Navigating CDD and FATF Travel Rule: VASPs to identify Originator

Navigating CDD and FATF Travel Rule: VASPs to identify Originator

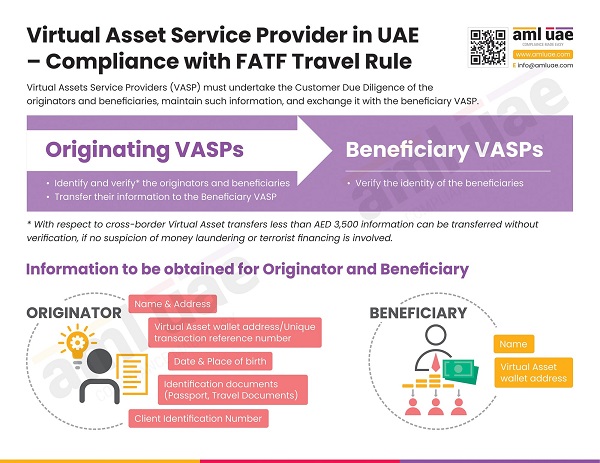

Given the anonymity involved and the lightning pace with which the virtual asset transfers are concluded, the FATF has issued a recommendation requiring the Virtual Asset Service Provider (VASP) to identify the virtual asset transaction’s originator and beneficiary. The originating Virtual Asset Service Provider must obtain information about the originator of the transaction and the beneficiary and accompany the virtual asset transfer with these details. This recommendation by FATF is considered a Travel Rule.

FATF Travel Rule emphasises obtaining the information about the parties and making the same available to the Beneficiary VASP, who shall verify the beneficiary details before concluding the transfer.

Here is an infographic navigating through the Travel Rule requirement that VASPs must follow and the information to be obtained and verified about the originator and the beneficiary.

AML UAE is an AML consultancy firm assisting AML-regulated entities in the UAE, including VASPs licensed with VARA, ADGM or DIFC. AML UAE understands the AML regulations and the virtual asset network, which helps VASPs to effectively identify the risk, design and implement robust AML/CFT framework, and identify the right technology to manage AML compliance, including customer due diligence process to identify and verify the identity of originator and the beneficiary.