Source of funds and source of wealth: Essential element of Customer Due Diligence

Source of funds and source of wealth: Essential element of Customer Due Diligence

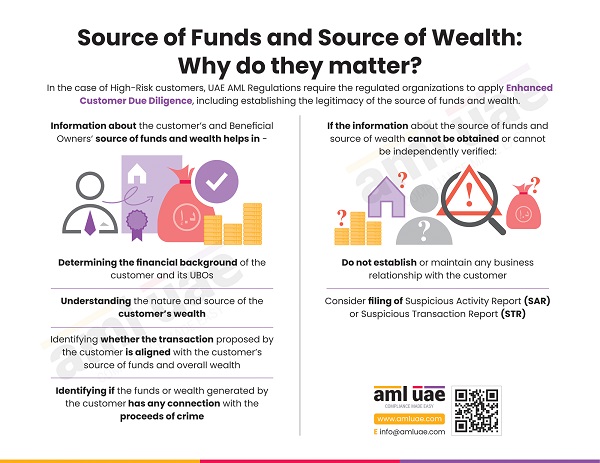

Money laundering is about concealing the origin of illegal funds and making them appear as if they were earned through legitimate sources. Once the criminal proceeds are integrated into the financial system, it becomes challenging to trace the original illegal source or the owner of the funds. To mitigate this risk, the UAE AML regulations mandate that regulated organizations – Financial Institutions, DNFBPs, and VASPs– obtain information about the source of funds and wealth and establish its legitimacy in case of high-risk customers or where ML/FT suspicion is observed.

Understanding the source of funds and the customer’s wealth brings transparency to the transactions. These details help the regulated organization determine the customer’s financial profile, which sets a base for monitoring the transaction and immediately identifies any unusual transaction inconsistent with the customer’s financial capacity.

It also helps determine the nature and source of the customer’s wealth, which is pertinent to understanding if the customer’s activities are directly or indirectly associated with any criminal activities or organization.

The Source Of Wealth due diligence is conducted at the time of customer onboarding or account opening and refreshed as per the customer’s risk categorization. Further, the SoW due diligence includes the collection of documents from the customer. Once the documents are collected, the compliance teams check if the SoW is reasonable and in line with the customer’s profile. If the documents are insufficient or there are queries, the customer is contacted, and the required information is obtained. Sometimes, the compliance team takes Source of Wealth information from the publicly available registry and reputable sources; in such cases, the reliability of the source is evaluated and taken into consideration while finalizing the genuineness of Source of Funds.

The extent and nature of the information collection for the Source of Funds depends on the risk-based approach adopted by the regulated entity. The compliance team collects SoF information regarding the activities that generated the funds used in a transaction, the method of transfer, the financial institution from which the transaction originated, the country from which the fund transfer is made, and the existence of any third parties in the fund transfer.

Establishing the legitimacy of the high-risk customer’s source of funds and wealth enhances the quality and effectiveness of the organization’s AML framework to mitigate the ML/FT risks.

With this visual depiction, let us understand the significance of the source of funds and wealth as part of AML’s efforts.

What is Source of Funds in Financial Crime Compliance?

Source of Funds (SoF) is the origin of funds used in carrying out a business transaction. The SoF is the origin and means of a business transaction made by the customer. It is focused on the funds transferred by the customer to a regulated entity. Further investigation on the Source of Funds places higher reliance on the customer’s personal and financial background and the risk-based approach taken by the regulated entity.

The concept of the source of funds may not be clear to the end customers, and they may wonder what the Source of Funds is in KYC, but it’s part of the Enhanced Due Diligence process carried out to control and mitigate ML/TF risks.

What is Source of Wealth in Financial Crime Compliance?

The Source of Wealth (SoW) is the origin of the accumulated monetary assets of an individual. It involves an analysis of the economic activities undertaken by a person to accumulate the entire body of wealth. In accounting terms, it’s the overall net worth (assets minus liabilities) of a person.

Examples of Source of Wealth

Following are the examples of Source of Wealth:

1. Family Wealth:

The wealth generated from inheritance, gifts, pension benefits, lawsuit settlement, divorce settlement, etc.

