Understand the types of CDD measures to effectively mitigate the ML/FT risks

Understand the types of CDD measures to effectively mitigate the ML/FT risks

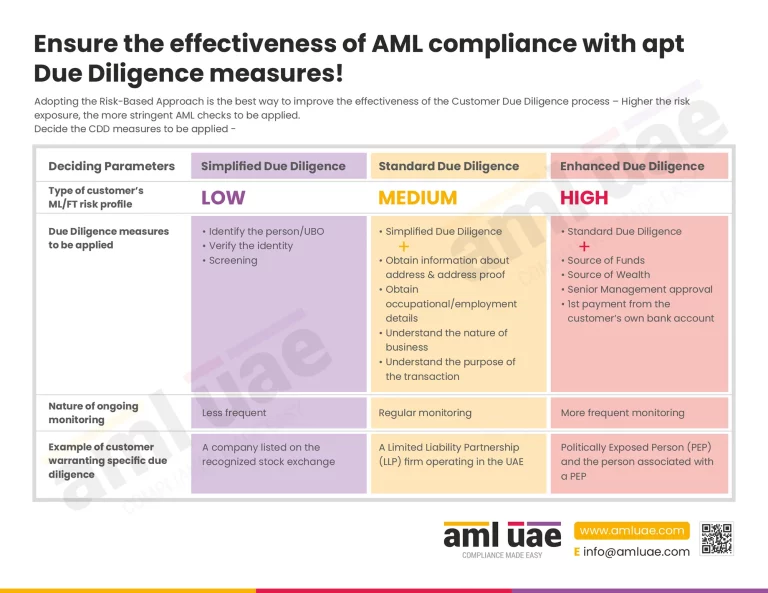

The UAE AML regulations provide for the application of a risk-based approach, i.e., the higher the money laundering or terrorism financing risk, the increased and more stringent AML/CFT checks to be applied. In line with this, if a particular customer’s ML/FT risk is assessed as HIGH, the regulated organizations must apply Enhanced Due Diligence Measures comprising additional risk mitigation measures. While adopting simplified or standard due diligence measures are sufficient in other cases (for customers identified as Low or Medium risk).

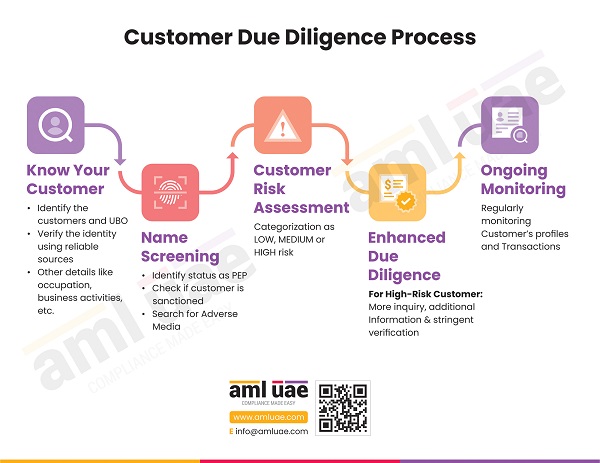

Thus, it is pertinent to understand the types of Customer Due Diligence (CDD) measures to adequately apply the same, depending on the nature of the customer’s risk profile. Here, an infographic presents the three types of CDD processes, the circumstances when a particular CDD process is to be followed, measures to be applied and its relationship with ongoing customer monitoring. Also, a few examples have been captured for each CDD type for better understanding.

AML UAE is AML Consultancy firm, assisting regulated organizations in designing and implementing a robust AML Compliance framework and imparting AML training. AML UAE also helps the clients develop the customer onboarding process, with clear AML policies and procedures around Customer Due Diligence to be followed.