Identity Verification for Partnership Firms: Navigating the essential element of customer onboarding under UAE AML Law

UAE has introduced stringent regulations to combat financial crimes such as money laundering and terrorist financing. These laws mandate that Financial Institutions, Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Asset Service Providers (VASPs) implement adequate frameworks within the organization to identify and prevent money laundering and terrorism financing instances.

Identifying the customers and verifying their identity is essential to the AML compliance program. The regulated entities must apply thorough identity verification measures when dealing with a partnership firm, not just individual customers.

In this article, we will discuss the critical elements of the identity verification process under UAE AML regulations when establishing a business relationship with a partnership firm.

Why are partnership firms vulnerable to financial crime?

A partnership firm is a legal structure owned and managed by individual persons. Sometimes, the legal identity of the partnership firm is exploited by criminals to conduct money laundering or terrorism financing, concealing their identity under cover of the partnership firm.

Further, setting up a partnership firm is relatively simple and quick, making it more vulnerable to financial crime risks and used as a money laundering technique to disguise the actual ownership of illegally obtained proceeds.

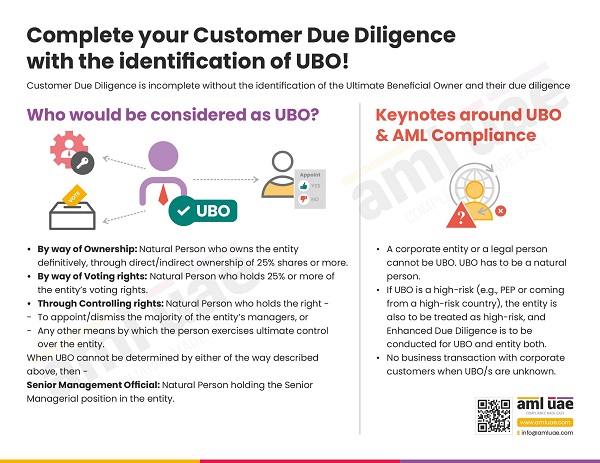

Given this, the UAE AML regulations mandate that when conducting a business transaction with a partnership firm, the firm’s identity, including the identity of the Ultimate Beneficial Owners (UBO) and the controlling parties, must be obtained and verified using reliable, independent documents, or sources. This measure shall help uncover the bogus firms established to execute financial crimes.

What is Customer Due Diligence under AML regulations?

