Counting on Compliance: The Vital Role of Accounting in AML

With growing instances of money laundering and terrorist financing, the UAE AML laws are evolving, imposing more regulatory compliance and reporting obligations upon the regulated entities to combat these crimes. To abide by the AML compliance and reporting requirements, the regulated entities – be it a Financial Institution, Virtual Asset Service Provider (VASP), or Designated Non-Financial Business and Profession (DNFBP), the need for a transparent, accurate, and comprehensive accounting of the business activities cannot be overlooked.

In this article, we shall explore why accounting is so significant in implementing the AML program efficiently and the intersection of the accounting and AML framework.

Intersection and Significance of Accounting in the AML Program

Accurate and complete accounting is crucial to detecting and combating financial crime and staying compliant with regulatory reporting. Here are some of the critical points where the alignment of AML compliance and the accounting function must be ensured:

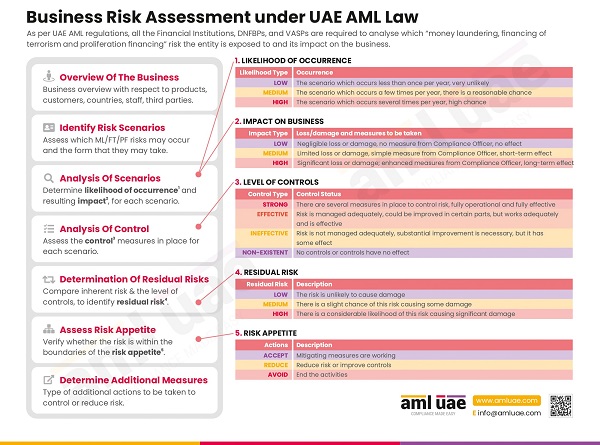

Business Risk Assessment

The UAE AML regulations mandate the regulated entities to periodically conduct the Enterprise-Wide Risk Assessment to identify and evaluate the financial crime risk the business is vulnerable to. For assessing the risk, the regulated must rely on the qualitative and quantitative parameters impacting their business. The “quantitative” aspect of the risk assessment reflects the entity’s historical information, such as instances where any high-risk indicators or red flags were observed. For this, the regulated entities generally refer back to their business trends for the previous years. This is not possible unless the records and details are appropriately accounted for in the company’s books of accounts.

The quality and relevance of the business risk assessment are highly dependent upon the quality and accuracy of the data used for performing the risk assessment. Thus, the primary step of assessing the ML/FT risk cannot be concluded satisfactorily if the accounting function of the entity is flawed.

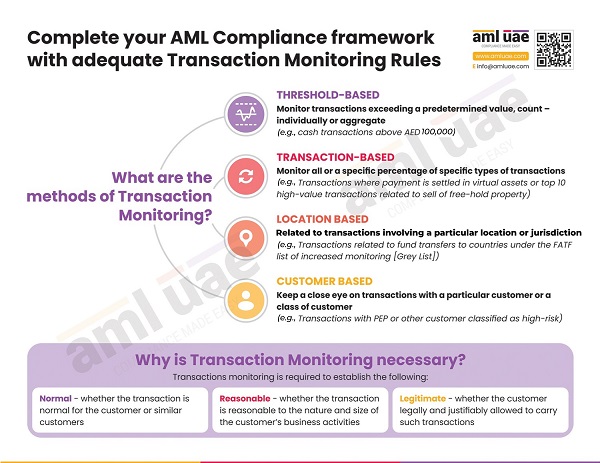

Transaction Monitoring

One more obligation imposed upon the regulated entities is to develop and maintain a robust ongoing transaction monitoring program, having adequate controls in place to detect unusual patterns suggesting a connection with money laundering or terrorism financing. The essential requirement of an effective Transaction monitoring program is to have an appropriate data source covering the complete and up-to-date details about the transactions executed by various customers of the regulated entity. The data must be comprehensive regarding purchase, sale, deposit, withdrawal, payments, receipts, time, party, location, value, etc.

This need to have the correct data source on which the monitoring rules and logic shall be applied depends on the entity’s accounting functions. Only if the business’s financial transactions are correctly recorded can such transactional data be made available to the Transaction Monitoring system to analyze and identify the red flags.

