Role of an AML Compliance Officer in a real estate agent or brokerage firm in UAE

Real Estate is considered one of the typologies criminals exploit to launder illicit money. Thus, UAE AML regulations have included the real estate agents and brokers under the ambit of Designated Non-Financial Businesses and Professions (DNFBPs), required to adhere to an anti-money laundering framework, including the appointment of an AML Compliance Officer to oversee the implementation of AML measures and identify the money laundering instances.

In this article, we will explore the functions of an AML Compliance Officer in a real estate agent or brokerage firm and their significance in combating financial crime from the UAE real estate sector.

Understanding AML Compliance in the real estate sector

Certain business organizations have been entrusted with identifying, preventing, and reporting instances of money laundering and the financing of terrorism. In this context, the procedures and controls adopted by these organizations to mitigate the financial crime risks would be treated as AML Compliance.

AML compliance involves designing and implementing internal AML/CFT policies, procedures, systems, and controls to manage the money laundering risks, implementing the Customer Due Diligence process and ongoing monitoring program to identify and report suspicious transactions, training the relevant staff to create AML awareness, etc.

AML compliance for real estate agents and brokers will help ensure that the sector is not exploited or misused by criminals to place the proceeds of illegal activities. Real estate agents or brokerage firms’ efforts and commitment towards AML compliance will promote the reputation and attract responsible buyers and sellers engaging with the real estate brokerage firm.

AML non-compliance by real estate agents and brokers in UAE can result in reputational damage and hefty administrative fines.

Real estate agents and brokerage firms in UAE must understand their AML compliance obligations and appoint a competent AML Compliance Officer to stay AML compliant and safeguard businesses against financial crime.

The Role of an AML Compliance Officer to combat money laundering in the real estate sector

As one of the DNFBPs under UAE AML regulations, the real estate agents and brokers must comply with the UAE AML regulations and implement necessary measures to protect the firm from being exploited by the money launderers. To oversee the effective implementation of the AML/CFT framework across the firm, the law mandates appointing a designated person to act as an AML Compliance Officer.

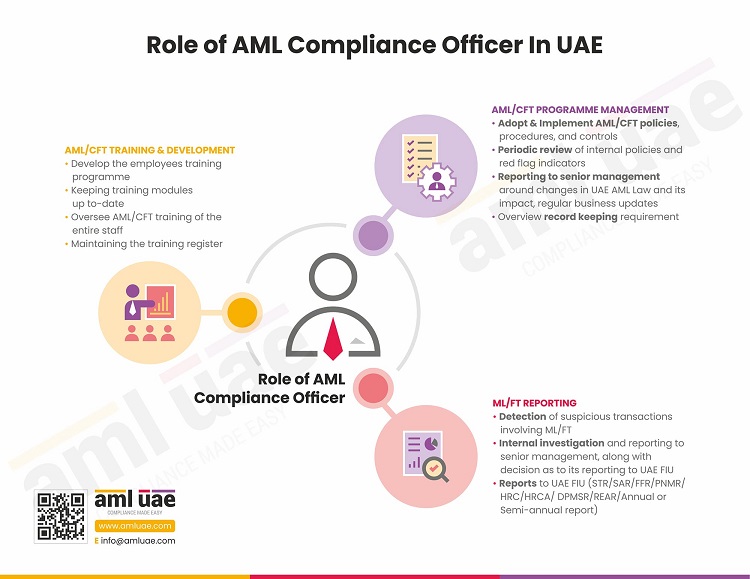

The primary role of the AML Compliance Officer would include the following:

– The Compliance Officer must conduct the Enterprise-Wide Risk Assessment to identify and evaluate the company’s possible ML/FT risk exposure. This risk assessment must be aligned with the management-approved risk appetite. It must consider the relevant risk factors, such as the nature of buyers and sellers the company is associated with, the geographies of its operations, the nature of properties involved, the complexity of the transactions, delivery channels used, etc.

The outcome of the EWRA or the overall business risk assessment shall help the AML Compliance Officer understand the AML/CFT measures required to safeguard the company.

– The Compliance Officer (CO) must establish and implement comprehensive internal AML/CFT policies, procedures, and controls customized to its business operations and the assessed risk. The policies must consider the relevant AML regulations, including the specific guidelines, e.g., the Ministry of Economy’s supplemental guidance on AML/CFT for the real estate sector. The CO must periodically review and update the AML/CFT policies and procedures to ensure their relevance and effectiveness.

– CO is also responsible for ensuring that the company follows robust Customer Due Diligence measures before establishing any business relationship with a customer (whether a buyer, seller, property developer, lessor, or lessee). This should also include designing Know Your Customer forms and implementing adequate customer risk assessment methodology to determine the risk each customer poses to the company’s real estate brokerage business.

CO should also ensure that the company has deployed necessary systems and tools to conduct timely screening of the customers, to comply with sanctions screening requirements and determine whether the customer is a Politically Exposed Person (PEP) or has any adverse media against the person, suggesting involvement in any criminal activities.

