What is NFT money laundering and how to combat it?

Technology has entered every field of work. The art field is the latest to have been impacted by technology in the form of Non-fungible Tokens (NFTs). NFTs are blockchain-based tokens depicting various art forms – painting, music, and games.

Since technological evolution brought the digitalization of art, money launderers came up with new typologies to exploit the same.

Since technological evolution brought the digitalization of art, money launderers came up with new typologies to exploit the same and transfer the illegally obtained funds through misuse of NFTs.

This article discusses NFT money laundering, why and how it is conducted, and what measures businesses should consider combating.

What are NFTs?

NFTs are tokens, which are data in the form of videos, pictures, artwork, memes, tweets, or any digital asset. These are stored on different forms of distributed ledgers, such as blockchains. These cannot be interchanged with other NFTs. Thus, they are non-interchangeable digital assets but can only be bought and sold using cryptocurrencies.

They have unique identifying codes and are finite in numbers. People can see NFTs for free, but to own them, they must pay the price to the actual owner. The value of an NFT is based on its perceived value, driven by its market demand.

After the purchase, there is a built-in authentication, which the new user can show as proof of ownership. Here, the new owner gets ownership of the NFT and not the physical object, while the original creator owns the intellectual rights of the work. So, NFTs are famous because people value digital bragging rights over an item instead of the actual physical item.

How are NFTs different from cryptocurrencies?

The only similarity between cryptocurrencies and NFTs is that they are built on the same programming. Both are secured in digital wallets. And you need cryptocurrencies to buy NFTs.

Any physical currency and cryptocurrency are fungible. It means that these assets can be interchanged and traded with one another. That is not the case with NFTs because they are non-fungible.

Cryptocurrencies and physical currencies are equal in value. It means one dollar is equal to one dollar. One Ethereum is equal to one Ethereum. In the case of NFTs, each has a digital signature that makes it unique; thus, one NFT cannot be exchanged with another NFT. At any given moment, only one person can own an NFT, and the digital signature gives that ownership value.

Why are NFTs attractive to money launderers?

As it is said, the perceived value of art and its market demand decide an NFT. The perceived value factor makes dealing with NFTs a bit subjective and hence, away from the scrutiny of regulators.

The transfer of ownership of NFT happens in an instant. Buying and selling NFTs is easy and smooth and requires no additional financial cost except the token’s value. Also, there are no geographical restrictions on these transactions; NFTs created in one country can be done in another country without any limitation.

Moreover, NFT is an entirely new concept and a new market. Many different NFT platforms exist with different structures, operations, standards, ownership models, and due diligence rules. Therefore, it becomes challenging for regulators to create standard regulations for the NFT space applicable to various countries across the globe.

Smart contracts in the NFT market are one of the critical reasons money launderers are attracted to it. In smart contracts, the user generates revenue each time a transaction occurs on the blockchain. So, launderers rapidly conduct a transaction to generate revenues. Now, this becomes a significant motivation to execute smart contracts; in the process, forget about the identity verification of buyers. Launderers exploit this loophole to their benefit.

How does NFT money laundering occur?

Wash trading

Generally, criminals use their illicit money (converted into cryptocurrency) to buy an NFT. They use illegal money, but the purchase is a legal one. Later, they can sell the NFT and earn legal cryptocurrencies. This process is called wash trading.

The central concept in wash trading is to increase the value of the transaction. Thus, in this transaction, criminals benefit in two ways: they avoid taxes and convert unlawful funds to legitimate digital assets or currencies. Only a record of this purchase and sale transaction is present on the blockchain, and nothing about the funds obtained to buy this NFT.

Standard money laundering

Another way is to do multiple buying and selling transactions between their accounts or someone known to them to create layers of fake transactions. With each transaction, illegitimate money gets transformed into legitimate money.

Now, since the determination of the fair market value of an NFT depends only on how the appraiser values it, you never get to know the actual price of the NFT. Launderers create multiple accounts and transfer assets from one account to another for any price. These transactions layer the illegal money with legitimacy and cleanse huge funds.

How to combat NFT money laundering?

Whenever there is a new technological innovation, money launderers exploit them. And NFT is the latest technology to become its victim.

Individuals and businesses dealing in NFTs or facilitating NFTs exchanges must find ways to regulate NFT activities – to verify the buyer and seller’s identity and the transaction’s authenticity. They can improve their AML and KYC checks or implement some monitoring software to track all movements. They must trace NFT transactions between wallets and conduct the KYC of wallet holders.