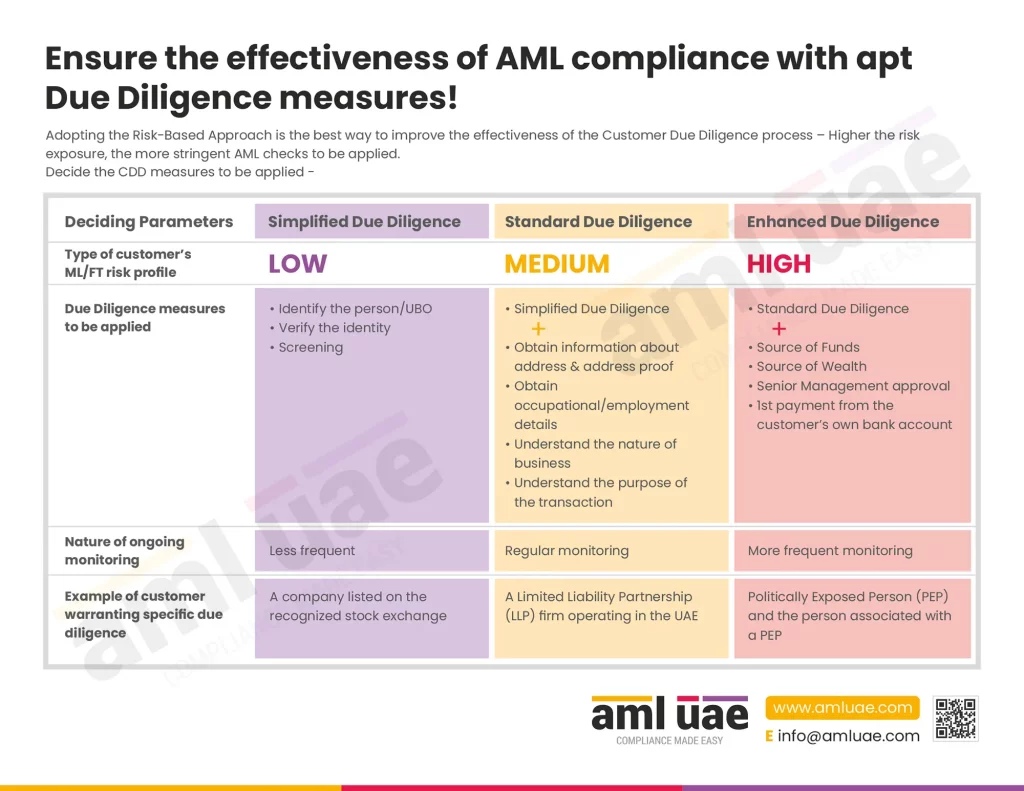

Customer Due Diligence (CDD) is a process of identifying the customer or supplier or any third party with whom the business transactions are to be conducted and verifying their identity to determine the legitimacy, including assessing the ML/FT risk the customer poses to the business.

How to ensure adequate identity verification for Partnership Firms?

When establishing a business relationship with a partnership firm, it is very pertinent to understand the firm and its true owners or controllers managing the firm’s business. It is necessary to ensure that the regulated organization is not unknowingly exploited by the partners of the firm for money laundering or other illegal activities.

To ensure adequate identity verification of a partnership firm, the following measures must be followed:

Obtain identification details, including other necessary information and documents

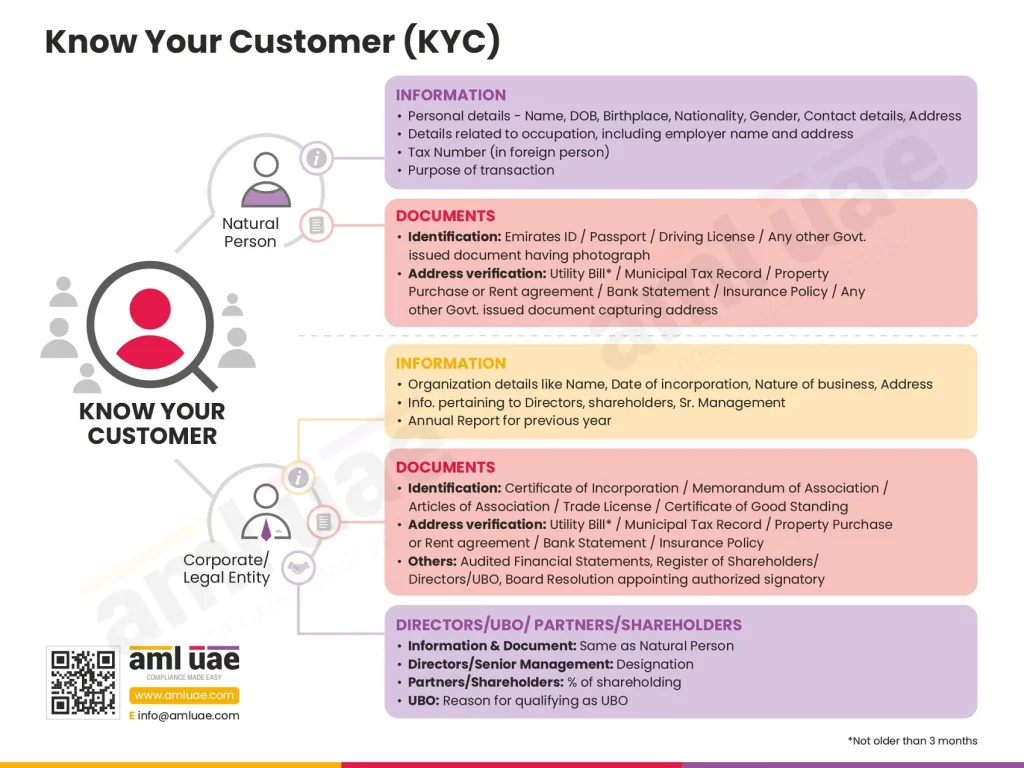

To begin with, the regulated entities must seek the identification details of the partnership firm. For this, it is recommended that the regulated entities get the “Know Your Customer” form filed by the firm, capturing legal name, legal structure, partners, their holding, contact details, license number, nature of the business activities, the purpose of the business relationship, etc.

Adequate documents supporting the identification details, such as a trade license or certificate of incorporation, must also be obtained. Further, documents presenting the organization structure must be obtained, which includes the Memorandum of Association and Article of Association.

Ensuring the identity documents obtained from the partnership firm are valid and up-to-date is vital.