In case of customer is identified as high-risk, Compliance Officer must ensure that Enhanced Due Diligence measures are applied to manage the increased ML/FT risk, including additional checks and verification related to the customer’s identity, source of their funds and wealth, etc.

– Ongoing monitoring is one of the essential aspects of overall AML compliance. The Compliance Officer must implement adequate systems and procedures to identify suspicious activities and monitor transactions and business relationships.

– The CO is, also known as a Money Laundering Reporting Officer (MLRO), responsible for accurate and timely reporting of suspicious activities and transactions with UAE’s Financial Intelligence Unit (FIU).

– Apart from filing Suspicious Activity Report (SAR) and Suspicious Transaction Report (STR), the AML Compliance Officer of the real estate broker is accountable for the following additional reporting:

- Filing of the Real Estate Activity Report (REAR) on the goAML portal, furnishing details of the designated transactions related to the purchase/sale of Freehold real estate property,

- Preparing and submitting a periodic AML/CFT report to the company’s senior management, giving updates on the AML measures applied during the period, any red flags observed, any reports field with FIU, any additional requirements for AML resources, etc.,

- Submitting relevant information and documents to the supervisory authority when requested.

– One other essential function of the Compliance Officer is to develop the AML training program for the company’s employees, including the senior management, to create awareness around the AML program and promote strong compliance culture.

– Along with AML/CFT measures, the Compliance Officer must consider compliance with Targeted Financial Sanctions. This will include screening the relevant sanctions list and, if any matches are found, applying adequate TFS measures and reporting it to the Executive Officer for Control and Non-Proliferation (EOCN) by filing Fund Freeze Report (FFR) or Partial Name Match Report (PNMR) on the goAML Portal.

– The AML Compliance Officer is responsible for ensuring the maintenance of AML/CFT records and information in an organized manner for a minimum period of five (5) years from the end of the business relationship or transaction. However, the period threshold is six (6) years for the real estate agents and brokers operating in or from ADGM’s Financial Service Regulatory Authority (FSRA) or DIFC’s Dubai Financial Service Authority (DFSA).

Must have Skills and Qualifications for an AML Compliance Officer

To ensure the effective implementation of the entire AML compliance program in the real estate agent or brokerage firm and protect the business from being vulnerable to financial criminals, the firms must appoint a competent AML Compliance Officer having adequate seniority and independence.

The functions entrusted to an AML Compliance Officer require technical expertise, subject and business knowledge, analytical skills, and a commitment to AML compliance.

The Compliance Officer is expected to have the following skill sets:

- Thorough knowledge and understanding of the relevant AML regulations applicable to the real estate sector,

- An analytical skills to detect and evaluate the ML/FT red flags,

- Communication skills to collaborate with staff, open communication with senior management and supervisory authority,

- Attention to detail to promptly identify any unusual patterns or transactions indicating financial crime or involvement of criminal proceeds and accurately reporting the suspicious transactions to the FIU,

- Professionalism and integrity are essential qualities for an AML Compliance Officer to ensure an unbiased approach towards AML compliance and avoid any conflict of interest between compliance and business.

Smoothening the functions of the AML Compliance Officer with adequate technology

with the help of emerging technology, the Compliance Officer can optimize the real estate broker’s compliance function to ensure timely detection of ML/FT risk indicators and stay 100% AML compliant.

AML Compliance Officer of a real estate agent or brokerage firm can implement developing tools and systems to automate the customer onboarding process, starting from buyer and seller identification, ID verification, liveness checks, real-time screening against sanctions, PEP, or adverse media, etc.

Further, artificial intelligence-based solutions can assess customer risk and monitor transactions and customer profiles. This ensures prompt alert generation for high-risk customers, unusual trends, or suspicious customer behavior.

Embracing developing technology and tools would ease the responsibilities and improve the effectiveness of the AML/CFT measures developed and maintained by the Compliance Officer in the real estate agent or brokerage firm in UAE by reducing the manual errors, and identification of potential ML/FT risks to curb the vice on a timely basis.

How can AML UAE assist the AML Compliance Officers of the UAE real estate agents and brokers to navigate the AML Compliance journey?

The role of an AML Compliance Officer in a real estate agent or brokerage firm in the UAE is critical to safeguard the real estate sector from being misused by criminals to route their dirty money.

AML UAE is a leading AML consultancy firm in the UAE. AML UAE can strengthen the efforts of the AML Compliance Officer by assisting in assessing the real estate agents and brokers’ ML/FT risk exposure and tailoring the internal AML/CFT policies, procedures, and controls to identify and report suspicious transactions.

We can also impart comprehensive AML training to the Compliance Officer and the staff, including senior management of the real estate brokers and agents, to promote collaborative attempts in the fight against financial crime. With our assistance in identifying and implementing the right AML technology and solutions, AML Compliance Officer can enhance the effectiveness of the compliance processes and efficiently identify potential ML/FT risks.

Stay AML Compliant!

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.