DNFBPs subject to AML Compliance in the UAE

DNFBPs subject to AML Compliance in the UAE

With increasing financial crime worldwide, the AML/CFT regulations are getting more stringent, bringing in more businesses and professions to identify and prevent money laundering and terrorism financing instances. The AML regulatory landscape in the UAE covers the Designated Non-Financial Businesses and Professions (DNFBPs) directly or indirectly associated with ML/FT typologies or whose professional assistance the criminals generally seek.

The following DNFBPs are covered under the purview of AML Compliance under the UAE AML regulations:

– Real Estate Brokers and Agents

– Dealers in Precious Metals and Stones (DPMS)

– Trust and Company Service Providers (TCSP)

– Lawyers, Notaries, and other legal professionals, and

– Auditors and Independent Accountants

These DNFBPs must adopt a comprehensive AML/CFT framework to identify and manage financial crime risks. This includes developing and maintaining AML/CFT policies and procedures, appointing an AML Compliance Officer, conducting an adequate Customer Due Diligence process before establishing a business relationship with a customer, complying with Targeted Financial Sanctions regime, imparting AML training to the staff, and maintaining strong AML compliance culture in the organization.

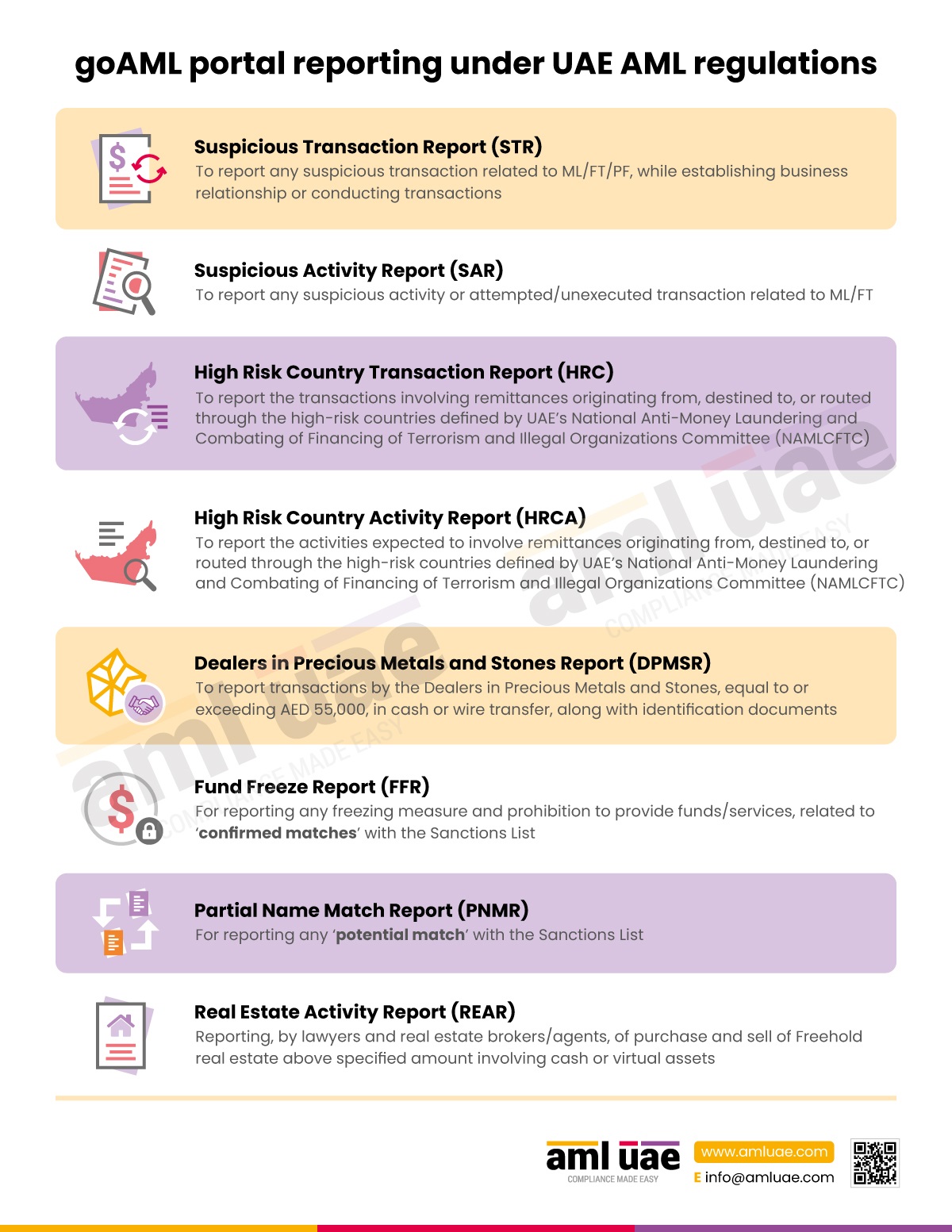

The above infographic discusses the designated businesses and professionals qualifying as DNFBPs under UAE AML laws and subject to the AML compliance regime.

AML UAE is the one-stop solution for end-to-end AML consultancy services for DNFBPs in UAE. We assist the DNFBPs in conducting the Enterprise-Wide Risk Assessment and designing the customized AML Compliance Program to manage the assessed business risk. We impart comprehensive AML training to the AML Compliance Officer and the team to ensure the effective implementation of the AML measures.

Let’s fight financial crime!