How can UAE businesses be AML Compliant?

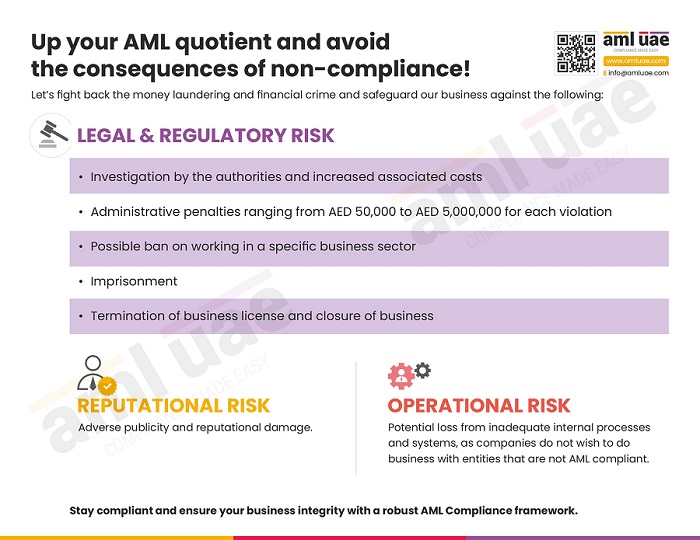

It is obligatory for banks, financial institutions, and other regulated entities to follow the AML rules and regulations or face penalties. UAE has imposed hefty fines for violation of AML rules and regulations. The penalties range from AED 50,000 to AED 1,000,000! By not being AML compliant, businesses put their reputation at stake and face the government’s ire. So, they need to ensure that they diligently follow the AML rules and make their business AML compliant.

The UAE Ministry of Economy has defined 26 categories of fines for non-compliance with the AML rules and regulations. It’s essential to mitigate the risks involved in non-compliance. AML consultants prove to be of great assistance to be AML compliant.

Optimizing the AML compliance program is of paramount importance to ensure that it is efficient, cost-effective, and scalable. It is critical to keep pace with the changing AML rules and leave no scope of non-compliance. The risk profile may also change over a period. So the business needs to ensure that their system is updated and equipped with the knowledge of the latest amendments to comply with the AML rules effectively.

With the aid of technology, businesses in UAE and worldwide can harness its power and streamline the AML compliance process. The AML software is a great tool to facilitate the AML process. AML software plays a crucial role in being AML compliant

