting an attempt to launder huge cash with forged IDs and fake names.

Mismatch in the transaction value and the customer’s financial profile

A customer makes transactions worth value beyond the ordinary means of the customer, as identified by a review of the customer’s financial document.

With awareness of the gaps comes the approach to staying vigilant to detect unusual transactions and prevent money laundering and terrorist financing.

Reporting of Suspicious Transactions involving precious metals and stones

The AML regulations in UAE provide that the regulated entities, including the dealer in precious metals and stones, must report the identified red flags to the Financial Intelligence Unit without any delay. To comply with this regulatory reporting requirement, the DPMS must adopt a thorough and systemic approach, following the below steps:

1. Preliminary inquiry to determine the nature of suspicion

Once the frontline employee, upon detection of any unusual activity or risk indicator, must make further inquiry into the matter. This inquiry may involve reviewing the customer’s profile, past transaction history, etc. If required, the employee may seek clarification or further details from the customer, but subject to compliance with the “non-tipping off” requirement.

The employees must evaluate the matter diligently to avoid sending unnecessary reports to the AML Compliance Officer, which, upon preliminary investigation, turns out to be genuine and legitimate activity.

2. Intimation to the AML Compliance Officer

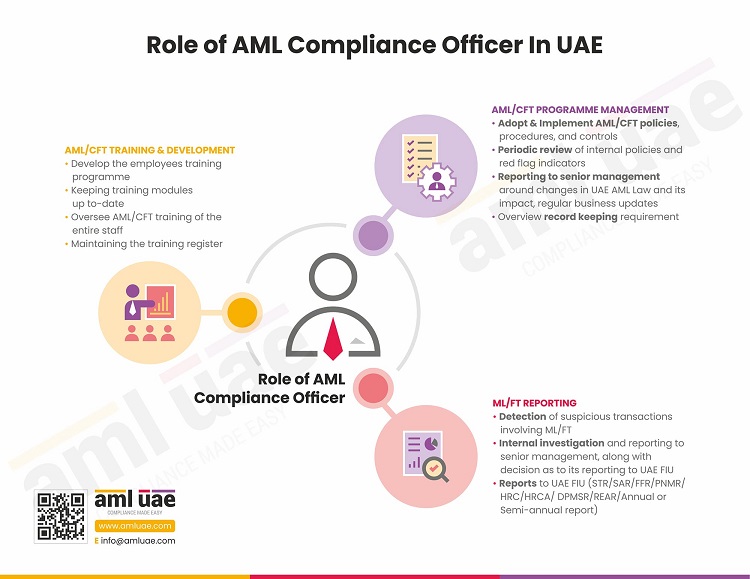

If the employee has reasonable grounds to believe that the suspicion still prevails even after investigation and requires escalation to the AML Compliance Officer for further investigation, it must intimate the matter to the AML Compliance Officer. Such reporting or intimation to the Compliance Officer must be in writing, capturing the necessary details about the transaction, why the employee considers the subject activity or transaction suspicious, parties involved, and other details and documents necessary for the Compliance Officer to investigate the suspicion further.

3. Independent investigation by the AML Compliance Officer

Upon receipt of the internal report on observed suspicion from the employees, the AML Compliance Officer must attend to the matter immediately and independently review the facts to determine the legitimacy of the suspicion and the suspected transaction/activity. The investigation’s basis and the review’s outcome must be well documented. If the Compliance Officer believes that the transaction or activity is suspected of involving money laundering or terrorism financing, the reporting shall be done with the FIU by filing the Suspicious Transaction Report (STR) or Suspicious Activity Report (SAR), as the case may be.

However, if the Compliance Officer is of the view that the transaction is genuine and does not involve any proceeds of crime, then such a decision must be recorded along with the rationale for the same.

4. Reporting the suspicion to the Financial Intelligence Unit (FIU)

Having determined the suspicion, the AML Compliance Officer, also known as the Money Laundering Reporting Officer, must immediately file the relevant report to the FIU, furnishing information about the parties suspected, the nature and value of the transaction, red flags observed, action taken by the authorities, etc.

Following a robust and systematic reporting mechanism, the DPMS can ensure timely and quality reporting of suspicious situations to the FIU.

Best Practices to avoid exploitation of precious metals and stones for financial crime

For effectively handling the identification and reporting of unusual transactions, here are a few best practices the dealers in precious metals and stones must adopt:

Adequately documenting the red flags

To assist the employees in understanding the unusual transaction patterns and detect the risk indicators, it is recommended that the DPMS have a list of red flags relevant to the business and circular amongst the team. With a list of potential risk indicators handy, identifying unusual transactions and evaluating the same to confirm the suspicion becomes quick and efficient.

Implementing tools and technology

When the number of customers visiting the jewellery showroom and the volume of transactions is too huge, deploying the right tools and software always proves to be the backbone of AML compliance. The emerging technologies, having data analytics capabilities, can review the transactions in real time, detect the patterns and trends that appear uncommon for the business, and generate alerts for the team to review further.

This will filter out the false positive alerts, allowing the team to focus more on the disposition of the genuine red flags.

Staying updated on the emerging trends and ML/FT typologies

The AML Compliance Officer of the DPMS must stay up-to-date on the evolving ways criminals could exploit the precious metals and stones industry. This knowledge would be crucial to proactively implement the necessary controls to detect such attempts and prevent business exploitation through innovative laundering methods.

Designing internal SAR/STR forms

To ensure accurate and comprehensive reporting, the DPMS must design internal STR/SAR forms. This shall ensure consistency in the details furnished by the frontline employees to the Compliance Officer without missing any critical information.

Furnishing complete and accurate details to the FIU

The AML Compliance Officer must ensure that the report filed with FIU has relevant, complete, and accurate information, which helps the FIU to analyze the possibility of money laundering or terrorism financing and make sure that necessary actions are initiated against the culprit.

Moreover, the Compliance Officer should avoid unnecessarily flooding the FIU with false alerts, reported just for the sake of reporting without diving into the actual nature of suspicion.

Conducting necessary training

Training is pivotal to imbibing a sense of awareness in the team toward identifying and handling unusual transactions. Adequate training on suspicion transactions promotes employee accountability, enabling them to detect and respond to the observed red flags effectively. Education around the internal reporting mechanism must be ensured to empower the team to manage the internal suspicious reporting requirement skillfully.

Let AML UAE assist the DPMS sector in timely detecting and reporting suspicious activities!

A thorough understanding of the red flags and awareness of its reporting process is fundamental in detecting and reporting suspicious transactions. With our team of professionals at AML UAE, we assist the dealers in precious metals and stones in UAE in designing the AML framework, including the list of sector and business-specific ML/FT typologies, and developing the standard reporting system to help the team in timely and accurately reporting the observed red flags to the AML Compliance Officer. We also impart training to the team on identifying and reporting suspicious transactions discussing case studies to bring a practical aspect to the learning.

Let’s unite to maintain the integrity of the precious metals and stones segment!

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 6 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.