UAE is leaving no stone unturned to prevent money laundering by implementing the AML policy rules and regulations. The introduction of the AML- CFT program (Anti-Money Laundering and Combatting Financing of Terrorism) which includes strict penalties and deterrence in the form of imprisonment as well, is a decisive step towards fighting money laundering. Non-compliance with the AML laws attracts heavy fines and jeopardizes the company’s reputation. It is best to hire a reliable AML consultancy firm to avoid the risk of non-compliance and always keep the business AML compliant.

But some companies fail to comply with the AML rules and regulations and in turn have to face the consequences of non-compliance. They sabotage their reputation and damage the goodwill in the market and face financial losses in the form of heavy penalties. One of the reasons for this attitude is a lack of awareness of the AML laws as companies might be willing to stay compliant, but lack of knowledge can prove to be a deterrent in AML compliance. Let us discuss the critical AML/ CFT terms with which every business should be acquainted.

Important terms in the AML-CFT Compliance Program

Money Laundering

Financing of Terrorism

AML-CFT Program

AML- CFT refers to the Anti-Money Laundering and Combatting Financing of Terrorism (AML-CFT) Program, which is a structured system that helps organizations to prevent the financial crime of money laundering. Banks, financial institutions, and other regulated organizations must follow the AML rules and regulations and stay AML compliant. The Central Bank of UAE (CBUAE) manages the implementation of the AML-CFT program. There are different components in the AML-CFT program that should include:

- Written policies, procedures, and measures

- Designated AML Compliance Officer (MLRO)

- Continuous employee training

- Independent audit of the AML/ CFT program

Designated Non-Financial Businesses and Professions

MLRO

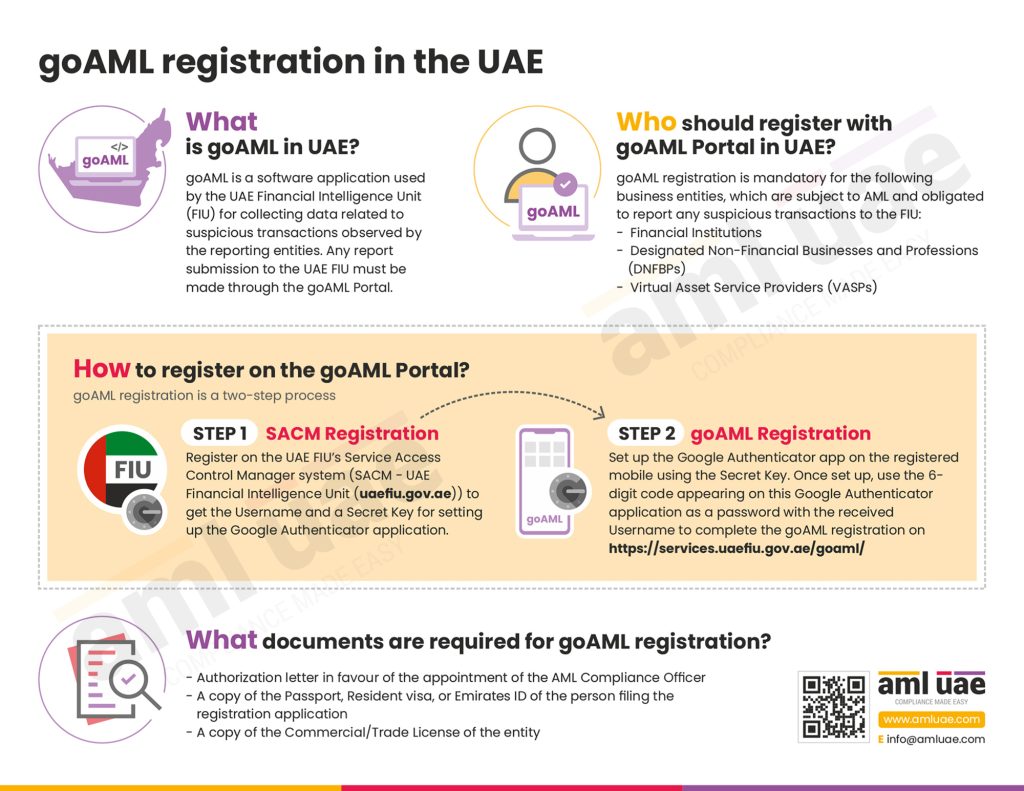

GoAML System

The GoAML system is an integrated software developed by the UNODC – United Nations Office on Drugs and Crime (UNODC). All the financial institutions and DNFBPs have to register in the goAML system and submit their reports. Data is collected, managed, analyzed, and insights are drawn from the document management system that helps prevent money laundering and end massive funding of criminal and terrorist activities.

