Money Laundering and Terrorism Financing Risks in NPO

Non-Governmental organisations NGOs or NPOs- Non-Profit Organisations play a critical role in a crisis and contribute significantly to resolving issues and disputes. They provide humanitarian relief, sometimes even before the government can. But are they exposed to money laundering, and do they play a role in combatting money laundering and terrorist financing? Well, it’s a double-edged situation that they present. On the one hand, they help alleviate poverty and prevent situations from deteriorating, and on the other hand, they are prone to the risk of money laundering and financial terrorism.

Current Scenario Of Money Laundering and Terrorism Financing Risks in NPO

The FATF recommendation number 8 requires that countries review their laws and regulations to ensure that non-profit organisations are not misused for the financing of terrorism. The recommendation is directed toward eradicating terrorist funding in the non-profit sector. But the irony is that even after two decades, only 10 jurisdictions comply with the recommendations. This connection is inevitable and came to light after 9/ 11 when the role of a charitable organisation with terrorist organisations was unearthed.

It is noteworthy that in the initial days, the FATF recommendations were not focused on non-profits. But after 9/ 11, the FATF extended its actions to the non-profits. The tricky part is to conduct financial surveillance without putting a question mark on the integrity of the charitable organisations.

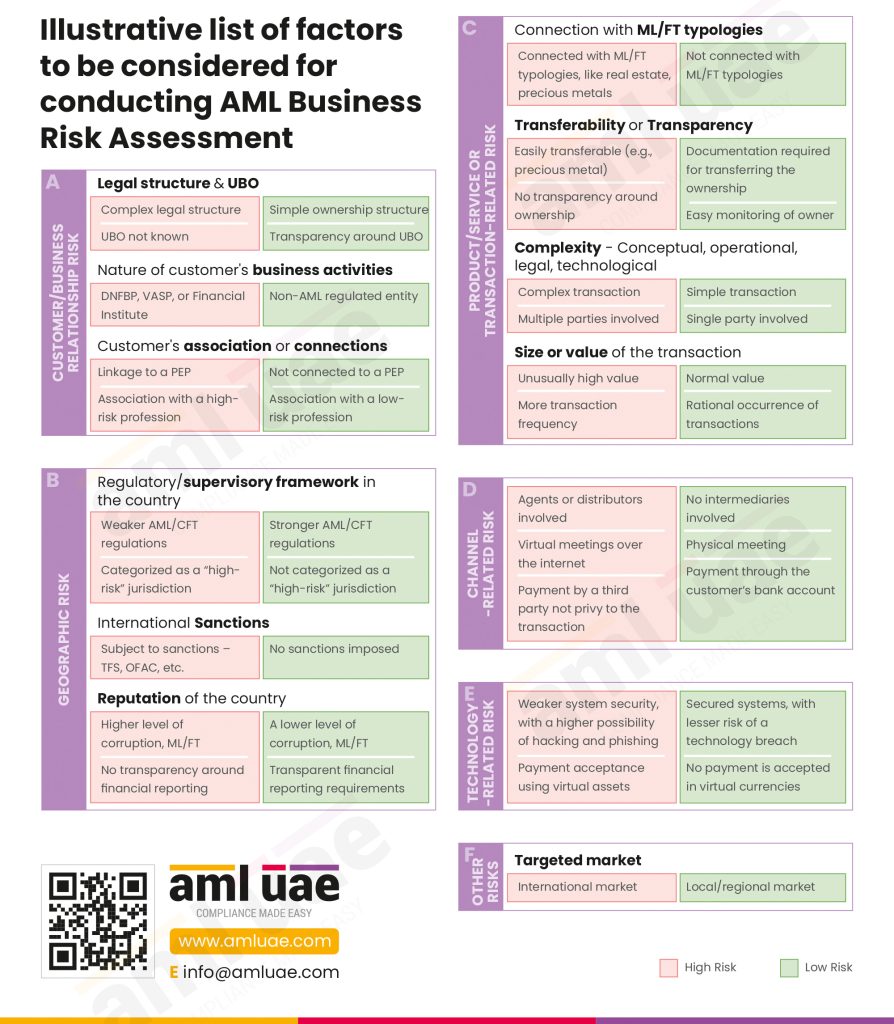

Over-regulation has become a concern, so the FATF introduced a risk-based approach and adopted tactfulness to deal with money laundering cases. FATF has recommended that such measures should be taken that should not disrupt charitable activities and should not discourage legit philanthropic activities.

These measures are applicable in scenarios in which government services do not reach, and non-profit organisations first reach the people to offer financial assistance. So, they should not be unduly prevented from accessing resources so that they can carry out their legit charitable activities successfully.