All the information obtained about the firm shall assist in identifying and evaluating the ML/FT risks the firm poses to the business and accordingly determine the level and degree of the AML/CFT measures to be applied to manage the risk.

Identifying the partners and beneficial owners

Identification of a partnership firm is incomplete without identifying the actual mind behind the legal structure – the partners, UBOs, and the controlling parties. The regulated entities must seek adequate identification details about the UBOs and partners, such as full name, nationality, date and place of birth, address, identification number, etc.

Further, the necessary documents supporting the identification information must be obtained, for example, the passport, Emirates ID, Driver’s License, or any other government-issued document bearing the person’s photograph.

The regulated entities must ensure that the information obtained about partners and beneficial owners is complete and accurate. The partnership structure, as presented in the KYC form, must match the firm’s legal documents.

Verify identity using documents obtained and other reliable, independent sources

Once all necessary documents and information have been collected, the next step is to verify the identity details’ authenticity and the documents’ legitimacy. For verification purposes, the regulated entities may rely on government-issued identity documents or resort to independent databases like the corporate registry or third-party paid resources to ensure that the partnership firm and its partners are legit persons to conduct business with.

The regulated entities should seek the original document for verification purposes and obtain a photocopy of such document, with a remark from the person verifying the documents as “original sighted and verified.” Suppose the firm cannot produce the original documents for verification. In that case, the regulated entity must insist on getting a certified copy of the identity document, certified as a “true copy” by a chartered accountant, bank manager, notary, police officer, etc.

The regulated entities must ensure that the identity documents are not forged or tampered with. Further, necessary steps must be taken to match the photo presented on the identification document with the person actually presenting it.

Screening the partnership firm and the partners, UBOs, and controlling parties

The regulated entities must screen the firm and its UBOs, partners, etc., to check whether any person is designated under any sanctions list, specifically under UAE Local Terrorist List or UNSC Consolidated List.

It is also essential to determine whether any of the partners of the firm or the UBOs are Politically Exposed Persons (PEPs) or close relatives of associates of PEP or any other high-risk individuals.

Further, the regulated entity must also check if there is any negative news or adverse media available against the firm or any of the partners of the firm, indicating criminal history or involvement in financial crime.

Ongoing monitoring

The regulated entities must ensure that the identification formation obtained about the partnership firm and the partners is accurate, complete, and valid at all times. For this, the entities must implement adequate ongoing monitoring measures and systems, including regular reviews of identification documents and maintaining adequate documentation related to the identity verification process and changes therein.

Record-keeping

Record-keeping is an important aspect of the identity verification process. Regulated entities must maintain accurate records of all the documents collected and the verification process, including records related to ongoing monitoring and changes in the initial information or documents. The identification verification-related records must be maintained in an organized manner and must be made available to the relevant authorities upon request.

A robust identity verification process, including identifying eth partners and UBOs, is mandatory to manage the ML/FT risks while establishing a business relationship with the partnership firm.

How can technology come in handy in the identity verification process of the partnership firm?

Identity verification is essential to manage the risk and stay AML compliant. Given the legal structure of the partnership firm and the requirement to identify and verify the identity of the partners, the regulated entities are recommended to leverage the technology for efficient identity verification.

Regulated entities may use emerging technologies like Artificial Intelligence or Machine Learning to streamline the identity verification process while onboarding a partnership firm as a customer. For example, biometric verification (facial recognition) or automated identity document verification solutions can help reduce the time and resources required to carry out identity verification of the partnership firm and presents more accurate results, reducing the risk of manual errors or manipulation.

Identity verification is a crucial component of complying with AML regulations while establishing business relationships, specifically in the case of a legal person, including a partnership firm. A comprehensive identity verification process is essential to identify the ML/FT risks and determine the adequate measures to be implemented to manage the risk arising from the partnership firms onboarded as customers or suppliers.

Any gaps in customer identification may expose the business to unwanted financial crime risk and administrative fines for regulatory non-compliance.

How can AML UAE assist you in the identity verification process?

AML UAE is a leading AML consultancy service provider in UAE, assisting regulated entities in identifying business risks and tailoring the AML/CFT policies, procedures, and controls to mitigate the assessed risk effectively. It includes designing a robust customer onboarding framework, including the identity verification processes customized for partnership firms, corporate entities, individuals, trusts, etc., to assess customer risk and apply appropriate AML/CFT controls.

We also impart AML training to the Compliance Officer and the team to effectively implement the designed processes and controls and ensure that identity verification of partnership firms is adequately performed to prevent ML/FT vulnerabilities.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.