They must know how launderers engage in NFT money laundering and related red flags to identify suspicious transactions. Countries can implement relevant regulatory laws and actions to control this NFT market. It requires efforts globally because NFT transactions can occur globally without border restrictions.

Money launderers exploited the NFT world as countries, and international regulators introduced AML rules in the traditional buying and selling activities of art. So, criminals come up with newer ways and means; businesses must take the help of AML consultants to identify the risks to NFTs.

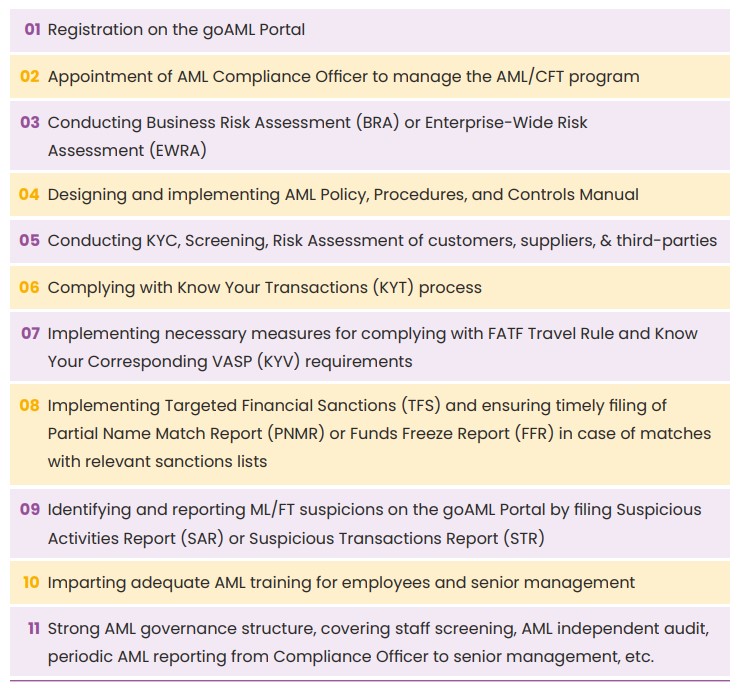

Key AML Measures and Responsibilities for curbing NFT money laundering

The crypto companies, NFT service providers and facilitators, and other Virtual Asset Service Providers (VASPs) in UAE must implement the following measures to comply with law and protect the NFT ecosystem:

How can AML UAE help?

AML UAE is a leading provider of AML compliance services in the UAE across different sectors, such as corporate service providers, virtual assets service providers, dealers in precious metals and stones, financial institutions, etc. Our AML consultants understand AML laws and money laundering red flags specific to business and transactions and thus can guide you in protecting your business against money laundering threats.

We help assess your business risk and set up an AML Compliance framework aligned with AML/CFT obligations. We implement specific comprehensive screening procedures and help you identify the potential red flags of NFT money laundering for early detection and preventive actions.

Get ready for the fight against money laundering with AML UAE

Get in touch with our team to discuss how we can help

Our recent blogs

side bar form

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.

FAQs on NFT Money Laundering and ways to combat it

The mainland companies or onshore crypto and other virtual assets companies in UAE are regulated by the Securities and Commodities Authority (SCA). Further,

Virtual Assets Regulatory Authority (VARA) controls Dubai-based virtual assets service providers (except DIFC). While it is Financial Services Regulatory Authority

(FSRA) & Dubai Financial Services Authority (DFSA) for ADGM and DIFC based VASPs respectively.

According to FATF, “virtual asset” refers to any digital representation of value that can be digitally traded, transferred or used for payment.

A cryptocurrency is a type of virtual asset. But not all virtual assets are cryptocurrencies.

A virtual asset is an asset held digitally or virtually. It is a digital value you can virtually trade, transfer, and use for investment and payment.

Virtual assets include digital art, text, videos, in-game items, images, music, cryptocurrencies, and virtual real estate.

Primarily, the crypto, NFT, and other virtual assets companies in UAE have to adhere to the requirements of the following anti-money laundering (AML) laws and regulations:

- Federal Decree-Law No. (20) of 2018

- Cabinet Decision No. (10) of 2019

- Cabinet Decision No. (74) of 2020

- AML/CFT-specific guidelines issued by the Supervisory Authority

The various methods used to launder money include:

- Using smurfs, mules, or shell companies

- Investing in real estate with cash and then selling it or generating rental income

- Investing in jewellery and moving it to other jurisdictions

- Online auctions and sales

- Virtual assets, including NFTs and cryptocurrencies

Yes, all Virtual Asset Service Providers (VASPs) must register with the goAML Portal in UAE.