Know Your Transaction (KYT) and Know Your Virtual Asset Service Providers (KYV)

Know Your Transaction (KYT) and Know Your Virtual Asset Service Providers (KYV): Mitigating AML Risks for VASPs

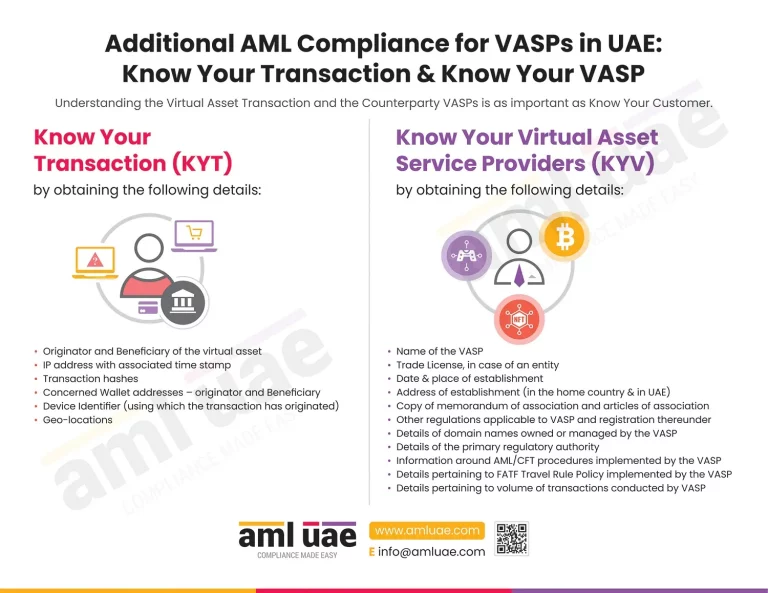

Along with the Know Your Customer (KYC) process, the AML regulations in UAE require the Virtual Asset Service Providers (VASPs) to implement the “Know Your Transactions” (KYT) measures to understand the transactional parameters involved while conducting a virtual asset transfer.

Similarly, the regulations mandate VASPs to identify and verify the identity of the corresponding VASP involved in the virtual asset transaction – whether as the originating VASP initiating the VA transfer or the beneficiary VASP – “Know Your Corresponding VASP” (KYV).

These KYT and the KYV requirements are aligned with the FATF recommendations for Virtual Asset transactions.

Here is an infographic discussing the “Know Your Transaction” and “Know Your Corresponding VASP” elements.

AML UAE offers end-to-end AML consultancy support to all the regulated entities, including VASPs operating in UAE, supporting designing and implementing the AML compliance framework, KYC, KYT and KYV process.