The complexity lies in dealing with the charitable organisations and identifying the intention and ignorance of the non-profits. There might be organisations involved in the money laundering crime, and there are also some organisations that have been subject to exploitation without their knowledge.

There might be several reasons for this, such as depending on the goodwill of the donors, ignorance or oversight of the working of the concerned staff. The financial abuse might be the work of insiders for which increased governance and stringent financial control are required.

If there’s the involvement of the outsiders, it is best to depend on the authorities and share relevant and complete information so that they can take the appropriate and timely actions.

Charities can be based on cultural or religious beliefs, so some charities might receive huge donations in cash which might be a routine thing. But the authorities need to recognise the peculiarities. The non-profit sector is vulnerable, which is often considered a high risk as the terrorists can exploit that.

Over-regulation to prevent the misuse of non-profits has become common, but it has led to a highly controlled environment for charities which they find hard to operate. They cannot access funds quickly and disperse them to provide humanitarian relief.

Such over-regulation has had adverse effects on the working of charities. So, the FATF accepted that de-risking without considering the level of risk associated with the customers and taking risk mitigation measures for customers within a particular sector can increase the risk. It will reduce the transparency required in the global financial system, and it will prevent the authorities from efficiently combatting money laundering and terrorist financing.

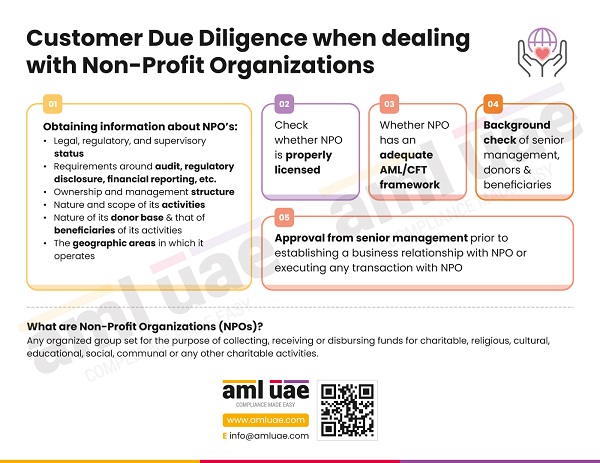

A risk-based approach helps thwart the challenges arising out of the vulnerabilities and the risk to which the non-profits are exposed. Charitable organisations need to focus on proper registration, sharing relevant information, and maintaining the correct records to help keep a tab on money laundering. They need to identify the beneficiaries and the sources of the distributed charitable funds.

Why are NPOs vulnerable to Money Laundering and Terrorist Financing?

Globalisation has made extreme changes in the way the NGOs were working, and it has brought them into the ambit of the terrorist organisation opening the doors for financial terrorism.

The charitable organisations work primarily on the strength of the volunteers, who are often not made to go through stringent identity verification checks. Moreover, the non-profits lack the technical expertise as they don’t have competent professionals to handle risk assessment and are not familiar with the legal framework. So, it becomes a vulnerable space that criminals can misuse easily.

The public trust in the noble work of the NGOs often does not attract any scrutiny regularly. The criminals often try to hide their unlawful acts in the legitimate activities of non-profits.

Conclusion - Money Laundering and Terrorism Financing Risks in NPO

Targeted risk assessment requires better assimilation of information and identifying the processes that criminals use to launder money. So, there needs to be a thorough understanding between the authorities and the non-profits. The required knowledge and information should be shared, and both parties benefit from the actions taken.

It is noteworthy that in the fight against money laundering, the authorities can also include the public. A good example of such a collaboration is the public advice and awareness carried out in the UK and Denmark. It helps the citizens to donate to Syria safely.

Collaboration between the government and NGOs will continue to help fight money laundering. It creates a network of organisations, including micro-financial institutions, that can help fight against money laundering. The authorities can strengthen their fight against money laundering and terrorist financing with collaboration and cooperation. Mutual learning and coordinated fight can undoubtedly deter criminals from indulging in financial crime.

AML UAE

AML UAE is one of the leading aml consultant in the UAE, offering AML compliance advisory services. We help organisations in the UAE be AML compliant with the rules and fight money laundering. We offer a wide range of services such as AML/CFT Policy, Controls, Documentation, and an in-house AML compliance department setup. We help identify the weak compliance areas and help you avoid penalties. You can also get assistance in the proper AML software selection and AML/ CFT health check. Our other services include Annual AML/ CFT Risk Assessment Report and AML Training. We have a highly experienced team with core expertise in AML compliance. Talk to our experts now and follow the AML rules and regulations without any difficulty.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.