How are funds for terrorism provided?

- Huge sum of money is obtained through several illicit activities

- Leveraging the power of money laundering activities in order to utilize the illegally occupied cash in a more destructive way

- Obtaining massive sum of money with the help of criminal activities like smuggling of drugs, kidnapping, fraud, money laundering, and extortion

Anti-money laundering or AML regulations are a key measure to counter-terrorist financing. Financial institutions (FIs) and Designated Non-Financial Businesses and Professions (DNFBPs) play a vital role in combatting the financing of terrorism simply because criminals or terrorists mostly rely on them, especially banks, in order to transfer illicitly occupied funds.

Therefore, many regulations and laws have been enacted in order to prevent terrorist financing, primarily known as counter-terrorist policies. As per the counter-terrorist policies, financial institutions should know their customers closely.

Therefore, they should monitor and keep records of the transactions of the customers or clients. In this manner, business enterprises can have sufficient information related to their customers and ensure that their customers or clients are not involved with any financial crimes or illicit financial activities.

Suppose a massive sum of money is found with an intention to support terrorist activities. In that case, law enforcement agencies will come into the picture to combat some of these crimes or illicit financial activities.

Financial Action Task Force (FATF)

FATF is an abbreviated form of Financial Action Task Force established in 1989 by G-7 countries to prevent money laundering activities from the economy as a whole. The FATF comprises 35 governments and two regional organizations. The FATF is working in order to combat terrorism financing and money laundering by developing standardized procedures to stop the threats to the international financial system.

Criminals like terrorists can infiltrate the economic system of several countries with weak controls. Therefore, it is pretty challenging to check the financing of terrorism by establishing standard procedures. The FATF standards require governments to take several legal measures to ensure that the serious crime of terrorism financing, covering most of the elements stipulated by the convention of terrorism financing, be punished as a separate crime altogether.

Furthermore, the FATF reflects the measures created to counteract money laundering activities and make sure that the implementation of the private sector’s required preventive measures is being taken in the best possible manner.

The Terrorism Prevention Branch or the TPB of the United Nations (UN) office on Drugs and Crime (UNODC) sweats on the legal aspects of all the relevant universal legal documents that are proudly countering terrorist financing.

This law usually includes a review of internal legislation to counter terrorist financing and the appropriate punishment of crimes. It also provides for the implementation of all of these international standards and empowers law enforcement officials with specialized training.

Anti-money laundering compliance solutions

Terrorist financing is a serious criminal activity that can have severe consequences. These illegal activities are perceived as financial crimes like money laundering, which involve obtaining vast amounts of money through several illicit methods. Therefore, all financial institutions and DNFBPs at the risk of terrorist financing should comply with the home country and global regulations such as FATF. Although compliance with these regulations appears complicated, complying with them has become much easier with the help of anti-money laundering-related technology-based solutions.

How can AML or CFT tool help?

- AML and CFT can lead to forfeiture and recovery of unlawfully acquired assets

- It aids the authorities with legitimate roadmaps to identify those who facilitate illicit and criminal activities

- Expose the infrastructure of criminal or illegal organizations conspiracies and webs of corruption to commit inhuman terrorist attacks

- Support effective and broad deterrence efforts against a wide range of illicit and unlawful activities, including the funding of terrorism

About AML UAE

The above information clarifies the meaning of terrorism financing and the negative impact it can have on the economy of the organization and the country as a whole. However, in order to combat this terrorism funding, any business entity has to follow a few steps and control their relevant internal legislation minutely. For that, one may need expert help like us, AML UAE.

AML UAE provides various services like drafting of AML Policies and implementation thereof, setting up on internal AML Compliance department, AML training, and assistance in the selection of AML Software. Get in Touch Now!