Regulatory compliance and reporting requirements

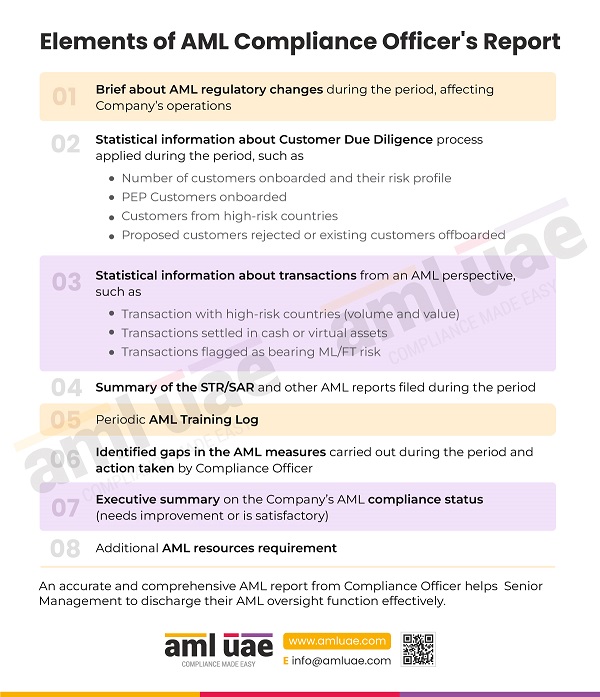

Periodic AML report from the Compliance Officer to the senior management

The AML Compliance Officer of the regulated entities is required to prepare and furnish a periodic AML report to the senior management, providing an update on the entity’s compliance status. This update must include the critical business statistics around the number of transactions with high-risk customers, transactions where payment is received in cash, transactions involving high-risk jurisdictions, etc. This is possible only when the AML Compliance Officer has access to the transactional records, properly accounted for with necessary details.