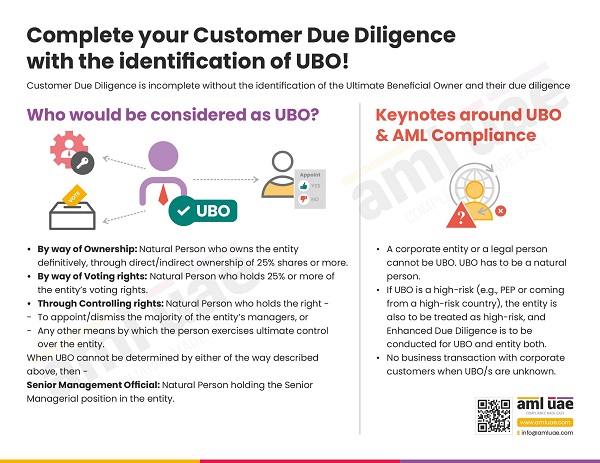

Ultimate Beneficial Owner

An Ultimate Beneficial Owner- UBO is a natural person who eventually or ultimately owns or benefits when a transaction is initiated. It also includes the natural person on behalf of whom a transaction is being carried out and the one who exercises effective ultimate control over a legal person.

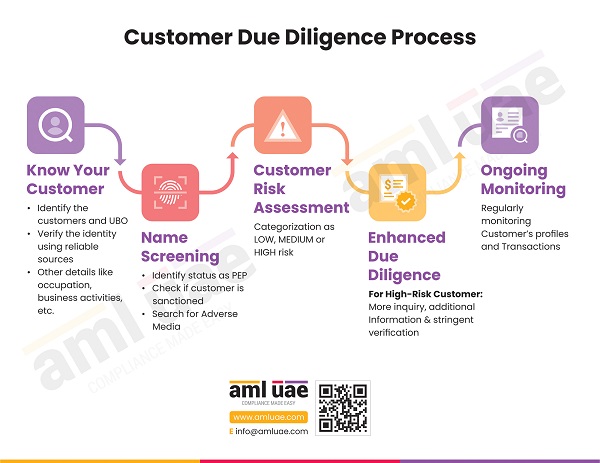

Customer Due Diligence

Customer Due Diligence (CDD) is a step that helps the banks, DNFBPs, and other financial institutions establish and verify the customer identification of a beneficial owner. With CDD, the institutions can learn about the customers, verify their claims of who they say they are, and understand the nature of economic activities, ownership structure, and control exercised by the natural person or legal entity. They can know whether it is a high-risk customer and the risk involved in money laundering.

High-Risk Customer

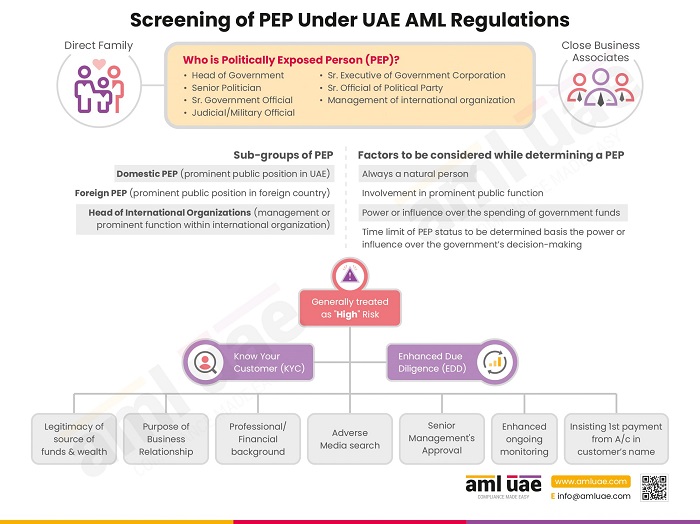

Politically Exposed Persons

Suspicious Transactions

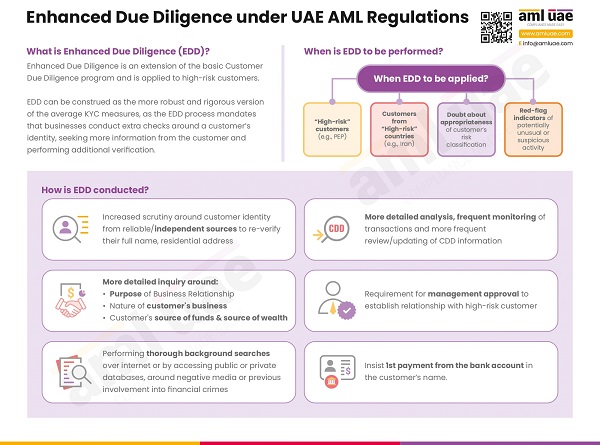

Enhanced Due Diligence

Economic Sanctions

Financial Intelligence Unit

AML Consultancy Services

Lack of awareness can cause a huge problem for banks, financial institutions, DNFBs, and other regulated bodies which have to follow the AML rules. One of the best ways to stay AML compliant is to outsource AML compliance services and get access to the updated knowledge and resources of AML compliance. With the assistance of a reliable AML compliance service provider, businesses can put all their worries to rest, and they can focus on augmenting business growth.

The AML consultancy provider will offer a wide range of services such as AML CFT Controls and Procedures Documentation, In-house AML compliance department set up, and AML training. They will also assist in AML software selection, Annual AML/ CFT Assessment Report, and AML / CFT Health Check-up services. The experts will handle the complexities involved in the AML compliance process at a nominal fee and help the business avoid hefty fines and penalties. AML UAE is one of the top AML Consultants in the UAE, assisting thousands of companies with its expertise, knowledge, and experience in the AML domain. For more information on this company, feel free to visit AML UAE.

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.