Checklist for implementing an effective AML Program

Checklist for implementing an effective AML Program

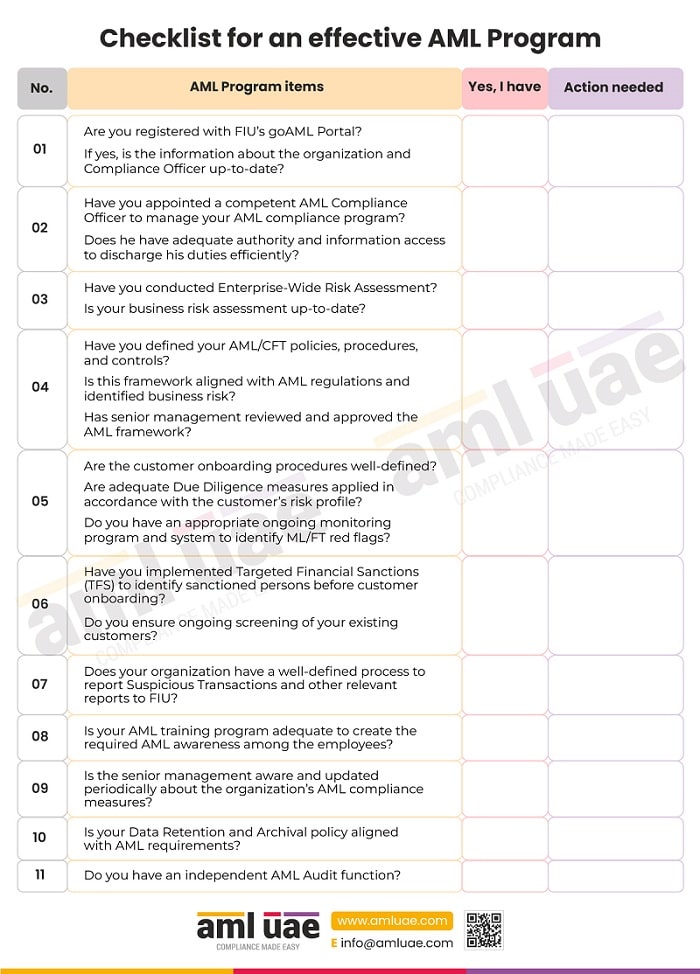

The UAE AML regulations require the regulated entities – Financial Institutions, Virtual Asset Service Providers (VASPs), and Designated Non-Financial Businesses and Professions (DNFBPs) to establish and maintain a robust AML Program, focusing on the identification and mitigation of financial crime risks.

An ideal AML program must begin with adequate licensing and registration with the concerned authorities, including registration with the FIU’s goAML portal and appointing a competent AML Compliance Officer.

Further, the AML program should be aligned with the Enterprise-Wide Risk Assessment, and thus, the organization must ensure that its overall business risk assessment is up-to-date. The AML Program must include comprehensive AML Policies, Procedures, and Controls defined in accordance with the applicable AML regulations, adequate Customer Due Diligence processes, including methodology for conducting customer risk assessment, ensuring sanctions compliance, and applying Enhanced Due Diligence measures when dealing with high-risk customer or high-risk transactions.

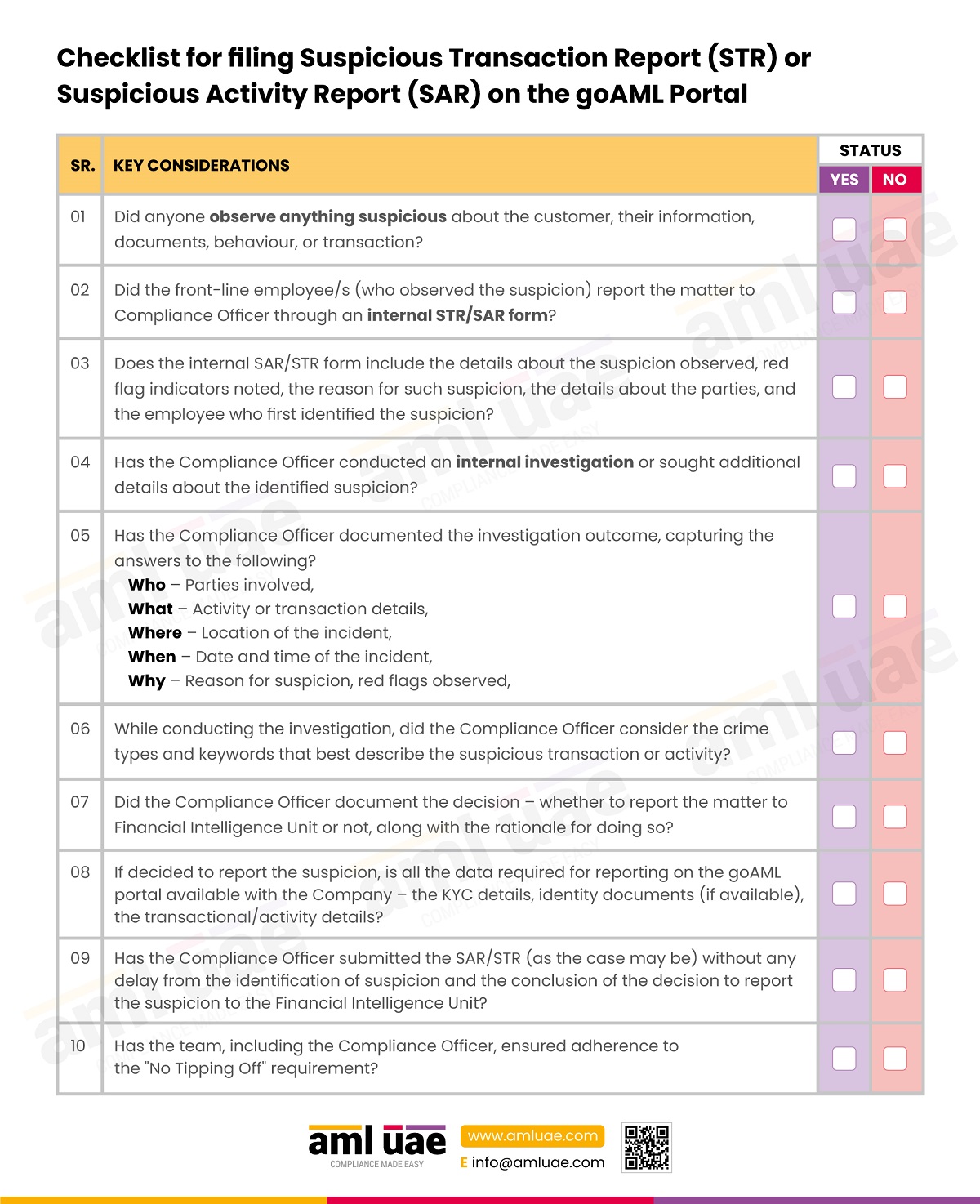

Internal processes and systems for identification of the ML/FT red flags and their reporting (internal intimation to the AML Compliance Officer and the external reporting to FIU) must also form part of the overall AML Program.

AML governance structure should also be well-defined in the AML program – the AML Compliance Officer’s reporting to senior management, AML training program, implementation of independent AML audit function, etc.

With this checklist, assess the effectiveness of your AML Program and identify the area that needs immediate action to strengthen the same.

AML UAE, a leading AML Consultancy firm in UAE, is at your service to improvise your AML Program’s quality and relevance to identify and manage financial crime risks. We assist regulated entities in assessing the overall ML/FT risk exposure and customize the AML Program – Policies, Procedures, and Controls to mitigate these risks.