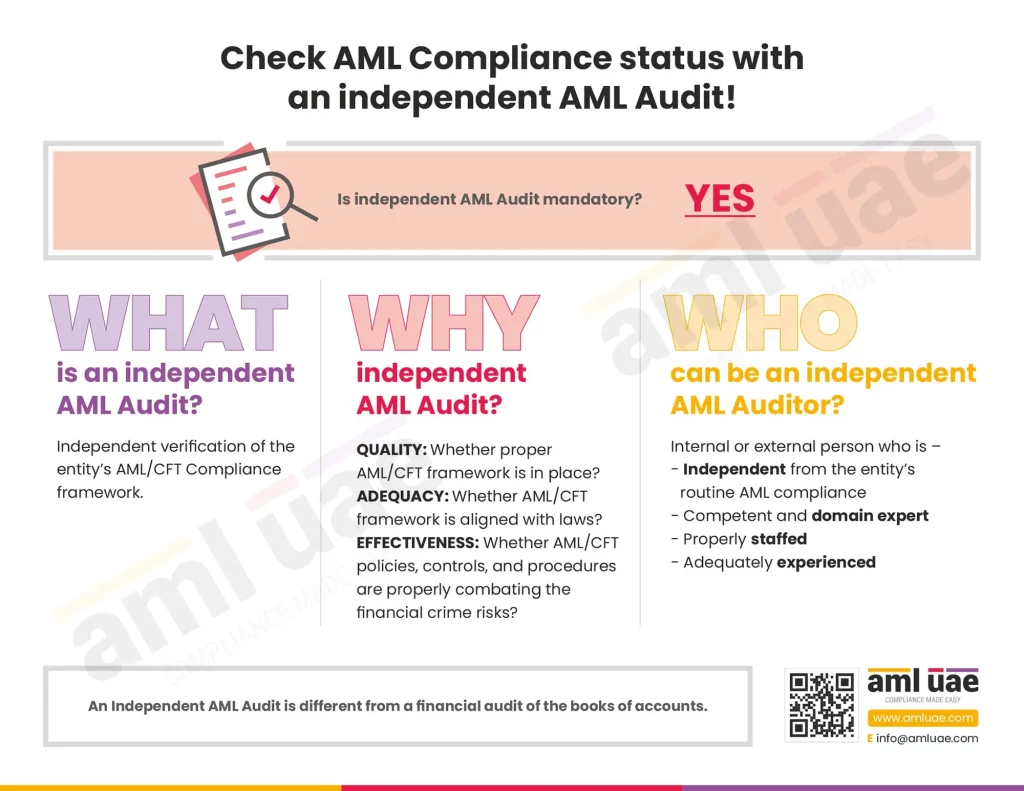

AML Audit

The regulated entities in the UAE must have an independent AML Audit function in place to test the status and adequacy of the entity’s compliance with regulatory requirements. Performing an AML audit is impossible without having proper records to check on which the auditor can provide its opinion. Thus, fulfilling the AML audit requirement would be faulty in the absence of proper accounting.

AML Surveys

The AML Supervisory Authorities in UAE often issue surveys to the regulated entities, requesting for sharing the details about the value and volumes of specified categories of transactions. It is pertinent to adhere to this survey request and furnish accurate and complete information to the authorities. Again, without having done adequate and timely accounting, retrieving the required data and ensuring its validity would always be a challenge.

AML Recording Keeping requirement

Further, the AML laws require the regulated entities to maintain the AML records for a minimum period of 5 years from the transaction’s completion date or the end of the business relationship, whichever is later. The details and information to be maintained under AML must include the transaction details capturing the nature of the transaction, date, and value of the transaction, parties involved, mode of payment, reference to connected transactions, etc. The financial records must be maintained in a way that can be promptly furnished to the authorities when requested, allowing them to review the entity’s compliance efforts and its authenticity.

This AML Documentation requirement can only be achieved when the entities appropriately account for the transactions executed both ways – inward and outward supplies, including receipts, payments, withdrawals, etc.

Best practices for leveraging the benefits of accounting to AML compliance

The following practices shall prove to help accelerate the AML compliance program with the assistance of the accounting function:

AML training to the accountants

Accountants are well-versed in the study and analysis of financial data, enabling them to detect unusual financial transactions, gaps around the cash flows, or inconsistencies in the working capital cycle of the business.

With ready access to the financial data, they can strongly support the entity’s transaction monitoring program. The accounting team must be trained around the AML framework, internal procedures and controls, and intricacies of the ongoing monitoring rules and logic. When accountants review the transactions, they can quickly evaluate for the possibility of any anomalies and promptly notify the red flags identified. When the accounting brains back the robust monitoring program, malicious transactions can be uncovered effectively. They can scrutinize the transactions to detect any structuring arrangement to avoid the reporting threshold or unexpected change in the customer’s transactional pattern.

Further, accountants generally understand the business’s possible risk exposure and define the required controls. When accountants understand AML requirements and the financial crime vulnerabilities, the controls proposed by the accountants would be wholesome and capable of managing the overall business risk, including the money laundering and terrorism financing risk.

Integrating the AML systems with accounting systems

A regulated entity needs to have a seamless connection between the AML systems, such as customer screening and transaction monitoring, with the accounting tools used by the business. This integration will ensure that the complete data maintained from the financial records perspective is made available to the AML systems in real-time, permitting timely review of the transactions and business relationships and curbing potential financial crime attempts.

Further, the integrated systems should handle the generation of intelligent MIS reports and business-AML analytics that serve as a base for the AML Compliance Officer to check the overall quality of the AML controls and procedures and prepare necessary reports required to be furnished to the internal reporting authorities or external AML authorities.

Collaboration between the accounting team and the AML Compliance Officer

The AML Compliance Officer must proactively communicate and collaborate with the accountants to design and develop comprehensive and integrated controls and processes for AML compliance.

Allow AML UAE to uphold the potential of your accounting function for the benefit of AML compliance

Financial accountability and transparency are of utmost significance in all aspects of business, including AML compliance. AML UAE has a team of professionals from accountancy backgrounds with vast experience in AML compliance who can assist you in combining the accounting and AML functions to optimally utilize accounting to foster AML compliance and prevention of money laundering and terrorism financing. We can help you design standard controls and risk mitigation measures, adequately meeting your compliance and accounting needs and training the team of accountants, empowering them to contribute to the entity’s AML efforts.

Let’s make the most of the accounting team in the course of AML compliance.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 6 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.