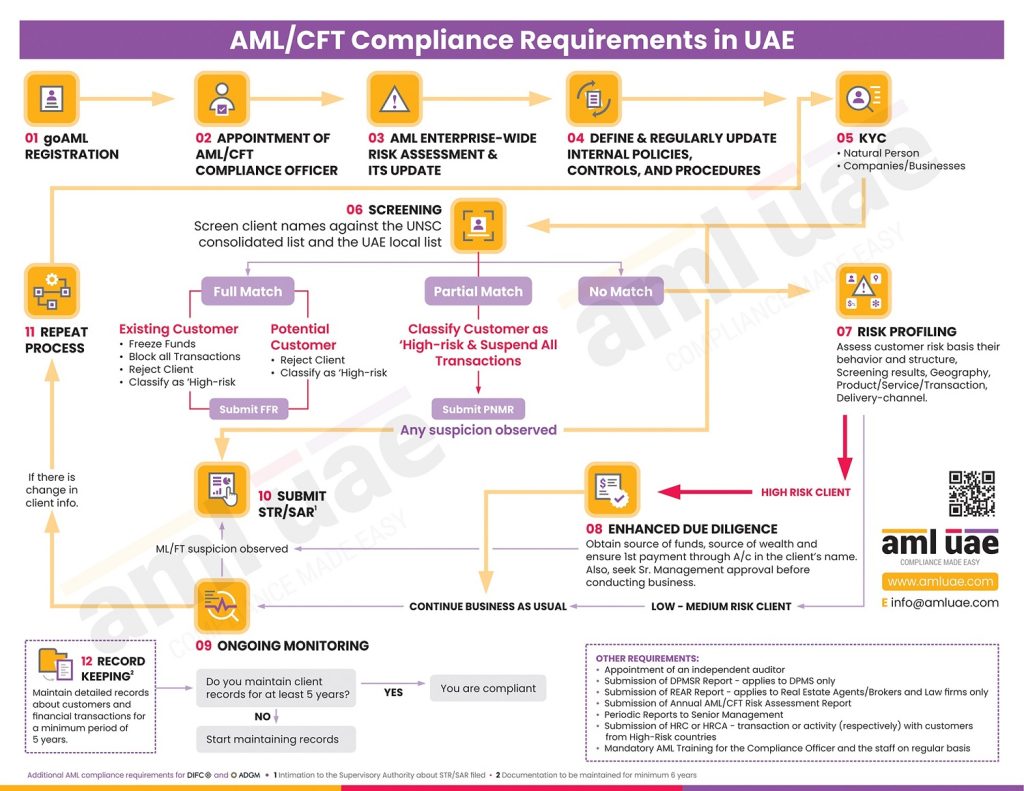

There are various aspects to look for following the AML rules and regulations. A business has to create a robust AML/ CFT program, provide AML training to its employees, follow the proper procedure for AML policy, rules and documentation. It also includes the selection of the right AML software.

The AML software will help the business incorporate all these elements into the AML compliance program and avoid any risk of non-compliance. The AML software will enable companies to immediately identify suspicious transactions and strengthen the AML compliance strategy.

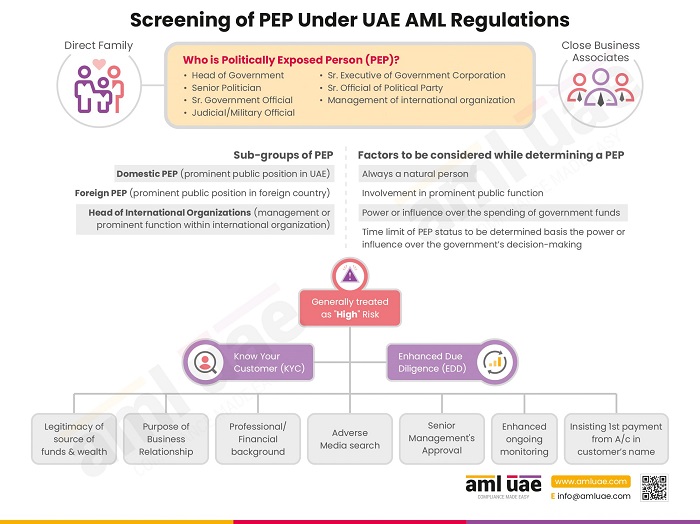

The software collects and stores customers’ KYC data and verifies it. It also verifies the customers’ risk and screens against a sanction list. It will provide information about PEPs and enable businesses to be sure about whom they’re entering into a business relationship. The software alerts them on any suspicious transaction or account and provides real-time updates to take the necessary action to prevent money laundering.

Role of AML Consultants

Businesses are occupied with running their businesses efficiently, providing high customer satisfaction, enhanced customer experience, promoting growth, and maximising profitability. Dealing with the complex AML compliance process can take a back seat in a competitive marketplace.

Businesses are at risk of non-compliance, so following the AML/ CFT Policy, Controls, and Documentation procedure is necessary. With the help of reliable AML consultants, companies can get the proper rules, policies, and systems in place and create a strong AML compliance framework that will help them fight money laundering successfully.

It is an elaborate process that involves risk identification by analysing the business process and identifying the risk which money launderers will take advantage of and be successful in their criminal intentions. Companies can immediately identify the illegal movement of money. The consultants will also examine the existing AML policies, letting the business know if their current AML compliance procedure is competent enough to keep money launderers at bay.