Our recent blogs

side bar form

Share via :

Frequently Asked Questions (FAQs)

- Strict enforcement of AML/CFT Laws

- Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) measures

- Fines and Penalties on violators

- Filing of STR (Suspicious Transactions Report) with the FIU

- By introducing whole new centralized banking and payment account registers

- By aligning the rules of Financial Intelligence Units with the latest international trends

- Money laundering: To hide the source of illegal funds and integrates such funds into the legit financial system

- Terrorism financing: Collating funds to carry out terrorist activities to threaten the peace and integrity of the society

- Money laundering: As the definition suggests, the source of funds involved in laundering is always illegal

- Terrorism financing: Funds collected for terrorist activities may not always be illegally obtained, as sometimes genuine profits are also diverted for terrorist activities

- Money laundering: Generating more profits through illegal activities

- Terrorism financing: Driven by ideologies and emotions to adversely affect the society

- Money laundering: This is a cyclical process, where profits generated through illegal activities are-invested back into illegal activities. Involving 3 stages – Placement, Layering, and Integration

- Terrorism financing: This is a straight/linear process where funds are consumed for carrying out the terrorist activities

- Money laundering: 3 stages – Placement, Layering, and Integration

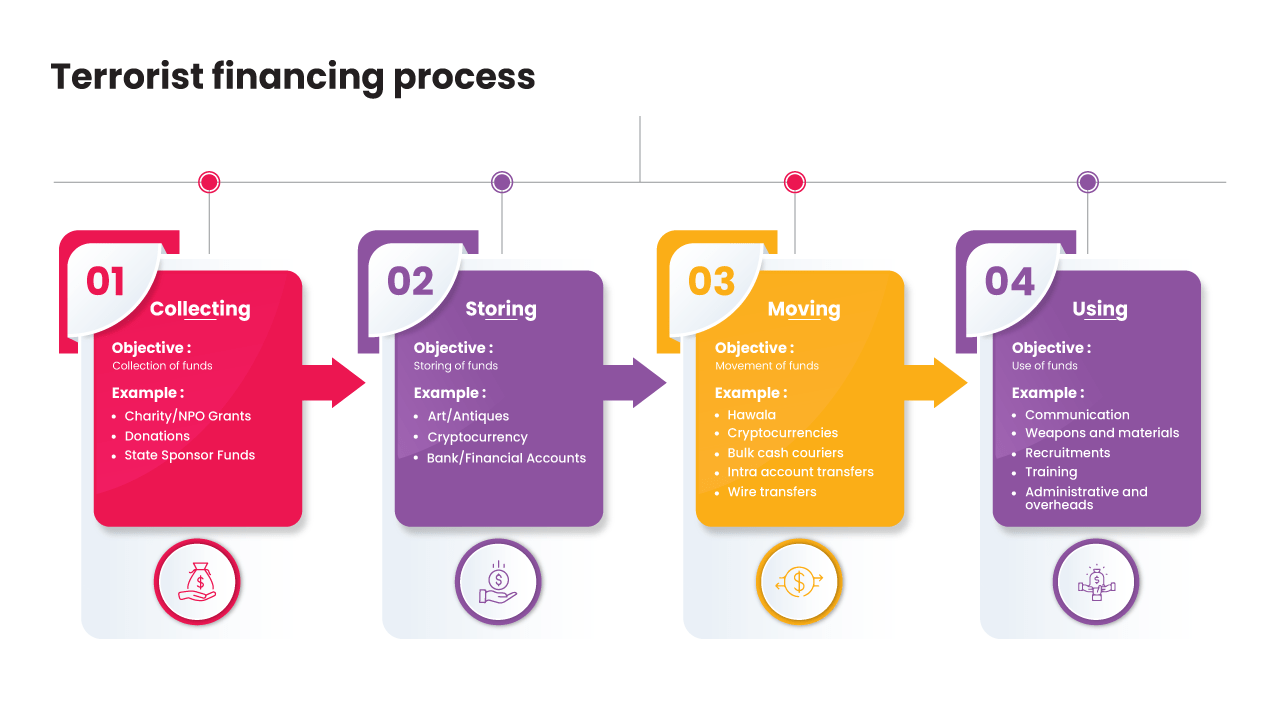

- Terrorism financing: 4 stages – Collecting, Storing, Moving, and Using

- Terrorism financing hardly follows any pre-determined pattern, and that too is not fixed all the time,

- Terrorist groups are aware of countermeasures being deployed. They identify the loopholes to avoid the attention of authorities and evade these measures,

- Terrorism financing involves other criminal activities like smuggling, narcotics, money laundering, etc., which complicates the terrorism funding process,

- Involvement of multiple countries and high-profile individuals,

- Counterfeiting and increased use of cash instead of digital/bank transfers do not leave any trail to identify the source of such funding

Add a comment

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.