2. Personal Wealth:

The wealth generated from lottery wins, the sale of artworks, the sale of a fixed asset, and other personal backgrounds and circumstances.

3. Employment Activities:

The wealth generated from salaries, commissions, bonuses, or pension or other retirement benefit schemes.

4. Business Activities:

The wealth generated from the sale of products and services, business income, and other commercial activities like brokerage, commission, etc.

5. Investment Activities:

The wealth generated from the sale of investments such as properties, shares and securities, royalties, patents, etc.

Examples of Source of Funds

Following are the examples of Source of Funds:

1. Salaries, Bonuses, Pension or other retirement benefit payouts

2. Interest income on bonds, FDs, personal savings account

3. Dividend income or return on investments

4. Proceeds of real-estate sale transaction

5. Inheritance or gifts

6. Winnings from lottery or casino

What is the difference between Source of Funds and Source of Wealth?

1. The source of Wealth is the origin of the entire body of wealth, whereas the Source of Funds is a narrow term. It is only concerned about the origin of funds used for a transaction.

2. The Source of Wealth has more relevance when onboarding a customer and performing his risk assessment and when you think the risks associated with a customer have changed. The Source Funds investigation is necessitated every time a transaction is made with a high-risk customer.

For compliance officers, the Source of Funds and the Source of Wealth go hand in hand. If the value of the transaction is more than the customer’s wealth, it requires a detailed investigation into the Source of Funds.

What if the result of Source of Wealth Due Diligence is unsatisfactory?

If the result of Source of Wealth Due Diligence falls short of the required standards as backed by the risk-based approach taken by the entity, the entity can:

1. Offboard the customer

2. Decide against onboarding a customer

3. Assign a higher risk rating to the customer

4. Enhance monitoring on customer’s activities and transactions

5. Put threshold-based controls on customer’s activities

6. Place restrictions on transactions, products, and payment methods

7. Raise an internal STR and assign it to the compliance officer for further investigation into the Source of Funds and Source of Wealth