The gap analysis will clarify the appropriate actions that need to be taken to achieve AML compliance for the business. The gap analysis report is shared with the AML compliance officer and the stakeholders. After the discussion, the consultants create the best AML/ CFT program. A customized AML program is required to combat the challenges of the non-compliance risk and fight money laundering. The AML policy, controls, and procedures are created, eliminating or minimising the risk of non-compliance, and businesses can focus on improving customer growth.

Building an effective AML compliance process

The FATF –Financial Task Force has provided several recommendations for AML rules and regulations that define the AML compliance process. The FATF was founded in 1989 to fight money laundering and terrorist financing. It also aims to prevent the funding of accumulation and expanding weapons of mass destruction. FATF has provided some standard recommendations on the global level which countries can follow to fight the menace of money laundering

In 2020 the Minister of Justice had issued ministerial resolutions for setting up specialised courts for dealing with money laundering cases. This resolution was meant for the judiciary in the courts of Sharjah, Umm AI Quwain and Ajman, and Fujairah. It is noteworthy that each country has particular AML compliance requirements that businesses must follow.

It is crucial to have a robust AML compliance program that will meet all the needs and prevent the risk of non-compliance. Organisations can efficiently fulfil the requirements of AML compliance, avoid penalties, guard their reputation by not associating with suspicious activities or entities, and help the government achieve the goal of preventing money laundering.

UAE has issued the Federal Decree No. 20 of 2018 on the Anti-Money Laundering and Countering the Financing of Terrorism which defines the legal structure to ensure AML compliance with the international standards.

The law aims to prevent money-laundering practices and create a legal framework that assists authorities in ensuring AML compliance and arresting the criminals involved in money laundering. The law aims to counter the financing of terrorist activities and suspicious entities

AML Software

Standardising the AML program is necessary. An AML software will help to fulfil this objective. A reliable AML service provider will assist in selecting the proper AML software.

It is vital to empower the AML compliance team with the right resources and transparent policies to adhere to without any confusion.

How to get an effective AML compliance program?

The intricacies involved in the AML compliance program might prove overwhelming for businesses already occupied with keeping the company afloat, providing high customer satisfaction. The complex legislation might prove daunting for companies, so it would be best to hire an AML consultant to create an effective AML compliance program.

So how an AML compliance service provider will help in this arena? They will assist in setting up an AML compliance department and help businesses always stay AML compliant with their services.

As business owners in the UAE, people need to invest time and energy in the research to follow the AML / CFT policy, rules, and documentation process or set up an In-house AML compliance department. It is compulsory for banks, financial institutions, and other regulated entities to integrate an AML compliance framework into the company. It is best to create an in-house AML compliance department.

In addition to this, an AML compliance officer has to be appointed who will manage the AML compliance process. The AML consultants play a huge role in helping businesses be AML compliant.

Conclusion

Our recent blogs

side bar form

Share via :

FAQs

The following businesses must comply with AML:

- Banks

- Financial institutions

- Real estate agents

- Dealers in precious metals and gems

- Trust and company service providers

- Lawyers, notaries, and other legal professionals

- Accountants and auditors

If the employee is compliant with AML regulations, identifying suspicious transactions and carrying out risk assessments would be easier. Also, employees would carry out activities in alignment with internal AML policies, procedures, and controls, and conduct due diligence of customers before onboarding them.

For everyday AML compliance, an employee’s responsibilities are:

- To check daily activities for any suspicion of money laundering or any other financial crime

- To ensure KYC and CDD of customers are conducted

- To raise complaints if any doubt is raised

- To comply with the AML policies, processes, and internal controls implemented in the company

A company can be tested for AML compliance in the following ways:

- Implementation of risk-based AML measures

- Identity verification of customers through CDD and EDD measures

- Checking customers against Sanctions screening and PEP status

- Identifying suspicious transactions and submitting reports

- Forming AML team, appointing AML Compliance Officer, and conducting AML training

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.