Restrictions on Business Relationships under UAE AML Law

Restrictions on Business Relationships under UAE AML Law

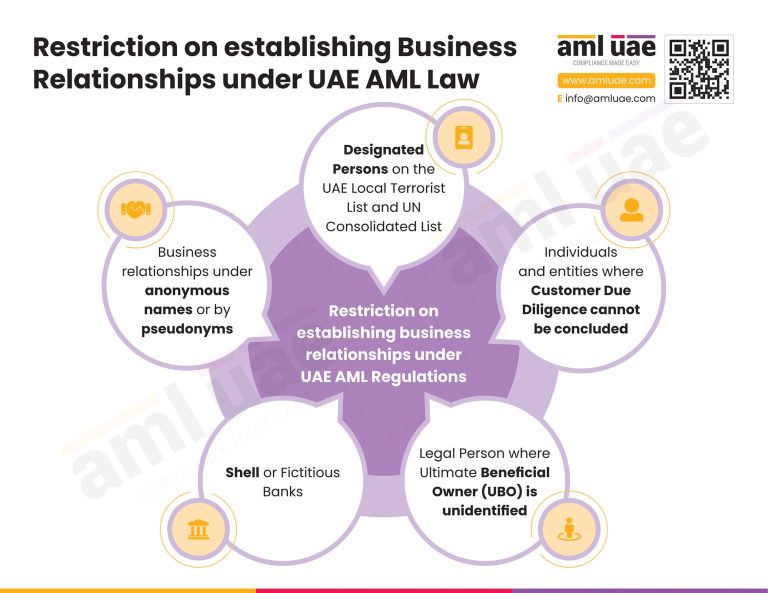

The AML regulations in UAE restrict Financial Institutions, Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Assets Services Providers (VASPs) from establishing a business relationship under the following situations:

- When the person is designated person under UAE Local Terrorist List or UNSC Consolidated List or any other relevant Sanctions List

- When the person is uncooperative and hinders the completion of the Customer Due Diligence process

- Circumstances where the proposed customer is a legal person or legal arrangement and its Ultimate Beneficial Owners cannot be identified

- Regulated entities are prohibited from setting up a business relationship with a shell or fictitious bank (that does not have any physical presence or employees for carrying out actual business operations)

- No business relationship or account can be established on an anonymous basis or using numbered or pseudonyms

Onboarding customers under the abovementioned circumstances would increase money laundering/terrorism financing risk and be tantamount to non-compliance with AML regulations.

Here is an infographic you can take as a base to avoid dealing with particular customers under specified situations.

AML UAE is a leading AML consultancy in UAE, assisting UAE-based regulated entities in developing and maintaining AML/CFT framework to fight financial crime, tailormade to the business’s ML/FT risk. We also impart AML training to the client-facing team and Compliance Officer to ensure that the business does not unknowingly get into a restricted category of business relationships and expose itself to higher ML/FT vulnerabilities and non-compliance penalties.