Money Laundering risk associated with nominee shareholders and directors

There is a significant Money Laundering risk involved with Nominee Shareholders and Directors as they are misused by criminals to conceal the true identity of the beneficial owners.

What is Nominee Shareholder/Director?

To conceal the identity of the true beneficial owner or the controlling interest, the entities get into an arrangement wherein a nominee shareholder or director is appointed. A nominee shareholder is a person whose name the shares are registered, however, for the benefit of some other person. At the same time, a nominee director is appointed to the entity’s board to represent somebody else’s interests. In most cases related to the nominee arrangement, the person appointed as shareholder or director is just for the namesake. At the same time, the actual beneficiary or the controlling party is different, and a contract governs the entire arrangement.

Various professional service providers, such as Trust & Company Service Providers, Lawyers and Accountants, offer formal nominee services by allowing their name to be used as nominee shareholder or director against professional fees.

Sometimes, informal nominee arrangements are used to hide the beneficial ownership through families and friends.

Why is the Nominee Shareholder/Director arrangement used?

Some of the nominee arrangements are backed by law, wherein the law mandates the presence of a legal representative in the country of operations, different from the country of the beneficial owner. However, the primary purpose of the nominee arrangement is to hide the identity of the beneficial owners by creating a false layer of ownership or management structure.

Such nominee shareholders and directors are vulnerable to being exploited by financial criminals to administer and control the entity to conduct money laundering or terrorism financing (ML/FT) activities without being disclosed as beneficial owners owning or operating the entire nominee structure.

Red flags associated with nominee shareholders and directors

When the public filings about the entity happen in the name of the registered shareholder or director, who is acting on behalf of someone else, then the actual controlling parties hide behind the veil of nominee arrangement.

The money laundering and terrorist financing potential risk indicators associated with nominee arrangement include the following:

- Ultimate Beneficial Owner (UBO) declared for the entity is also listed as UBO of the other registered business entities, and UBO is a professional corporate Service provider,

- The reason for the nominee arrangement is not apparent or does not make business sense,

- Family members acting as nominee shareholders or directors without any business rationale,

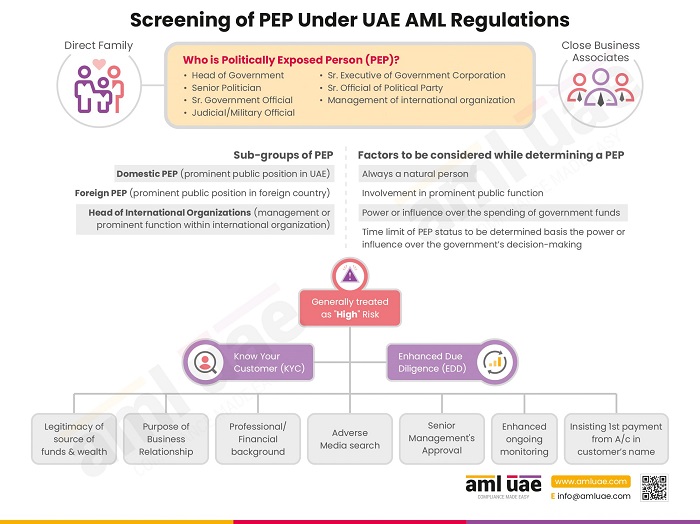

- When the actual controlling person is a Politically Exposed Person (PEP) or an individual having negative media reports,

- The nominee shareholder or the director is not able to explain the entity’s business activities and corporate history,

- The nominee shareholder or the director refuses to provide the necessary information and documents required for registration,

- The name of the entity does not match the business activities of the entity.

Mitigating the Money Laundering risk associated with nominee shareholders and directors

To combat the money laundering and terrorism financing risks posed by the nominee arrangement, the UAE authorities have implemented various regulations mandating the nominee shareholders and directors to self-declare such nominee arrangements to promote transparency around the ownership structure.

In one of the documents issued by the Ministry of Economy, named “Nominee Shareholder/Director – formal or informal”, the Ministry requires the Company Registrars to apply enhancing controls for monitoring and regulating the nominee arrangements in the UAE to ensure transparency around beneficial ownership. The Registrar must obtain the details from the registered shareholder about their status as nominee and, if so, information about the actual controlling person operating the transactions.

The document issued by the Ministry of Economy recommends Registrar to apply the below-mentioned additional measures to mitigate the ML/FT associated with nominee arrangements:

- Obtain and review the nominee agreement,

- Understand the name of the nominee arrangement and the legitimacy of the purpose of the same,

- Classify all the entities with nominee arrangements as “high risk” from ML/FT perceptive,

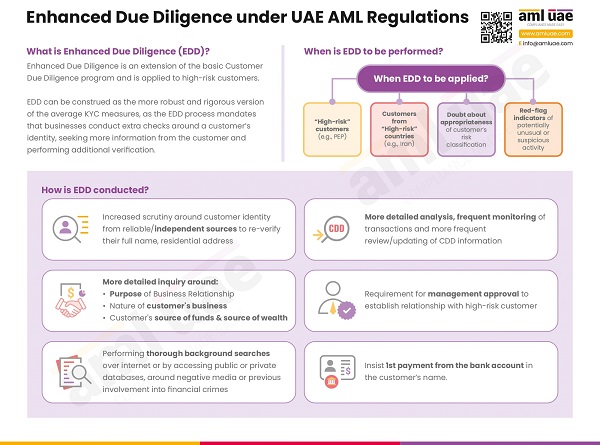

- Apply Enhanced Due Diligence measures,

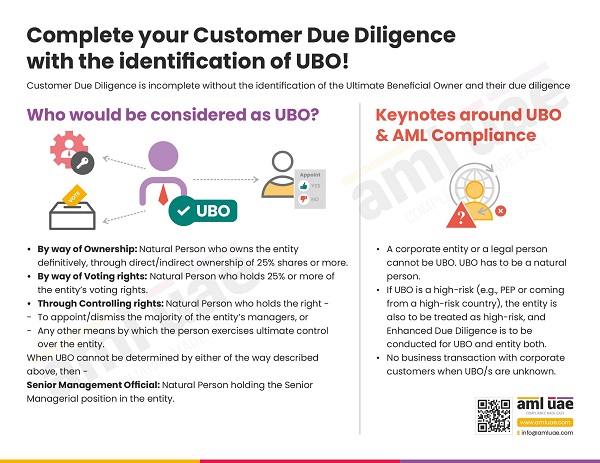

- Ensure that all UBOs are declared, and their identity is verified.

How can AML UAE assist you?

Though the primary responsibility lies on the Registrar to apply enhanced due diligence measures on entities having nominee arraignment, it is recommended that all regulated entities – Financial Institutions, Designated Non-Financial Businesses and Professions and Virtual Asset Service Providers apply due measures when dealing with such nominee shareholders or directors and mitigating the associated ML/FT risks.

AML UAE is one of the leading AML Compliance service providers in the UAE, offering end-to-end support to regulated organizations to manage their AML Compliance and safeguard their business. Let’s together fight the exploitation of the nominee arrangement from being used as a vehicle for conducting money laundering and terrorism financing by customizing our policies, procedures and controls.

Avail comprehensive, expert, and efficient services for AML compliance matters

Contact our team at AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.