8. If the compliance officer has a suspicion as to ML/TF then he considers filing the STR with the UAE FIU goAML portal

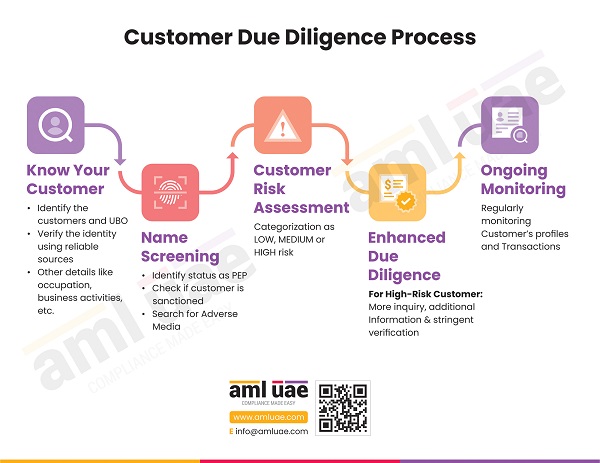

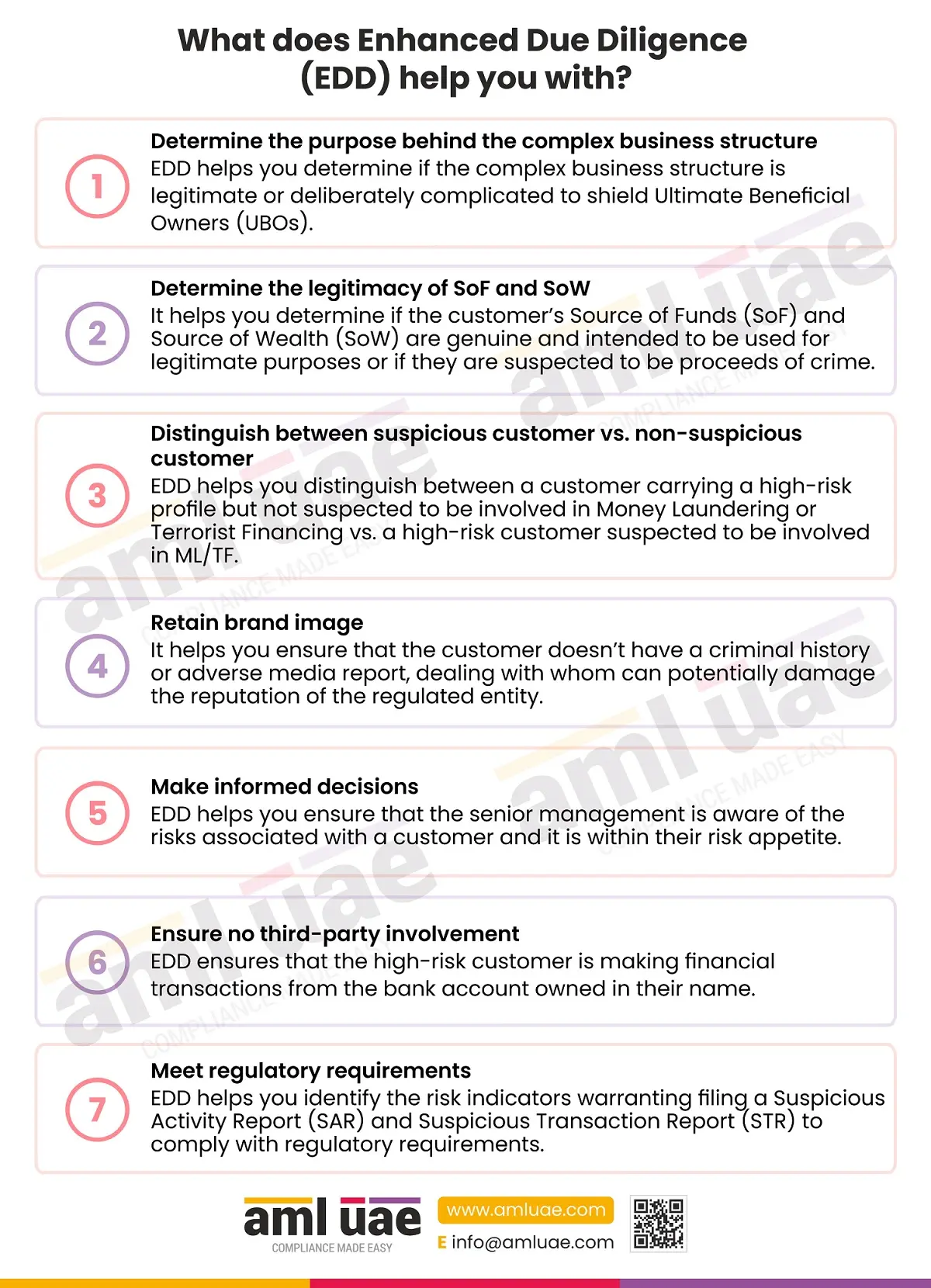

Legal Background: Enhanced Due Diligence and SoF and SoW

Article 4.2 of Cabinet Decision No. (10) of 2019 concerning the implementing regulation of Decree-Law No (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism Organisations requires Financial Institutions, DNFBPs, and VASPs to apply Enhanced CDD measures to manage high risks and take reasonable measures to identify the Source of Funds and Source of Wealth of customers and beneficial owners. The Enhanced Due Diligence (EDD) requires the regulated entity to obtain necessary documents and information and satisfy itself as to AML Source of Funds requirements and Source of Wealth Requirements.

SoF and SoW in Customer Risk Assessment

Source of Funds verification limits opportunities for criminals to exploit financial systems. The type of documents to rely on when performing a Source of Funds check depends on the associated risks with a transaction. Documents required to check the Source of Funds include bank statements, documents confirming the sale of real estate, the sale of shares and securities, and a win from a casino.

Source of Funds and Source of Wealth information play a vital role in Customer Risk Assessment. The following factors require due consideration:

1. Whether the Source of Wealth information is adequately obtained and documented in Customer’s Profile

2. Whether the Source of Funds information at the time of customer onboarding has been adequately obtained and documented in the customer’s profile

3. Whether the ongoing Source of Funds information is adequately obtained and documented

4. Whether there are any open queries as to SoF or SoW

5. Whether the customer is a Politically Exposed Person (PEP)

5. Whether there is negative news, criminal history, ML/TF charges associated with the customer

6. Whether the customer is genuine and reputable

7. Whether the Source of Funds or Source of Wealth originates from a high-risk country

What documents can verify Source of Funds and Source of Wealth

The Source of Wealth and the Source of Funds documents must be issued by a reputable company, commercial provider, or government agency. The following documents, data, or information could be considered reliable while collecting SoF and SoW information:

1. Government-issued data and documents – Tax returns, Property Register, etc.

2. Bank statement, passbook

3. Payslip

4. Stamped grant of probate

5. Audited Financial Statements

6. Will

7. Sale and purchase agreements

8. Import and export documents

When to conduct the source of funds and source of wealth enquiries

Enquiries into the source of Funds and Source of Wealth are conducted in accordance with the regulatory requirements, the entity’s risk-based approach, and the AML/CFT policies and procedures.

The AML/CFT policies and procedures must clearly identify triggers for necessitating the performance of Source of Wealth and Source of Funds enquiries.

Here are some events that would trigger Source of Wealth and Source of Funds verification:

1. SoF and SoW checks are required when onboarding or conducting a transaction with a high-risk customer.

2. As a part of ongoing monitoring of a business relationship with a high-risk customer

3. When there’s a change in the customer’s risk profile (Non-PEP customer becoming a PEP)

4. When the customer’s transactions are inconsistent with his profile

5. When a transaction is complex, or it is a high-value transaction

6. When a transaction is destined to or originates from a high-risk country

Best Practices for Source of Funds Due Diligence

The AML/CFT policies and procedures of the company must answer the question of how to check the Source of Funds. Here are best practices for AML Source of Funds Due Diligence:

1. Assess the overall risk associated with the customer and the transaction being carried out

2. Analyse documents and information collected and determine if the nature and size of the transaction align with the customer’s profile

3. Document the rationale and any other relevant information and final decision as to onboarding or otherwise for future reference.

Best Practices for Source of Wealth Due Diligence

The AML/CFT policies and procedures of the company must answer the question of how to check the Source of Wealth. Here are best practices for AML Source of Wealth Due Diligence:

1. Consider the risk rating of the customer and ensure that the source of wealth information aligns with the customer’s profile

2. Collect documents and information, including audited financial statements, tax returns, payslips, inheritance certificates, and so on.

3. Document the decision-making process and record your observations and the final decision.

The importance of AML Source of Funds Verification

Investigating a customer’s Source of Funds is important to fighting financial crimes like money laundering and terrorist financing. In cases where the SoF and SoW do not match the customer’s risk profile or intended volume and nature of transactions, filing a suspicious transaction report or suspicious activity report may be necessary.

The importance of AML Source of Wealth Verification

The Source of Wealth identifies what the customer does for a living and the origin of the wealth accumulated. The entire purpose of Source of Wealth Due Diligence is to avoid working with clients who have acquired their wealth through illegal means and to comply with regulatory AML/CFT requirements.

Proof of Funds

Proof of Funds (PoF) is the document evidencing the origin and means of a financial transaction. It demonstrates that the customer has the funds to carry out a particular transaction. A Bank statement usually depicts the balance available in the customer’s account to complete a transaction.

There is a difference between Proof of Funds (POF) and Source of Funds (SoF). The Proof of Funds (PoF) only focuses on documentary evidence, whereas the Source of Funds questions the origin of funds.

AML UAE is one of the leading AML Consultancy Service Providers in the UAE, assisting clients with tailoring the AML/CFT policies and procedures, implementing the robust AML framework, drafting the comprehensive Customer Due Diligence procedures, including Enhanced Due Diligence measures, imparting AML Training to the Compliance Officer and team, etc.